When the ultra-large box ship Ever Given lodged itself sideways in the Suez Canal, blocking all traffic, containerized cargo shippers may have thought to themselves, “What else can go wrong? Let’s hope this ends quickly.” Tanker owners and investors probably thought something different: “Finally, something positive. Please let this thing be stuck for weeks.”

The Ever Given grounded during a sandstorm Tuesday morning. As of Thursday morning, it was still stuck.

Assuming the blockage is relatively short-lived, tanker rate consequences should be minimal. In general, the Suez Canal is not what it used to be for oil trades — for reasons that date back to the 1950s.

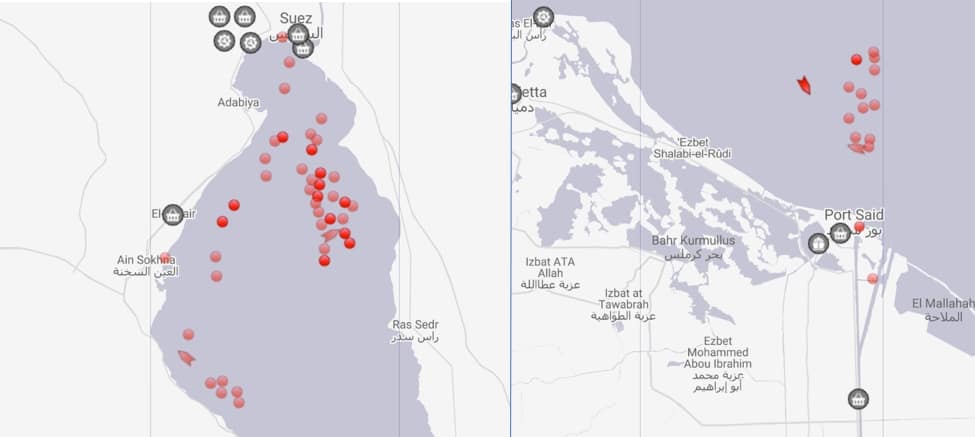

Tanker transit delays

Energy intelligence firm Vortexa identified 10 tankers carrying 13 million barrels of Middle East crude that face northbound delays due to the accident.

Argus Media reported that there are five Suezmaxes (tankers with 1 million-barrel capacity) loaded with crude and two with high-sulfur fuel oil awaiting southbound transits. Also in the queue: two product tankers carrying naphtha and one Aframax (750,000-barrel capacity) loaded with fuel oil.

The best-case scenario for tanker rates is for ships to divert away from the canal and travel around the Cape of Good Hope instead. That would add about 15 days to the voyage length from the Middle East to Europe and pare ships available to bid on cargoes — a positive for spot rates. The longer the Ever Given is stuck, the more likely tankers will reroute.

Even without such diversions, the accident will create trading inefficiencies.

Argus noted that the canal blockage could delay tankers returning empty southbound from Europe to the Middle East that had been scheduled for fresh cargo loadings. This could “force charterers to pay premiums to secure prompt replacements.”

The accident could also delay tankers ballasting northbound to pick up oil in the Black Sea or Mediterranean. These could miss loading dates, as well. However, Argus noted, “Vessel availability … is sufficient to allow charterers to find replacements.”

Rate upside will require “an extended closure” to tighten vessel supply “more significantly,” said Argus.

In fact, the initial effect on tanker time-charter equivalent (TCE) rates was negative. Oil prices — and consequently, marine bunker fuel prices — rose the day after the accident. Daily TCE rates are calculated net of fuel. Higher fuel costs initially pushed average reported VLCC and Suezmax TCE rates down slightly.

Importance of canal to oil trade

The Energy Information Administration (EIA) estimated that, as of 2017, around 9% of global seaborne crude and products transited either the Suez Canal or the 200-mile-long northbound SUMED pipeline that runs alongside it.

As of 2018, the EIA estimated volumes of around 1.1 million barrels per day (b/d) of crude transited the canal. An additional 1.3 million b/d of crude went via SUMED and 2.6 million b/d in refined products transited the canal.

More recently, Bloomberg reported a sharp drop in SUMED flows. Volumes fell below 1 million b/d during some months last year.

Very large crude carriers (VLCCs), tankers that carry 2 million barrels of oil, cannot transit the canal fully laden. The water is too shallow. Consequently, VLCCs bring Middle East crude to Ain Sokhna, at the northeast end of the Red Sea. There, cargoes are unloaded and put into the SUMED pipeline for transport or into storage tanks. Crude is then unloaded or placed in storage at Sidi Kerir, the discharge port for the SUMED pipeline on the Mediterranean coast.

VLCCs either deliver crude to Ain Sokhna and return to the Middle East to reload, or they partially unload at the southern end of SUMED, allowing them to ride high enough in the water to transit the Suez Canal, then top off their cargo holds again at Sidi Kerir.

SUMED operations are not impacted by the Ever Given accident. That’s another reason why crude-tanker rates shouldn’t see a big rise.

Long history of Suez disruptions

The Suez Canal accident strikes a chord in tanker circles because of history — in particular, the canonical tale of Aristotle Onassis, the most famous tanker magnate of them all.

As recounted in Frank Brady’s “Onassis: An Extravagant Life,” the Greek owner had ordered a series of new tankers in the early 1950s, but after a deal to carry Saudi Arabian exports collapsed, his ships were left dangerously idle. Facing a financial crisis, he considered selling his entire fleet off to Royal Dutch Shell, but didn’t.

“Then, through an incredibly historical coincidence, almost overnight, Onassis’ fortunes suddenly turned dramatically,” wrote Brady. “Facing almost certain ruin … Onassis made more money in a shorter period than he had ever made in his life. The catalyst was the Suez Canal.”

Egypt nationalized the canal in 1956 and barred passage to Israeli ships. Israel invaded the Sinai Peninsula and Gaza Strip. Egypt closed the canal to all traffic. It remained closed for the next six months.

The impasse forced tankers to circumvent Africa. Onassis was in the right place at the right time. “Onassis had many extra ships, not under contract, that could be leased to handle the demand,” wrote Brady. “He possessed the power to charge whatever rates he could.”

The price to transport oil from Saudi Arabia to Europe had been $4 per ton prior to the conflict. “Onassis was soon charging over $60 and each tanker-full was earning him a profit of over $2 million a trip,” wrote the biographer.

By the following year, Onassis was estimated to have amassed several hundred million dollars in profit (the equivalent of well over a billion circa-2021 dollars). “I was lucky,” the magnate said.

Former status ‘never regained’

The Suez Canal closed yet again in 1967 after the Six-Day War between Israel and Egypt. This time, the waterway was shut to all traffic for eight straight years, until 1975.

A report by investment management company Winton detailed how this closure, coming on top of the 1950s closure, forever changed oil trading patterns. If tankers couldn’t transit the Suez Canal, they could be bigger and take advantage of economies of scale. So, by the time the canal reopened in 1975, “the majority of oil tankers were simply too large to fit,” noted Winton. “The Suez Canal’s former status as the preeminent thoroughfare for crude was never regained.”

The disruptions to the Suez Canal in the 1950s, 1960s and 1970s precipitated the rise in popularity for VLCCs over Suezmaxes and, in 1977, the opening of the SUMED pipeline. As a consequence of VLCCs and SUMED, an accident closing the Suez Canal, like the grounding of the Ever Given, is dramatically less important to tanker rates than it would have been in the days of Onassis. Click for more FreightWaves/American Shipper articles by Greg Miller.

MORE ON TANKER SHIPPING: Minus $7,400 a day? How can shipping rates fall below zero? See story here. Full steam ahead for shipping stocks: See story here. OPEC+ deal shocker will prolong crude-tanker bloodletting: See story here.

Doris Brother

Raise the water level.

Mike Millard

Unload the tanker? Just a thought.

Doris Brother

Pull it backwards off the sandbar with many tug boats or raise the water level.