Artificial intelligence has become one of the most transformative technologies of our time, with applications ranging from voice assistants to autonomous vehicles. However, the rapid advancement and deployment of AI systems has led to an unprecedented demand for specialized computing hardware. This demand has created a bottleneck in the semiconductor industry, resulting in chip shortages that are constraining the growth of AI technologies.

This is J.P. Hampstead, co-host of the Bring It Home podcast with Craig Fuller. Welcome to the seventh edition of our newsletter, where we dive deep into our new artificially intelligent overlords and their voracious appetite for computing power.

The current chip shortage is particularly acute for AI-specific semiconductors. As Sam Altman, CEO of OpenAI, noted, “The biggest bottleneck for AI progress is compute – we need more chips.” This shortage is due to several factors, including the complex manufacturing process for advanced chips, supply chain disruptions, and the sheer scale of demand from AI companies and researchers.

To understand why AI requires such specialized and powerful hardware, it’s important to grasp what we mean by artificial intelligence in this context. Modern AI, particularly deep learning systems, relies on massive neural networks that process and analyze enormous amounts of data. These networks require billions of parameters and perform trillions of calculations to train and operate effectively.

The computational demands of AI systems are orders of magnitude greater than traditional software. For example, training a large language model like GPT-3 can require the equivalent of thousands of years of CPU time compressed into a few weeks or months. This level of computation is simply not feasible with general-purpose computer processors.

This is where specialized AI chips come in. Graphics Processing Units (GPUs), originally designed for rendering video game graphics, have become the workhorse of AI computing due to their ability to perform many parallel computations simultaneously. Other types of AI-specific chips include Tensor Processing Units (TPUs) developed by Google, and Application-Specific Integrated Circuits (ASICs) designed for particular AI tasks.

The market for these AI chips is dominated by a handful of companies. NVIDIA is the clear leader in the GPU market, with its chips used in the vast majority of AI training applications. According to industry data, NVIDIA controls about 80% of the AI chip market. Other significant players include AMD, Intel, and Google.

The growth in this sector has been explosive. The global AI chip market was valued at $8.02 billion in 2020 and is projected to reach $194.9 billion by 2030, growing at a compound annual growth rate (CAGR) of 37.4% from 2021 to 2030. This growth is driven by increasing adoption of AI technologies across industries and the ongoing development of more sophisticated AI models that require even more computational power.

However, the supply of these chips has struggled to keep pace with demand. Manufacturing advanced semiconductors is a complex and time-consuming process. The most advanced chips are produced using extreme ultraviolet (EUV) lithography, a technology that is only available from a single company, ASML in the Netherlands. As of 2021, there were only about 100 EUV machines in the world, each costing around $150 million.

The concentration of advanced chip manufacturing in a few companies and geographic areas has also contributed to the shortage. Taiwan Semiconductor Manufacturing Company (TSMC) produces over 90% of the world’s most advanced chips, making the global supply chain vulnerable to disruptions.

Looking ahead to 2025, the demand for AI chips is expected to continue its rapid growth. The increasing adoption of AI in sectors like healthcare, finance, and autonomous vehicles will drive this demand. Additionally, the development of more advanced AI models, including potential artificial general intelligence (AGI) systems, will require even more powerful chips.

To meet this demand, semiconductor companies are investing heavily in new manufacturing facilities. TSMC, for example, is planning to invest $100 billion over three years to expand its chip-making capacity. Intel has announced plans to build new fabs in the United States and Europe, with a total investment of over $80 billion.

Despite these investments, many industry analysts predict that the chip shortage, particularly for advanced AI chips, will persist into 2025 and beyond. The complexity of chip manufacturing, coupled with the exponential growth in AI applications, means that supply may struggle to keep up with demand for the foreseeable future.

It’s clear that the enormous computational requirements of modern AI systems have created an unprecedented demand for specialized semiconductor chips. While the industry is racing to increase production capacity, the shortage of these critical components is likely to remain a significant constraint on the growth and deployment of AI technologies in the coming years. As we look to the future, the development of more efficient AI algorithms and novel computing architectures may be crucial in addressing this challenge and unlocking the full potential of artificial intelligence.

Quotable

“When it comes to driving freight demand, domestic manufacturing has an impact that imports can’t match. Both contribute to the movement of goods across the United States, but the effect of home-grown production on trucking and transportation is far more significant.”

-FreightWaves founder and CEO Craig Fuller, 12/17/2024

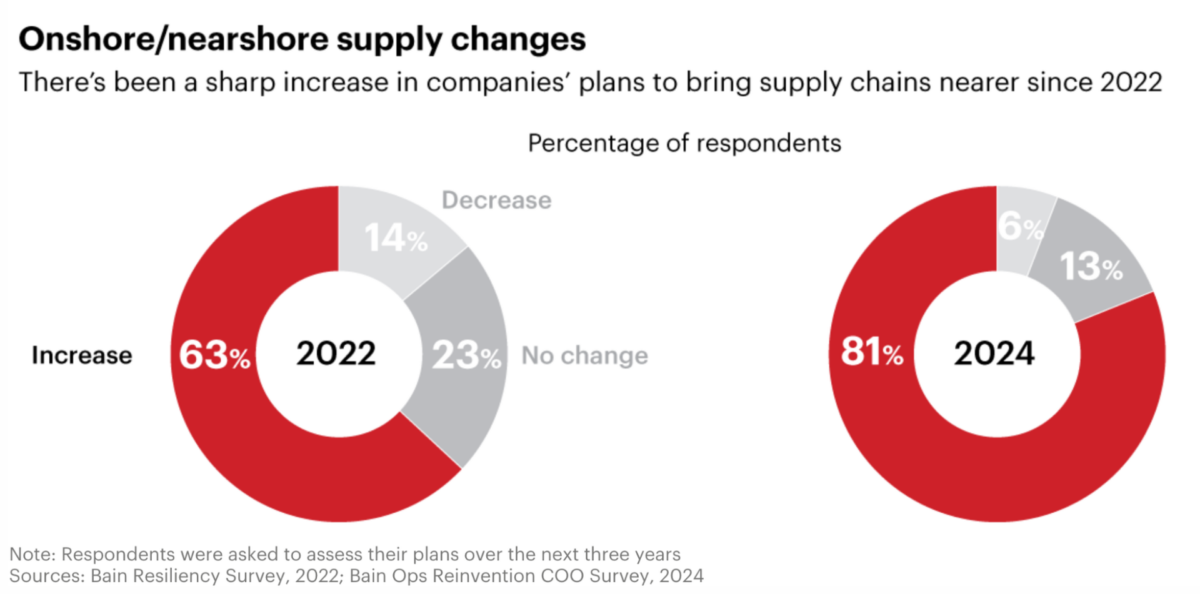

Infographic

(Survey and graphs: Bain)

News from around the web

Majority of companies have slowed or stopped offshore manufacturing investment

Efforts, especially in the United States, to reduce the reliance on foreign trade have gained steam over the past decade. The concept of shipping manufacturing jobs overseas in search of cheaper labor accelerated in the early 2000s, turning what was once a workforce employing over 14.5 million people in 2000 to a low of 11.5 million in 2010. From 2011 through 2023, data from the U.S. Bureau of Labor Statistics shows the country has recovered just over 1 million jobs, to 12.9 million by 2023.

China’s manufacturing activity slows in December

China’s factory activity expanded at a slower pace in December, official data showed on Tuesday, despite recent stimulus measures and in the face of increasing trade risks. The Purchasing Managers’ Index, based on a survey of factory managers, slipped to 50.1 in December from 50.3 the previous month, the National Bureau of Statistics said Tuesday.

It was the third straight monthly reading above 50, a level that indicates an expansion of manufacturing activity. The slowdown in factory activity was due to a “decline in the output component,” according to a note by Capital Economics’ Gabriel Ng.

Deere Highlights Recent Investments in Manufacturing

Deere recently announced plans to expand its Reman Core Center facility in Strafford, Mo., by an additional 120,000 square feet. This $13.5 million expansion will break ground in mid-2025 and is expected to be completed in 2026, bringing the facility’s total footprint to 400,000 square feet.