Several years ago, one of my friends in the hedge fund world told me about a little-known macroeconomic indicator that provides one of the most incisive views into the future of industrial production: orders for Japanese machine tools.

This is J.P. Hampstead, co-host of the Bring It Home podcast with Craig Fuller. Welcome to the eighth edition of our newsletter, where we get acquainted with the Japan Machine Tool Builders Association (JMTBA) order book and what it means for the global economy.

The JMTBA is a key organization in the Japanese manufacturing sector, providing crucial data on machine tool orders that serve as a leading indicator of industrial production. Founded in the postwar period, the JMTBA has been at the forefront of tracking and reporting on the machine tool industry’s performance, which is often seen as a bellwether for broader economic trends.

Machine tool orders are considered a leading indicator because they represent capital investments made by manufacturers in anticipation of future production needs. When companies order new machine tools, it typically signals an expectation of increased demand for their products in the coming months or years. As the JMTBA notes, “superior machine tools are the crucial factor in manufacturing a wide range of machinery. This is why machine tools are viewed within all sectors of the machinery industry as having a critical presence far greater than their share alone would indicate.”

The JMTBA reports detailed monthly data on machine tool orders, breaking them down by type of machine and origin of order (domestic or foreign). This granular data allows analysts to gauge the health of various manufacturing sectors and regions. For instance, in 2023, the JMTBA reported that “the total value of machine tool orders in 2023 decreased 2.5% from the previous year and marked the first year of year-on-year decline in three years.”

(Photo: anek.soowannaphoom/Shutterstock)

Looking at the most recent data for 2024, we can observe some interesting trends. In December, the JMTBA reported that “the total value of machine tool orders in November was 119.33 billion yen [$757 million]. This decreased 2.6% compared to October 2024 and marked the second consecutive month of month-on-month decline.” However, this figure still represented a 3% increase compared to the same month of the previous year.

Breaking down the November 2024 data further, we see that domestic orders rose by 2.7% over October to 34.33 billion yen, marking the first month-on-month growth in two months. Foreign orders, on the other hand, fell by 4.6% from October to 85 billion yen, marking the first month-on-month decline in three months.

When examining specific types of machine tools, the data reveals varying performance across categories. For instance, in 2023, turning machines, which accounted for 34.1% of total orders, saw a significant decline of 12.8% compared to 2022. Machining centers, representing 41.4% of total orders, also experienced a decrease of 15.3%. However, some categories bucked the trend, with boring machines showing an impressive 11.4% year-on-year growth.

Comparing the overall 2023 data to 2022, we see a clear softening in the market. Total machine tool orders in 2023 amounted to 1,487 billion yen, down 15.5% from 2022’s 1,760 billion yen. This decline was evident in both domestic and foreign orders, with domestic orders falling 21.0% to 476.8 billion yen and foreign orders decreasing 12.7% to 1.097 trillion yen.

The somewhat soft data for 2023 and the early months of 2024 could be indicative of challenges ahead for industrial production in 2025. As the JMTBA noted, “With demand for reconstruction from the COVID-19 pandemic slowing down and various factors of uncertainty in the global economy, this year was a somewhat sluggish year compared to the past few years.”

However, it’s important to note that despite the decline, the industry has shown resilience. The JMTBA points out that “manufacturing industries in each country are being forced to address a variety of issues, including automation, environmental friendliness, digital transformation, and the decentralization of production bases. These needs have provided underlying support, preventing a significant decline in orders even during this adjustment phase, and a certain degree of resilience has been felt.”

Looking ahead to 2025, the current trends in machine tool orders suggest that industrial production may face some headwinds. The consecutive months of decline in late 2024, coupled with the overall decrease in 2023, could translate into slower growth or even a potential contraction in industrial output. However, the ongoing need for technological upgrades and automation in manufacturing could provide a buffer against more severe downturns.

While the JMTBA data indicates some softening in the machine tool market, it also highlights the industry’s resilience in the face of global economic uncertainties. As we move into 2025, close attention to these leading indicators will be crucial for anticipating trends in industrial production and the broader economic outlook.

Quotable

“The US economy remains on a solid growth trajectory supported by healthy employment and income growth, robust consumer spending and strong productivity momentum that is helping tame inflationary pressures. We expect these positive dynamics will carry into 2025, allowing the Fed to pursue gradual, but cautious, policy recalibration.”

– Gregory Daco, E&Y chief economist, in his December 2024 Economic Outlook

Infographic

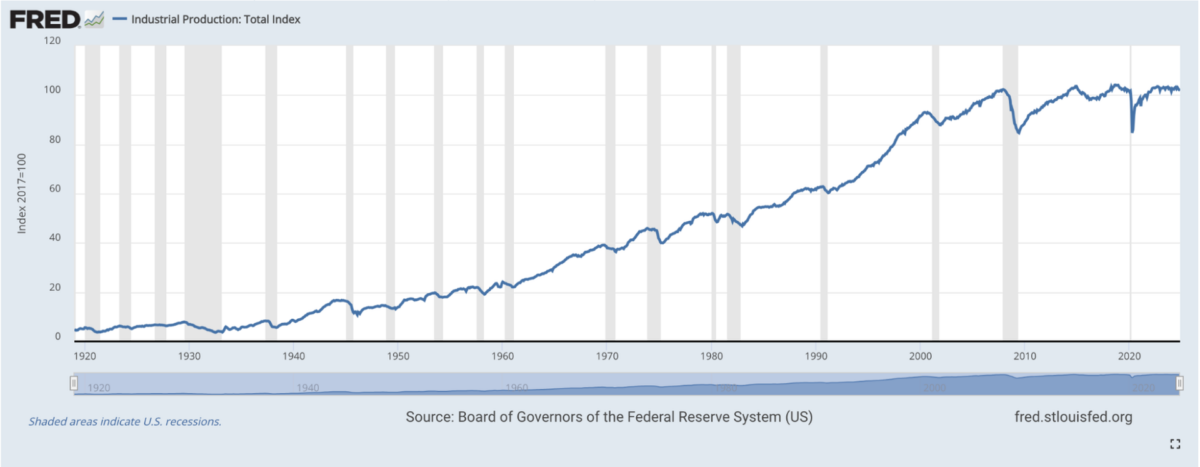

U.S. industrial production stands at 101.9 as of November 2024, and since INDPRO is indexed at 2017, that implies just 1.9% growth in industrial production from 2017 to November 2024. Chart: Federal Reserve.

News from around the web

Anduril Awarded Defense Production Act Investment To Expand Solid Rocket Motors Industrial Base

Anduril Industries, America’s fastest-growing nontraditional merchant supplier of Solid Rocket Motors (SRM), has been awarded $14.3 million by the Department of Defense under Title III of the Defense Production Act to expand the SRM industrial base. Strained munitions production underscored by recent global conflicts has led Congress and the Department of Defense to prioritize strengthening the SRM industrial base.

Major factory construction projects to watch in 2025

Tesla, TSMC and LG Chem are among the manufacturers slated to begin production at their multibillion-dollar factories this coming year.

The R&D Puzzle in U.S. Manufacturing Productivity Growth

We find that “R&D intensity” has been increasing at both the firm and industry level, even as productivity growth declines. This points to a decline in the effectiveness of R&D in generating productivity growth in U.S. manufacturing.