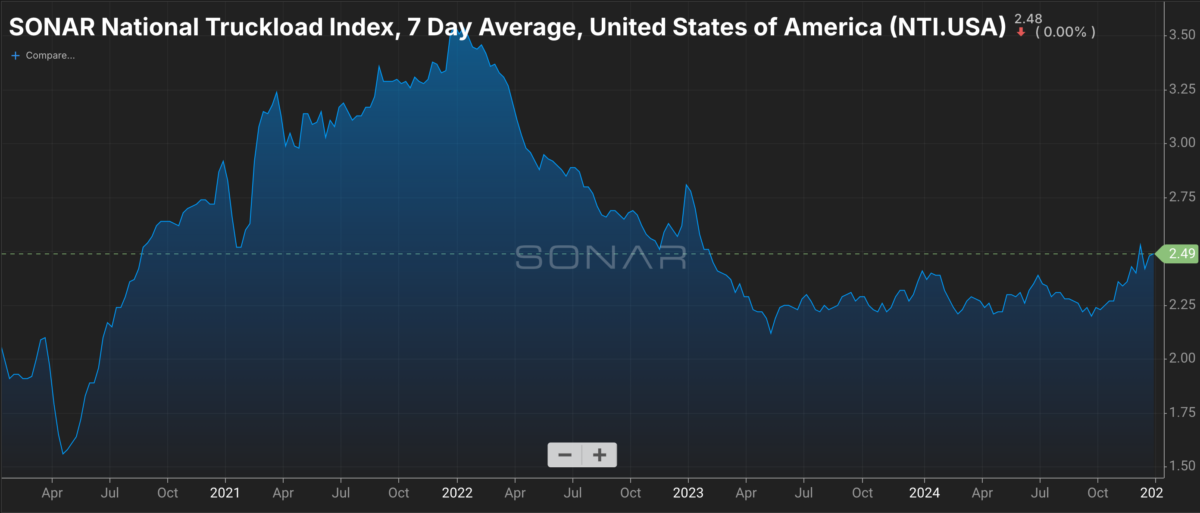

The truckload market enters 2025 showing signs of stabilization after nearly three years of freight recession. While earnings remain depressed across the sector, Susquehanna analyst Bascome Majors sees reasons for optimism that the industry is poised for recovery over the next two years. In a Friday client note, Majors writes that “tangible signs of progress are still incremental – a holiday peak with seasonal lifts in tender rejection rates and slightly super-seasonal dry van spot rates, supported by our checks that reveal more optimism toward one-way truckload contract price recovery this bid season.”

Against this backdrop, Majors has upgraded several truckload and intermodal stocks, forecasting that 2025 will serve as a “bridge year” to more meaningful improvement in 2026. He believes shares can perform well this year “as incremental progress on pricing and margins over the next six to nine months drives hope for a more meaningful price-driven earnings recovery in 2026.”

Knight-Swift Transportation (KNX) received a rating upgrade to Positive with a $67 price target, implying 27% upside. Majors acknowledges near-term margin pressures in KNX’s expanding LTL network but believes “a solid peak season performance in one-way truckload should support both 1Q25 estimated earnings expectations and sentiment toward a greater price and margin recovery in 2026.” He projects KNX’s 2026 earnings per share to reach $3.50, up from an estimated $1.03 in 2024.

(The National Truckload Index is a national average spot rate, inclusive of fuel, in U.S. dollars per mile. Chart: SONAR. To learn more about SONAR, click here)

J.B. Hunt Transport Services (JBHT) was also upgraded to Positive with a $200 price target, representing 17% upside. Majors expects “moderate price and margin recovery in 2025” for JBHT’s intermodal business and views the company as “in excellent position to capitalize on a more meaningful intermodal recovery in 2026.” His 2026 EPS estimate for JBHT stands at $8.75, a significant jump from $5.71 projected for 2024.

Hub Group (HUBG) received an upgrade to Positive and a $55 price target, implying 25% upside. Majors sees potential upside from “self-help in Logistics margins for HUBG in 2025” and forecasts 2026 EPS of $2.90, up from $1.95 expected in 2024.

C.H. Robinson Worldwide (CHRW) was upgraded to Positive with a $130 price target, suggesting 26% upside. Majors believes CHRW shares “create an interesting mid-term entry point for investors to ride the ‘new operating model’ into a mid-cycle truckload market in 2026.” He projects 2026 EPS of $5.90 for CHRW, compared to $4.44 estimated for 2024.

Werner Enterprises (WERN) saw an upgrade to Neutral with a $38 price target, representing 7% upside. While Majors sees “meaningful risk to 2025 consensus EPS,” he notes that WERN no longer has “downside to shares when capitalizing a 2026 EPS recovery.” His 2026 EPS estimate for WERN is $2.10.

Underlying these upgrades is Majors’ belief that the trucking industry is approaching an inflection point after an extended downcycle. He writes, “We believe it’s appropriate to capitalize a greater 2026 profit recovery at target multiples modestly above long-term averages, a shift from our prior peak multiples on near-trough earnings approach.” This change in valuation methodology has driven most of Majors’ target prices higher.

Macroeconomic factors supporting the potential recovery include stabilizing truckload capacity, retail spending and industrial production. Majors notes that “Class 8 tractor sales remain just above replacement levels” and that “current forecasts suggest net Class 8 truck fleet growth slows to a crawl in 2025 but won’t turn negative.”

Looking ahead to 2025, Majors highlights several key indicators to watch. These include the progress of the spring bid season, which he describes as “a critical step on the journey to mid-cycle” pricing and margins. He also points to potential catalysts like “a likely disruption from an East Coast/Gulf ILA-Port Strike” and “ongoing pre-shipping ahead of expected Trump tariffs.” Additionally, Majors suggests monitoring Class 8 truck orders and intermodal container turns as barometers of industry capacity and efficiency.

While Majors acknowledges that “2025 won’t be a banner year for truckload-related transports,” he believes it “should deliver enough progress to keep the hope for real recovery in 2026 alive.” His upgrades reflect a cautious optimism that the worst may be over for the trucking industry, with potential for significant earnings growth on the horizon.