(Updated Oct. 260, 2020, 9 A.M. ET, with more on EFEW, Sine Draco Aviation)

Questions about whether the new Airbus A321 converted freighter could generate orders and catch up to the Boeing 737-800, which has a three-year head start in the express delivery market, are quickly dissipating.

Aircraft trading and leasing company Vallair announced Tuesday that Miami-based Global Crossing Airlines (GlobalX) has signed a prospective deal to lease 10 converted A321 freighters, with first delivery expected by the third quarter of 2021. All 10 are expected to be in revenue service by the second quarter of 2023, providing capacity to freight forwarders trying to keep up with e-commerce demand in Northern, Southern and Central America.

SmartLynx Airlines, headquartered in Riga, Latvia, on Thursday said its Malta subsidiary signed a lease with Luxembourg-based Vallair for two A321-200 cargo planes converted from passenger configuration and that it plans to further expand into the cargo market by adding eight more of the aircraft by 2023.

Vallair, which leases pre-owned aircraft, said the two aircraft leased by SmartLynx Malta will be operated on a dedicated basis for an international freight forwarder. Malta is an ideal location for inter-European distribution and will alleviate pressure on congested cargo hubs, it said.

SmartLynx Malta, established in April 2019, received approval to conduct passenger and cargo operations to, from and transiting the U.S. last summer.

GlobalX is a start-up charter airline that plans to fly its own passenger and cargo planes under contract with airlines and other customers. It is currently working to obtain its operating certificate from the U.S. Federal Aviation Administration (FAA). Under its “wet lease” business model, GlobalX will operate the planes and provide maintenance and insurance. In an investor presentation this month, the company said it plans to grow its fleet to more than 50 passenger and more than 30 cargo airplanes.

The SmartLynx transaction is notable on several fronts. The aircraft will be the first cargo planes operated by SmartLynx. It is the latest latest example of smaller airlines placing greater priority on freight. SmartLynx Malta is also the first operator to have A321 freighters converted by both Elbe Flugzeugwerke (EFW) and 321 Precision Conversions.

321 Precision Conversions, a joint venture between Precision Aircraft Solutions of Beaverton, Oregon, and Air Transport Services Group (NASDAQ: ATSG), a leasing and air cargo transport company based in Wilmington, Ohio, earlier this month completed the first test flight of its A321 converted freighter. The plane, which will be placed with SmartLynx, is scheduled for more certification flights before the FAA signs off on the major modification, likely early next year.

EFW, a joint venture between Airbus and ST Engineering in Singapore, has completed its first A321 conversion for Vallair, which leased the plane to Qantas Airways to support Australia Post parcel operations.

Qantas has said it plans to acquire up to three of the A321 freighters, and BBAM Aircraft Leasing and Management has an order with EFW, Dresden, Germany, for two planes.

Meanwhile, a third company is preparing to enter the field for converting A321s. Sine Draco Aviation Technology, a Chinese company with a North American subsidiary in Bellevue, Washington, recently launched development of an A321-200 passenger-to-freighter conversion program and said it expects to obtain FAA approval of its design in late 2021 or early 2022. The company said Tuesday it has selected Ascent Aviation Services in Tucson, Arizona, to do the modification work for its prototype freighter.

Conversion of passenger planes to cargo mode involves several structural changes besides seat removal, including the addition of a wide cargo door to allow for loading of pallets on the main deck, a rigid bulkhead to protect against shifting cargo, and a cargo handling system for pulling containers through the hull.

The A321 and 737-800 are tailored for regional and express delivery operators experiencing a surge in e-commerce business that is forecast to keep growing. That’s because they are more efficient to frequently operate on short milk runs than larger aircraft, which are better suited to slower operating tempos or otherwise might fly with empty space.

SmartLynx said it chose the A321 over the Boeing 737 classic versions and the 737 Next Generation (700 and 800 series) because of its lower carbon emissions and a desire to maintain commonality with the rest of its Airbus passenger fleet, which makes pilot training and maintenance easier. The A321 is 20% more fuel efficient than older aircraft in its class, according to Airbus.

Different designs, different payloads

SmartLynx also said it selected both EFW and 321 Precision Conversions designs to give customers greater choice in meeting their transportation needs.

321 Precision Conversions has the lower operating empty weight of the two versions, which allows carriers to use the entire 59,600-pound payload for revenue-generating cargo, Zachary Young, director of sales, told FreightWaves. The company’s design pushes the deck plan farther aft, which avoids the need for ballast in the rear of the plane.

The EFW freighter would have to trade off fuel capacity to achieve the same commercial payload capacity as the 321 Precision version, reducing its range by 11%, Young said. Manufacturers such as Airbus equip planes within a family to carry different numbers of passengers within a range of certified weights. Upgrading a used plane to a higher weight variant can cost about $600,000 and double that amount if to maintain the maximum fuel range, he said.

An upgrade requires the original manufacturer to issue a modified service bulletin, a repair damage assessment, additional inspections and possibly some structural reinforcements. The upgrades also increase repair risks, and the higher weight places greater strain on the landing gear, increasing overhaul costs.

The heavier EFW version accounts for an estimated 12 to 14 additional gallons per hour of fuel burn, according to route analysis studies conducted by 321 Precision. Depending on utilization and fuel prices, the 321 Precision freighter will save a minimum of $70,000 in fuel costs per year compared to the EFW version.

“Our conversion weighs less, carries more, goes farther, costs less. There is no greater enhancement on freighter performance than having the lowest operating empty weight,” Young said.

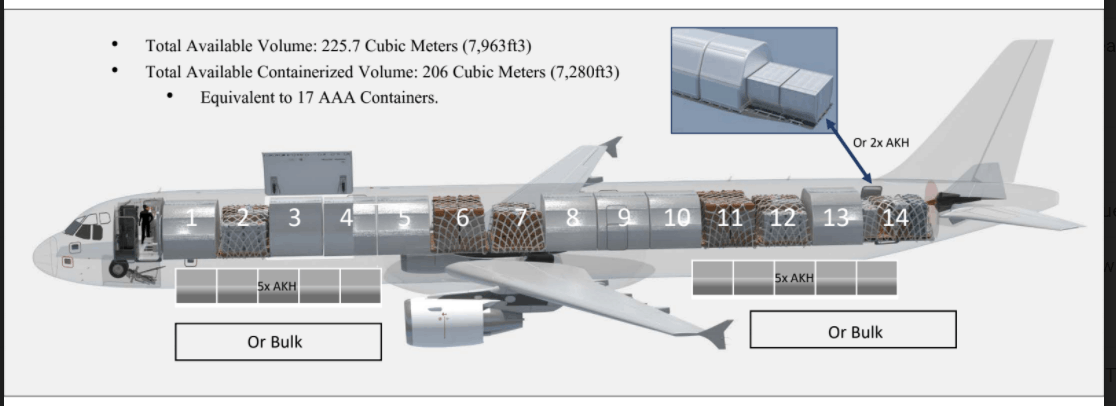

The conversion house has also turned the 14th pallet position longitudinally, allowing it to accommodate either a 71-inch-tall netted pallet or two LD3-45 containers.

Both EFW and 321 Precision allow for the same cargo volume, but the 321 Precision design utilizes more space in the rear of the fuselage, allowing the interior doors to be retained and creating a large vestibule that can hold up to six occupants and their baggage, Young added in an email.

EFW says its version is advantaged by:

- Strong design support from Airbus that ensures life-cycle value.

- Minimal maintenance costs associated with stress and fatigue.

- Up to $250,000 in annual fuel savings because the center-of-gravity is optimized to reduce the pilot’s need to trim the controls to maintain straight flight.

- More than 28 tons (over 61.800 lbs) of gross payload on its second conversion, with even further upside potential with upcoming conversions.

- Best-in-class flexibility for main deck with 14 full-size container positions vs. 13 full-size plus one pallet position.

- Optimized weight distribution allowing empty flights and random loading providing the full range of flexibility, which is beneficial for express carriers.

- Coverage for all weight variants of the A321, as well as any desired weight upgrades.

A321 vs. 737-800

The A321, which is considered a strong replacement candidate for older Boeing 757s, offers several advantages over the 737-800, according to aviation professionals. The narrow-body Airbus plane offers about 6,000 pounds more cargo capacity, depending on aircraft model and weight limits, and can carry small containers and pallets on the lower deck, compared to 737s that can only fit breakbulk and piece cargo under the main deck. Overall, the A320 family of converted freighters can accommodate 14 containers on the main deck and 10 in the belly hold, while the 737-800 has 12 pallet positions.

In addition to offering a higher volumetric capacity, “this ability to offer containerized cargo is a real selling point for the A321 as it increases efficiency by reducing turn-around times and facilities the weight-and-balance calculations,” said Alistair Dibisceglia, Vallair’s chief leasing officer, in a statement.

“The operating cargo capacity and operating economics of the A321 is superior to the 737-800,” GlobalX said in the investor presentation.

Also in the A321’s favor is the growing feedstock of relatively low-priced, young aircraft as airlines trim fleets in line with reduced passenger demand caused by the coronavirus crisis. Lower acquisition costs make it more economical to invest in engineering to transform the planes so they can carry containers. Vallair estimates there are 1,100 relatively young aircraft with modern avionics available for potential conversion.

Boeing has delivered 36 737-800 converted freighters to 10 global customers, with 134 total orders so far. Aeronautical Engineers Inc. received its supplemental certificate to modify 737-800 planes in March 2019 and has converted four planes, with 13 firm orders and options for an additional 24, said Robert Convey, senior vice president of sales and marketing.

Dibisceglia recently said Vallair is considering buying more than 20 A321-200s.

The A321 converted freighter is a “game changer,” Roy Linkner, chief commercial officer of 21 Air, a small cargo operator in North Carolina that is eyeing the plane as a candidate for future expansion, said on LinkedIn.

Click here for more FreightWaves/American Shipper stories by Eric Kulisch.

RELATED NEWS:

Airbus A321 embarks on second act in e-commerce

New A321 converted freighter passes first test flight in US

21 Air gets creative, adds capacity with passenger freighter