JP Hampstead here, co-host of the Bring It Home podcast. Welcome to the first edition of the Bring It Home newsletter, which continues the conversations from our podcast about reindustrialization and reshoring in North America and the American manufacturing renaissance.

It is a fundamentally exciting time for America’s industrial economy, full of opportunities and challenges. The reelection of Donald Trump means, among other things, that his break with decades of free trade orthodoxy in the Republican Party was not just an aberration. There’s an emerging bipartisan consensus that the United States’ relationship with China is slowly transforming from a strategic partnership to a more adversarial rivalry. And the United States’ economic relationships with Mexico and Canada have never been closer.

‘Re’-industrialization implies a return, a restoration or a repetition, and indeed, this is only the latest chapter in a story that’s been playing out since the 19th century (although it’s not necessary to go back that far right now). Without rehashing the history of America’s industrial development (19th century railroad construction, coal, steel, and oil monopolies, World War II), we can begin with China’s entry into the World Trade Organization in 2001.

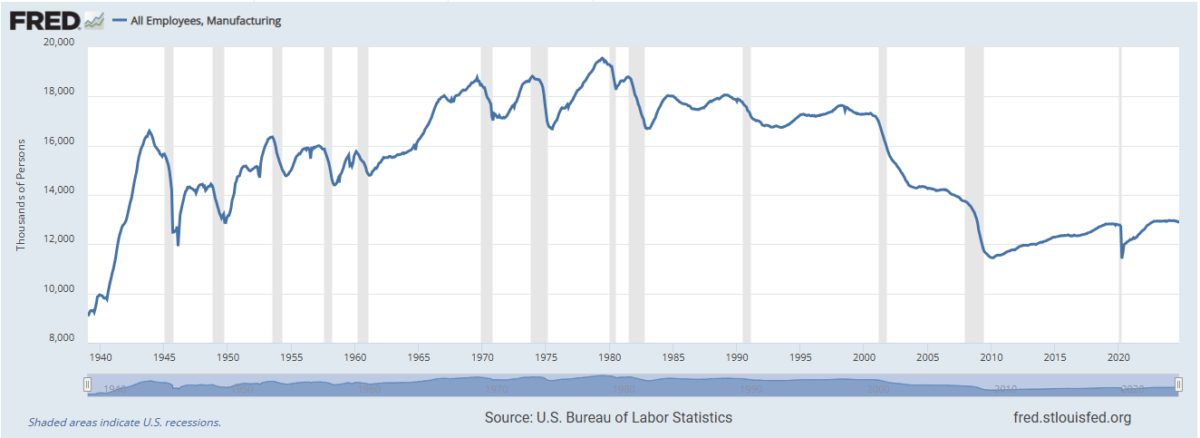

The absolute number of American manufacturing jobs peaked in June 1979 at 19.55 million, then plunged during the recession of the early 1980s before leveling between 17 million and 18 million for the rest of the 20th century.

In December 2000, U.S. manufacturing jobs stood at 17.1 million; a year later, the number fell to 15.7 million; a year after that — 14.9 million. Retailers and manufacturers increasingly found cheap sourcing in China, and as Chinese exports to the U.S. grew, U.S. manufacturing employment cratered further. The number of manufacturing jobs bottomed out in February 2010 after the Great Financial Crisis at 11.45 million — one out of every three manufacturing jobs was lost in the first decade after free trade with China began, a devastating impact.

The manufacturing sector has only made a slow, halting recovery since then in terms of employment, reaching 12.8 million jobs in October 2024.

We think manufacturing employment is set to go higher: More tariffs will reduce the labor cost arbitrage that companies exploit by locating production overseas; massive government investment through the Infrastructure Investment and Jobs Act (2021, $1.2 trillion in spending), Inflation Reduction Act (2022, $891 billion in spending), and CHIPS Act (2022, $280 billion in funding); and potentially lower corporate tax rates will all encourage capital investment in the U.S.

Manufacturing employment will probably never return to 1979 levels due to increased levels of automation and the fact that most of the jobs likely to return are in high value-additive sectors.

But the U.S. has plenty of advantages that will unlock manufacturing growth in the 21st century, especially in places where natural resources, transportation infrastructure and labor supplies intersect and overlap.

One of America’s advantages is, of course, our abundant energy resources.

Tune in to the second episode of Bring It Home this Thursday to hear Collin McLelland (@fracslap on X), founder and CEO of Digital Wildcatters, tell us all about the revolution in hydraulic fracturing and horizontal drilling that made the U.S. a net exporter of petroleum energy.

Quotable

“President-elect Trump and Congress must come together on much needed investment that will put Americans to work building and repairing our nation’s crumbling infrastructure. Stronger trade enforcement to address China’s massive overcapacity and a crackdown on countries trying to circumvent U.S. trade laws can boost manufacturing jobs. Factory workers were more than a prop in this election. Now’s the time to deliver for them.”

– Paul Scott, president of the Alliance for American Manufacturing, in reaction to Donald Trump’s election victory

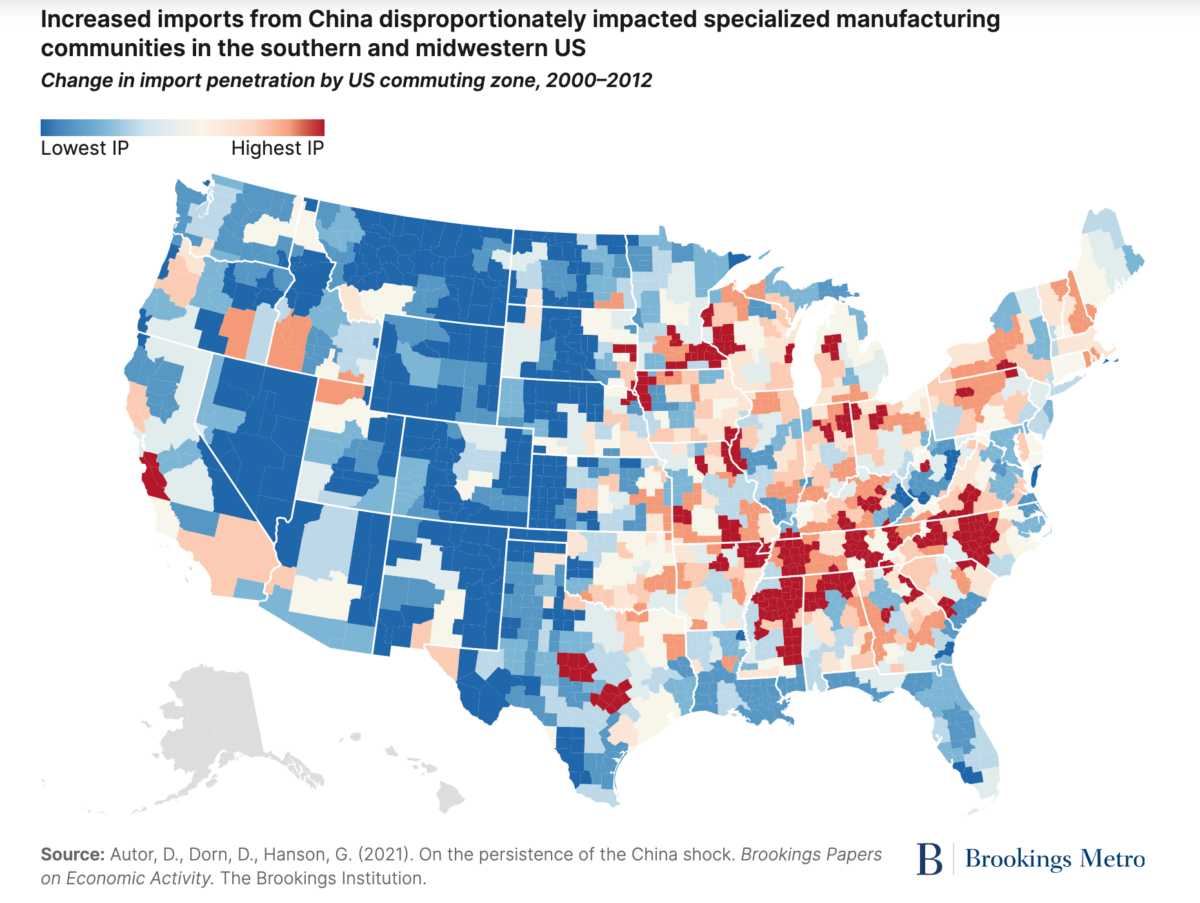

Infographic

Where Chinese imports outcompeted American products

News from around the web

GSK to invest $800M in Pennsylvania drug expansion

The GSK facilities will feature several advanced technologies, including digital twins, robotics, smart utility and electrical system monitoring and controls and AI for predictive maintenance and digital scheduling.

America’s Battery Plant Boom Isn’t Going Bust – Factory Construction Is on Track

We checked up on all 23 battery cell factories announced or expanded since the Inflation Reduction Act was signed – almost all of them gigafactories, which are designed to produce over 1 gigawatt-hour of battery cell capacity. Seventy-seven percent of the total planned capital investment, 79% of the proposed jobs and 72% of the planned battery production are on track, which means that a project is likely to happen roughly on time and generally with its expected level of investment and employment.

Will Trump’s Tariffs Spur U.S. Manufacturing? Executives Are Split

Manufacturing executives are split on whether President-elect Donald Trump’s campaign promise to raise tariffs on imports would increase production in the U.S. Some makers of high-value and precision products said they are optimistic Trump’s trade policies will draw some customers back to the U.S. Other company executives said raising tariffs on goods from countries like China would likely cause them to shift production to other low-cost countries.