The third-quarter earnings season showed all publicly traded less-than-truckload carriers experienced some type of bump following Yellow’s exit. If it was a competition, Saia was the winner.

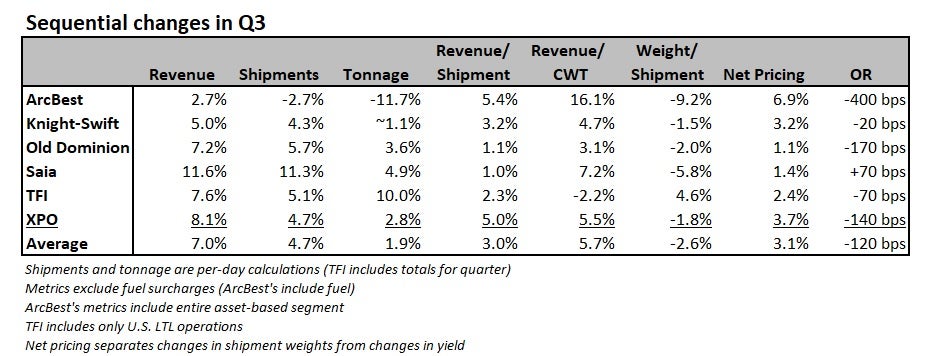

While there’s a little noise in the numbers, the sequential progression from the second to the third quarters is a good yardstick of how Yellow’s $5 billion freight share was redistributed. Yellow had been teetering for years but as tensions rose with its union workforce in the June-July time frame, shippers and 3PLs started moving their freight with other carriers. The third quarter may have not captured the entirety of the event but it is a great representation of what happened.

Also worth noting, private regional carriers and top 5 national operator Estes were likely market share takers in the period, but the market isn’t privy to their results.

Saia (NASDAQ: SAIA) reported an 11.3% increase in shipments per day from the second to the third quarters. The carrier added more than 1,000 employees in the period, building on an existing head count of roughly 12,000, to accommodate the influx.

The tighter capacity backdrop pushed yields higher.

Its revenue per hundredweight increased 7.2% excluding fuel surcharges. The calculation was bolstered by lower shipment weights, an occurrence seen throughout the industry as the broader industrial and manufacturing complexes have cooled. When accounting for the lighter weights, yield was likely up just modestly on a sequential basis.

The company’s operating ratio — operating expenses expressed as a percentage of revenue (the lower the better) — deteriorated 70 basis points sequentially in the quarter to 83.4%. However, the backslide was modest given the costs it incurred to take on the freight windfall. The quarter also contended with a July wage increase averaging 4.1%.

“SAIA is capitalizing on a once in a generation market share opportunity in the LTL market,” Deutsche Bank (NYSE: DB) analyst Amit Mehrotra said in a Friday note to clients. “This comes with extra costs on the front end, but customers are likely to stay and pay more over time.”

5% is the figure for most

Most carriers saw a 5% sequential increase in shipments during the quarter.

Old Dominion’s (NASDAQ: ODFL) “investing ahead of the curve” strategy allowed it to post a 5.7% increase in daily shipments with minimal disruption to service. The company has grown door capacity roughly 50% through $2 billion of real estate investments over the last 10 years. It typically operates its network with 25% latent capacity, allowing it to take market share while maintaining service commitments to existing customers.

The company recently earned best-in-class honors among national carriers for a 14th straight year, according to an annual shipper survey conducted from June to October.

Higher yields and cost management at Old Dominion led to a 170-bp sequential OR improvement in the period.

The company doesn’t think the freight reshuffle is completely settled either.

“We’re hearing about competitors that are missing pickups,” Old Dominion CFO Adam Satterfield said on a Wednesday call with analysts. “They don’t have the people part of the capacity equation solved and maybe took on too much freight and are starting to have negative implications from their overall service product.”

The comments align with a recent Morgan Stanley (NYSE: MS) survey of shippers and 3PLs that previously used Yellow. Thirty-five percent of those polled said that while they have already placed their freight with a new carrier, they will still be looking to make a change in the coming months.

XPO (NYSE: XPO) said per-day shipment counts increased by more than 1,000 in each month of the third quarter to more than 54,000 per day in September. All in, daily shipments were up 5% from the second to the third quarters and yields moved 6% higher excluding fuel surcharges.

The company used internal cost initiatives and favorable pricing trends to record 140 bps of sequential OR improvement, which was 370 bps better than its historical seasonal trend. Contractual agreements renewed 9% higher in the period, which was nearly twice the level recorded in the second quarter.

Shares of XPO were up 15% on Monday following the better-than-expected report.

XPO said it would also accelerate growth in its network in response to tightening capacity throughout the industry. A two-year plan will add 900 new doors to its coverage map by the first quarter of next year.

TFI International’s (NYSE: TFII) U.S. LTL segment (TForce) recorded a 5.1% sequential increase in shipments. The percentage was a little higher at the peak of the disruption but TFI has seen some slippage of that captured freight in recent weeks. The share gains are coming at a time when TFI is still engaged in an initiative to purge low-margin business from its network.

The segment’s yields were down 2.2% sequentially excluding fuel surcharges but that metric was negatively impacted by a 4.6% increase in weight per shipment. Actual pricing was likely 2.4% higher sequentially. The OR improved 70 bps even with a higher-cost labor contract taking effect Aug. 1.

Knight-Swift Transportation’s (NYSE: KNX) LTL unit recorded a 4.3% increase in shipments from the second to third quarters. Excluding fuel surcharges, yield improved 4.7% but a 1.5% decline in average shipment weight was a tailwind.

ArcBest’s (NASDAQ: ARCB) shares jumped 16% on its third-quarter report.

The company’s asset-based segment, which includes LTL carrier ABF Freight, saw shipments decline 2.7% from the second quarter. However, the change is a little misleading as it had been using dynamic pricing tools, which better match available capacity in the network to transactional shipments in the market, to keep loads elevated through the downturn.

The company started moving capacity from transactional customers to cover shipment needs at accounts under contract. Those accounts were diverting freight from Yellow throughout July as it became evident the carrier would fail. When comping ArcBest’s July exit rate to the loads its targeting currently, shipment counts are up roughly 5%. However, among its core accounts, shipments have increased more than 20% since Yellow’s closure.

The segment’s OR improved 400 bps sequentially even though a new labor contract was a 350-bp headwind in the period.

“We’re really targeting a freight profile that maximizes the profitability in our network,” CFO Matt Beasley told FreightWaves.

Will favorable capacity dynamics diminish when Yellow’s terminals reopen?

Bids on the 170-plus terminals Yellow owns are due Nov. 9. In September, a Delaware bankruptcy court approved an order naming Estes’ $1.525 billion stalking horse bid the winner. The agreement sets a base bid for Yellow’s owned terminals. Estes is unlikely to buy all of the properties but it could walk away with a couple of dozen.

Those properties, as well as the 100-plus terminals Yellow leased, could be back in action in the coming months. The new owners will likely want to ramp throughput at the sites sooner than later to start generating returns on those assets. But that doesn’t mean LTL rate cuts are likely.

“We’ve been in a freight slump here, so that’s why we had capacity as a group to fill in the holes for customers. But if you get back to a more normalized industrial environment, we get some growth going again, you get port activity going again, you get benefits of nearshoring, well then that’s another moat around pricing,” said Saia’s CFO Doug Col on a Friday conference call.

Also, some of the sites will likely be acquired by strategic investors and repurposed to other sectors.

“There’s going to be some cases that some of those don’t get returned to the LTL business because maybe the economics make more sense for that to turn into a warehouse or industrial real estate property of some kind,” said Fritz Holzgrefe, Saia’s president and CEO.

More FreightWaves articles by Todd Maiden

- ArcBest prudent in approach to new freight opportunities

- Auction houses to liquidate Yellow’s tractors, trailers

- Heartland books Q3 loss, cuts unprofitable customers and lanes

Freight Zippy

Amazing, Yellow could not earn a profit off of this business but Non Union LTL carriers with higher pay, better equipment, working conditions and job security can??

I have said it many times on here that the Teamster LTL model simply does not work in the modern world.

T Force is lining themselves up to be the heir apparent as the next Teamster disaster…

Trucker guy

No mention of DAYTON FREIGHT either? Their business level increased by 11 percent!

Todd Maiden

Walter, You are incorrect.

FedEx Freight numbers for FQ1/24 (June-August) : Shipments/day +2% sequentially, -13% y/y; tonnage per day +1% sequentially, -18% y/y; rev/cwt flat sequentially, +2% y/y.

Maybe the next fiscal quarter will better capture volumes from Yellow. Their recent quarter only included one month of Yellow’s closure (ceased operations on July 30). Also, FedEx Freight recently closed 29 LTL terminals. Management said they took on 5,000 shipments per day from Yellow, or roughly a 5% increase, but it didn’t show yet in the numbers. We’ll see if it’s there next quarter.

John Zipay

Yellow Freight deliberately closed up. They did not want to stay in business. CEO’S GOT THERE MONEY! Yellow owns 40 per cent of SAIA

walter Fegis

This article is such BS! FedEx Freight was up 8% and you mention nothing of it! please delete this fake news article!

Dick Bischoff

Now that Yellow is gone, TForce Freight has replaced them as the new Yellow. Run by a Canadian conglomerate, the CEO Bedard has no clue how to run or manage a US based LTL carrier and it shows. He is slowly purging the company of UPS based management but not bringing on any talent from well run regional or national players. Given the huge cost increases from the recent teamsters contract along with their rudderless cost cutting effort to control costs I see nothing but chaos in their future. Shippers are tiring of missed pick ups, transit delays and over reliance on rail to move their shipments..