When COVID decimated passenger travel last year, airlines pivoted to air cargo like never before, turning many idle aircraft into temporary freighters. It was an innovation born of necessity that helped bring in much-needed cash.

Shippers were desperate when nearly all widebody aircraft were eliminated from service a year ago, because they carry more than 50% of total air cargo in the hold below people’s feet. Big freighters couldn’t make up the difference and airfreight rates skyrocketed. High yields convinced airlines to repurpose aircraft for cargo customers, even though passenger aircraft hold fewer goods by volume than pure freighters that can load heavy containers on the main deck.

In most cases, airlines flew cargo-only flights with shipments in the belly. But many airlines innovated further by putting personal protective equipment, clothing, toys and other lightweight boxes in the passenger cabin to increase capacity and revenue. They used special seat bags or netting to secure the boxes and also filled the overhead bins. And some airlines took more drastic steps by removing seats so they could floor-load boxes. Loading and unloading shipments in the passenger compartment is much more labor-intensive because boxes had to be hand-loaded through the narrow doors and aisles, but several carriers said the returns justified the extra expense.

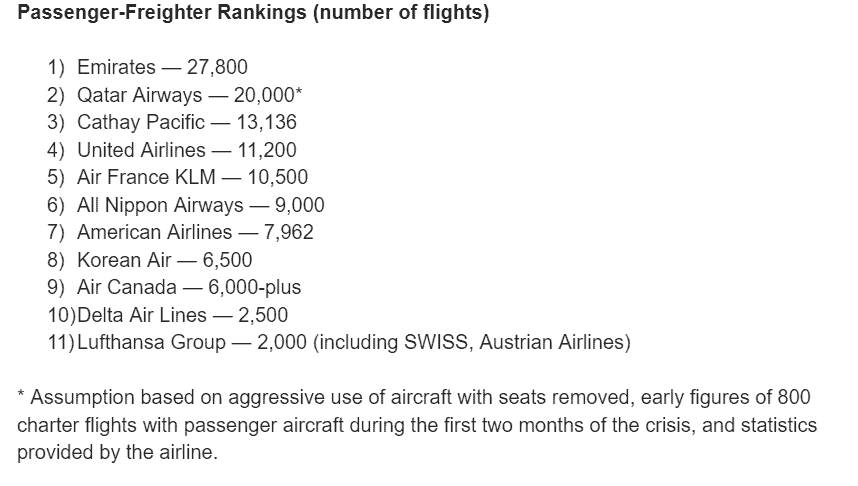

So 12 months into the coronavirus pandemic, which airlines were most aggressive shifting to cargo and operated the most passenger freighters?

The winner, according to an informal FreightWaves survey of the largest international passenger airlines and company statements, is Emirates. The Dubai-based airline flew more than 27,800 flights in dedicated cargo mode, hauling more than 100,000 tons of essential supplies such as PPE, COVID-19 test kits, ventilators, vaccines and food.

Emirates, which also runs a fleet of Boeing 777 freighters, used nearly 90 passenger aircraft for cargo-specific operations at one point.

In November, Emirates began using its giant Airbus A80 twin-deck passenger plane in select cargo charter operations. As passenger travel has incrementally picked up, the airline has gradually moved more toward its traditional model.

Qatar Airways is likely among the top three airlines in terms of cargo-only flights over the past year, but officials declined to provide a specific breakdown of freighter activity. The company said it operated more than 55,000 freighter and passenger freighter flights. It modified six 777-300 Extended Range planes by pulling the seats for extra cargo capacity. Its fleet includes 24 Boeing 777 and two 747-8 freighters.

IAG Cargo declined to provide figures for passenger-freighter flights.

Click here for more FreightWaves/American Shipper stories by Eric Kulisch.

Related News:

Singapore’s Scoot strips seats for cabin cargo

United Airlines surpasses 5,000 cargo-only flights since March