Traditionally a supplier makes a shipment or delivery and sends an invoice to the buyer. The buyer has the option to pay for the goods by the due date on the invoice, or, in many cases, to pay the invoice earlier at a discount.

Factoring

However, under a conventional factoring agreement, the supplier makes the delivery and then sells its invoice(s) or accounts receivable (AR) to a third-party, often to a bank or financial institution known as a factor. The supplier receives a discounted portion of cash in advance of actual payment of the goods from the buyer. The factor receives a fee, often retaining a discounted portion of the gross invoice once it is paid. The fee to the factor covers its cost of processing invoices and collecting payments, as well as its lending cost of funds.

In all industries including the supply chain, conventional factoring is used to improve a supplier’s cash flow.

The factor rate or discount rate is the fee charged by the factor on a monthly basis, usually in the range of less than 1% and up to mid-single-digit percentages depending on the financial strength or credit worthiness of the supplier and its buyers. These fees can be a flat rate on the amount of the invoice or a stated rate if the invoice is paid in the first 30 or 60 days and a higher rate when payments arrive after the standard repayment period.

Suppliers can enter service agreements with factors under spot agreements in which the supplier can factor any number of invoices it chooses, or on a contract basis wherein the supplier is required to sell all or a large portion of its invoices to the factor. Some factors provide tiered fees offering volume discounts to suppliers that reach larger aggregate factoring thresholds monthly or quarterly, and some factoring companies allow contracts without minimums or usage requirements.

Most factors allow a supplier to finance 70-90% of its eligible accounts receivable, typically those due within 90 days. This percentage is also referred to as an advance rate. Similar to most forms of lending, an application and approval process exists. Most factors determine an advance rate based on the supplier’s quality of collateral, the credit worthiness and pay history of the buyer/customer, gross margins of the supplier, and dilution rate — the difference between the gross invoice or face value and what the customer actually pays on average. Breakage, returns, unused labor, etc. are examples of dilution.

The remaining portion of the invoice, usually 10-30%, is referred to as the reserve. The factoring company collects its fees upon payment of the invoice by the buyer and makes appropriate adjustments for dilution. The remaining reserve is disbursed back to the supplier, usually within a week of invoice payment.

Other fees or disbursements from the factor include wire transfers, automated clearing house (ACH) transactions, lockbox fees, late payments fees, collections fees, ongoing credit check fees of the supplier’s clients and fees for lower factoring activity than required by the agreed minimum.

Recourse versus nonrecourse

Factoring is similar to asset-based or collateralized lending but is not technically considered lending. In a factoring agreement, the owner of the invoice, the supplier in most instances, sells its invoice to the factor without the two parties entering into a traditional lending agreement in which a loan or line of credit is extended. This type of factoring is considered a “nonrecourse” agreement as the factor is the owner of the invoice, or debt, and has assumed the repayment risk from the supplier. The factor is now the owner of the buyer’s obligation to pay and bears the administration, collection and potential risk of nonpayment.

In a “recourse” agreement, the supplier retains the recourse and payment collection risk of its buyer. If the buyer fails to pay for the invoiced goods or services, the supplier is required to repurchase the unpaid invoice from the factor.

Factoring versus supply chain finance

Factoring is initiated on behalf of the supplier whereas supply chain finance or reverse factoring is a buyer-controlled early-pay finance program. In this case, the buyer establishes the relationship with a financial institution or funds the initiative themselves, paying invoices early in exchange for a discount to the face value of the invoice. The buyer invites suppliers to participate. Most large big-box retailers engage in supply chain finance programs with their suppliers and vendors.

Once in a supply chain finance program, the supplier can trade and sell its invoices to the financial institution for early payment, again receiving a discounted portion of the total invoice. In supply chain finance, the supplier usually receives the full amount of the invoice less the fee or discount for early payment, not an advance portion with the remainder to follow like in factoring. The supplier can decide which invoices they want to sell or trade on an a la carte basis versus some factoring agreements, which require the entire portfolio of accounts receivable to be sold or have minimum volume requirements.

Factoring for carriers

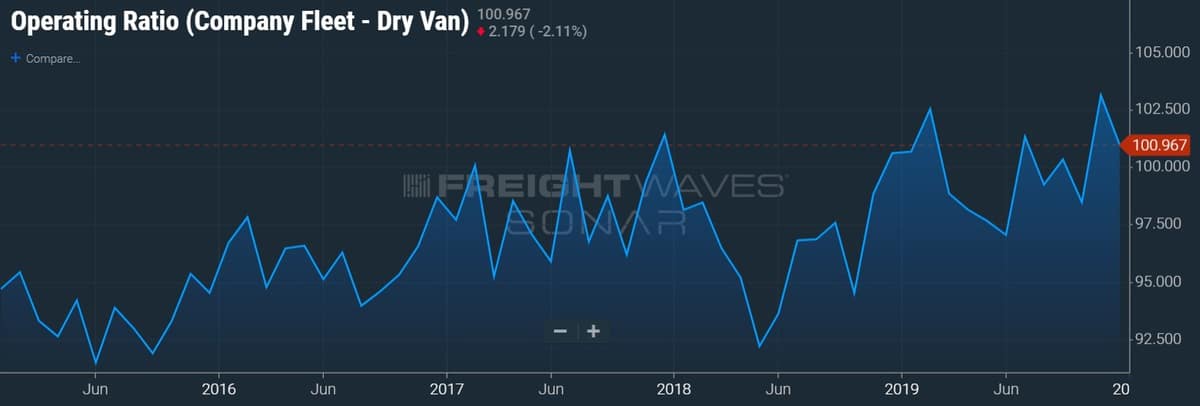

Factoring is used throughout the transportation and logistics industry. Many truckload (TL) carriers depend on factoring to bridge cash flow gaps when working with shippers that have longer payment cycles. Most TL fleets already operate on thin operating ratios (ORs) — the ratio measuring the percentage of operating expenses for each dollar of revenue — or the opposite of operating margin. Those that lack sufficient working capital and don’t qualify for credit lines turn to factoring as a means of funding their expenses.

ORs greater than 100% mean that more than $1 in operating expenses are incurred generating $1 of revenue.

There can be an even longer repayment period when carriers work through brokers for their loads. Shipper payments to brokers for delivered loads can take up 30 or 45 days, and then the carrier has another payment cycle with the broker.

Some truck brokers offer factoring services for advanced carrier payments or quick pays. Typical factor rates from brokers are 2% for advance of payment, or 98% of the agreed payment for delivery of the load compared to 100% of what may take a carrier a month-plus to receive. Some brokers waive the factoring fees for loads booked through their digital platforms or apps as a means of generating carrier loyalty.

Global factoring market

The total global factoring market is heavily fragmented, represented by more than 7,000 very large, well-capitalized global banks, middle market domestic banks and lending institutions, as well as online factoring and technology companies. The total global market is expected to reach $9.275 trillion by 2025, according to a report published by Adroit Market Research.

At its core, factoring is intended to shorten the payment of receivables or days sales outstanding (DSO) to the supplier, improving their cash flow. Most successful factoring relationships between supplier and factor are those in which the supplier operates a successful entity with a reasonably strong balance sheet, sells a product that is in high demand, and possesses a financially healthy customer base.

Rick G.

OTR Capital is the best factoring company out there. They truly care about my business and offer many ways in which I can improve the success of my trucking company. It takes time to process invoices and track payments due to me. They make it easy and I am proud to call them my factor.

EzLine

I don’t agree is any factoring good for any trucking company. If you have for example 10 owners operators and charge them 10% for dispatch and you pay 3% to factoring do you know how much you pay ? 3 owner operators truck just working for factoring . You make ZERO profit on 3 trucks and getting bigger risk for claim and damages Insurance increases DOT regulations etc , you can do invoices so easy than finding rite loads to owners when is market bad , I m broker who still driving truck for hobby, and doing this for 16 years , maybe i m only one who doing this way . Personally i don’t need any invoices, only driver need to send me clear pictures of BOL and i scan to printer , after few minutes i send back pictures of ACH deposit, load is closed done deal have nice day, no charge for quick pay ! For me is the biggest problem if carriers ever left me telling me i m bad . i will feel like looser thinking what i did wrong .

Brokers don’t care for truck driver they don’t know how to stain on the route for 10-15 or more days without family , and no one can tell me factoring is right, it’s ok to took the money from food on table or kids meal ? Brokers need to pay same day with no quick pay charge , if they don’t have money need to change job ! Say no to Factoring and cheap Brokers who don’t have money to pay same day . No quick charge for payment we don’t need that parasite 🦠!

Rick G

Gotta disagree with you. Time is money and OTR keeps me moving. I can use their app to take a pic of the POD and get paid same day. I focus on finding freight and don’t occupy my family or friend’s time trying to help me keep up with billing. I run a trucking business that profits and I do so with the help of OTR. I honestly have buddies that run 100+ trucks, and they factor because it’s cheaper than hiring employees to handle the accounting. Maybe you are opposed to factoring, and that’s perfectly ok with me. If you do decide to ever look into though, at least you can take it from me that OTR will treat you right.

Danny Bruning

What you also have to keep in mind is that even when brokers don’t charge an extra percentage for doing quick pays, the carrier is still getting less money for the load by negotiating their days to pay instead of the load value. Factoring allows for the highest paid freight available because it allows carriers to negotiate the load value instead of the pay terms.

EzLine,LLC

I try to pay good rate , if you don’t believe ask my carriers , my rate is about 10% to 15% higher than others brokers pay on market and plus no charge for quick pay !

You can find them on TruckStop for my reference, I sold last year over 300 loads long haul and i pay every loads same day or next morning , some loads i pay before they are delivered , posted maybe only 5 to 10 loads for whole year on board to try to cover ,call them and ask for the rate and payment , but for now everything is covered . same people’s pulling every week and newer complain , and i newer try to drop the price like other brokers do when they find cheaper carriers or market slow down… I don’t need cheap carriers i need honest people who try to do job on right way !

My score is 1 A days to pay , maybe for you sounds to good to be true, well check it !!!

Big problems is the broker who try to do cheaper , bro if you have quality and you think that your carriers will do excellent job newer go under price that is the number one rules , soonest or later they will call you back again to do negotiations and don’t give up on rate !

EzLine

I pay my carriers same day or next day after delivering my loads . No quick charge for payment next day . I recommend to all carriers to push pressure on brokers to get paid same or next day , most brokers don’t have enough money and they wanna do business over truck drivers thinking that is normal . Factoring cost each truck that owner is able to do maintenance for full year . Factoring is just legal fraud for truck drivers and there is no any guarantees that carriers will be get paid if brokers don’t pay later , personally i newer ever deal with any factoring and my customer also don’t have any risk for me as broker for non payment bcs they are holding my money for over 30 days sometimes 50 days

Noble1 suggests SMART truck drivers should UNITE & collectively cut out the middlemen from picking truck driver pockets ! IMHO

That’s the way to do it ! You’re a good person .

I know a car carrier who pays his employees on PAYROLL right after the load is delivered all depending on the time of day . Money is deposited directly in the driver’s account after sending in the trip sheet , either on the same day or the next , no later . If they hauled 3 loads , they got 3 pays . If they hauled 2 , they got 2 pays . No pc miler BS either . Per vehicle and per mile on the odometer ! That carrier doesn’t have a truck or two . They have many !

Some know how to take care of their own !

IMHO

Danny Bruning

This actually has a misleading description of what non-recourse factoring actually entails. On here, it is basically described as an insurance policy that would put the liability on the factoring company if a carrier hauls a load for a broker in bad financial standing and doesn’t get paid out. It is basically saying that with non-recourse factoring, a factoring company would never seek reimbursement for the money they advanced on a load that doesn’t pay. The *reality* of non-recourse factoring is that the factoring company will still seek reimbursement for an unpaid load *unless* the broker that the load was hauled for goes into chapter 7 solvency, which is credit related bankruptcy. This is a very rare occurrence. The reality is if you don’t have a 300-500 truck company, the value of non-recourse factoring is next to nothing. Any good factoring company will offer a credit check system to verify that brokers and debtors are in good financial standing before you accept a load.

Noble1 suggests SMART truck drivers should UNITE & collectively cut out the middlemen from picking truck driver pockets ! IMHO

This is one of the dumbest systems I have encountered !

Make the service buyer borrow to pay , not the service provider need to factor !

If I go on the web to buy a good , I PAY the service provider(shipping) right away ! Truckers are not financers/creditors ! Another scheme to fleece at the trucker’s expense .

Truckers are discounted on miles , discounted on retention , discounted on payments due , LOL ! This is insanity !!!

UNITE & restructure this BS industry . Then you can finance the borrower through your own bank ! Rather than lose a percentage due to factoring , finance the shipper WITH INTEREST to pay the transport service provider right away . Rather than a discount you’ll be drawing in a surplus !

Quote :

“In a “recourse” agreement, the supplier retains the recourse and payment collection risk of its buyer. If the buyer fails to pay for the invoiced goods or services, the supplier is required to repurchase the unpaid invoice from the factor.”

ROTFLMAO !

IMHO