Revenue per truck per week is defined as the total amount of linehaul and accessorial revenue generated by a trucking company, divided by the count of a carrier’s trucks, within a given week.

The TCA Profitability Program (TPP) considers this measure a ‘leading indicator,’ as higher readings (relative to historical or peer group results) should result in higher margins and profitability, unless it is consumed or absorbed by higher variable and fixed costs. When you invest in an asset, whether it’s a truck or a rental property, the primary objective is to generate the most revenue in a given time period.

For the purposes of this article, we define ‘truck’ as a tractor that is plated. For some readers, the natural response is “well, I have 10 unseated tractors, it should be divided by total # of seated tractors.” Using plated tractors serves two purposes:

1) It is easy to count the total number of licensed tractors (seated or unseated)

2) Tractors cost a significant amount of money in depreciation, interest, insurance, etc., whether they are seated or not

As such, if you have a high unseated tractor percentage, it’s going to be very difficult to achieve above average results for this measure (underlying message – get them seated or get them sold).

Revenue for this measure is all line haul revenue plus any accessorial revenue generated in that period (detention, load/unload, stop pay, etc.). Noticeably absent from the numerator in this measure is fuel surcharge revenue (FSC). Within TPP, FSC is allocated as a credit (as it should be) to fuel, in order to calculate things such as net fuel expense per mile or as a percentage of revenue. For those carriers, with a high percentage of broker (or open deck/flatbed) freight, where the amount received is a ‘all in’ rate, you can do two things:

1) Calculate gross revenue per truck per week, and start comparing to historical results over time

2) Use and estimate the FSC to properly segment separate FSC from linehaul and accessorial revenue.

When you see ‘Revenue per Truck per Week’ quoted, the denominator is the actual number of weeks in that fiscal period. For example, if a company uses a ‘4,4,5’ accounting cycle, depending on which fiscal month or quarter is being quoted, the number of weeks in that period could be different. Many companies simply use the actual number of weeks in a month or quarter. This is important to know when you are comparing your results to others – it can make a significant difference.

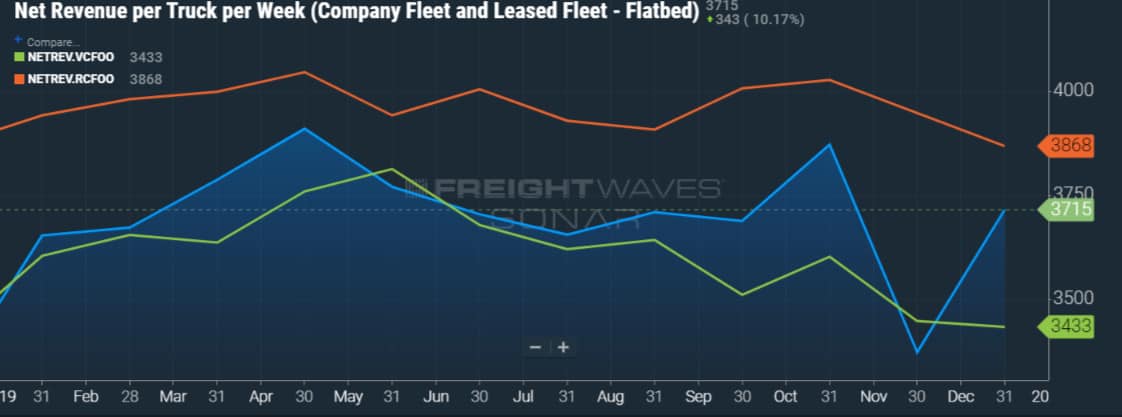

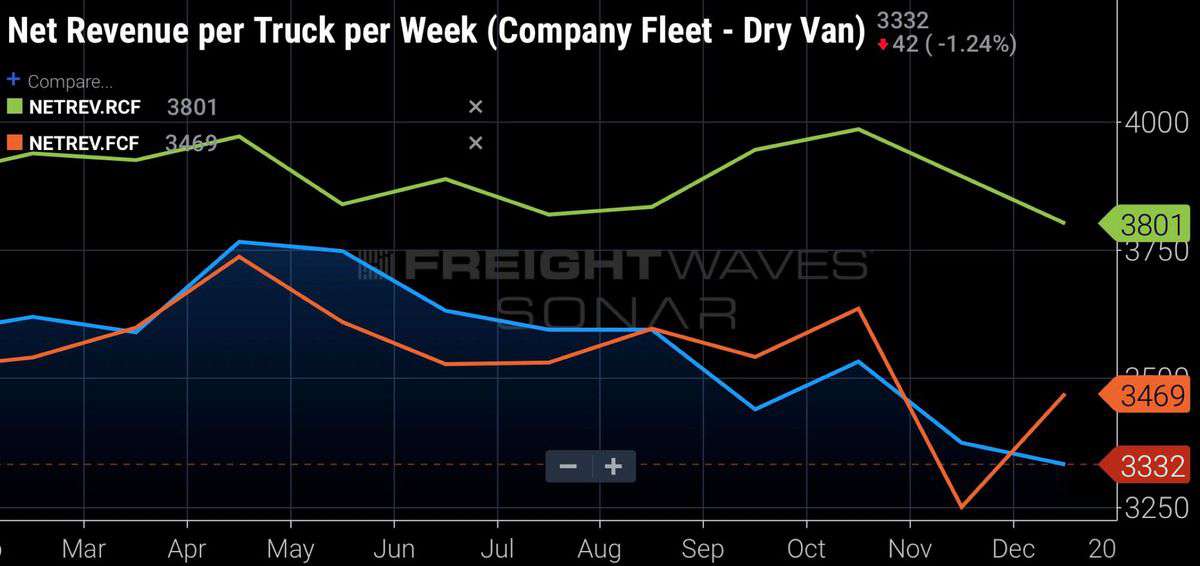

What is a ‘normal’ result for revenue per truck per week? That depends on a number of factors. First, the trailer and freight type. Flatbed and refrigerated loads typically generate higher revenue per truck per week. A ‘normal range’ with TPP varies from a low of $3,000 to a high of $5,000. Likewise for van loads/fleets, a normal range is between $2,800 and $4,800.

Keep in mind, the higher the unseated tractor count, the lower the revenue per truck per week. Carriers that are utilizing team drivers is another factor. Although it’s difficult to find both drivers and (to a lesser extent) the freight to work with team situations, it does provide a strategy for maximizing the potential revenue of a tractor, in a given time period. Finally, for those carriers that are able to haul twin trailers, these companies are able to generate more revenue, with the same miles traveled, and the same number of trucks.

Carriers, from one truck operators to enterprise carriers, should be monitoring revenue per truck per week as a leading indicator within their business, along with a small number of other critical measures.

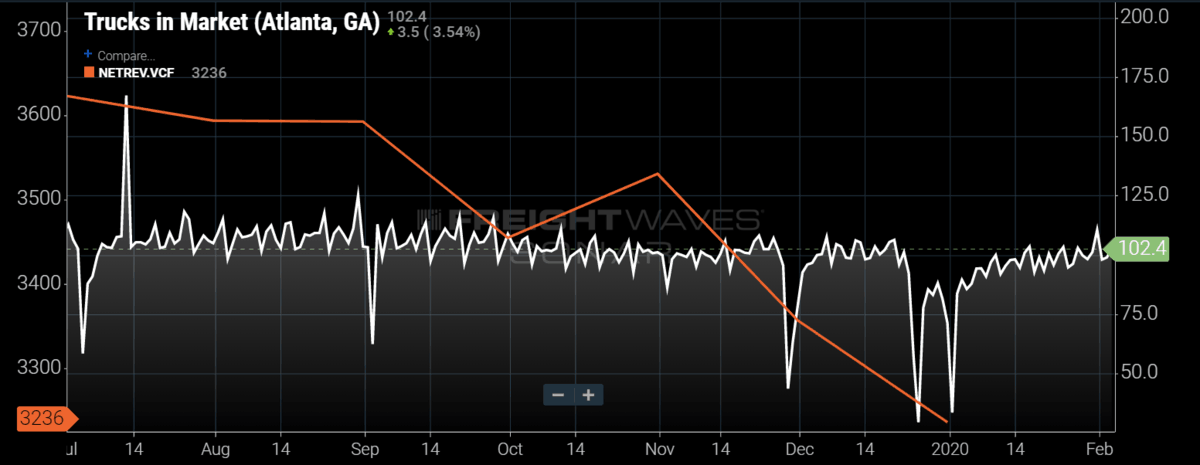

With SONAR, users are able to see average net revenue per truck per week for carriers within the dry van, refrigerated and flatbed operating modes. The carriers represented in these cohorts are participants in the TCA Profitability Program. In total, there are over 230 trucking company profiles represented in this benchmarking database.

To learn more about SONAR, go to https://sonar.freightwaves.com

If you are interested in benchmarking your fleet’s performance with the best operators, join TCA’s TPP. The data presented in this article come from analytics of over 230 truckload for-hire fleets, representing more than 70,000 trucks.

Hans Witt

I keep track of dollar per taxable mile. Gross revenue per day. Gross revenue per week. Gross revenue per round, Net to the truck per month , and per year!. The weekly roundup is to lax , you can’t track day to day proficiency , why brokers and dispatcher like it, and no body want you know what you dollar per mile is!. If you want keep drivers you had better keep track of dollars per per-day.