Intermodal volumes aren’t slowing down. By mid-December, we’re well past the time when goods bound by train would arrive in retail stores in time for Christmas shoppers, yet railroads are still carrying near-record numbers of boxes. Tariff pull-forward, consumer demand and inventory building are all driving higher intermodal volumes, setting the market up for rate increases next year.

Call it a “long peak.”

Total intermodal traffic in North America saw a significant boost last month, increasing by 8% year to date through November 2024 compared to the same period in 2023, according to the Association of American Railroads (AAR). U.S. railroads played a major role in this upsurge, originating an average of 282,000 intermodal containers and trailers per week in November 2024. This figure marks a 10.7% increase over November 2023 and represents the highest weekly average for any November since record-keeping began in 1989.

The year-to-date intermodal volume in the U.S. through November reached 12.75 million units, representing a 9.1% increase from the previous year, according to AAR. Only 2018 and 2021 saw more boxes, making this year the third-highest on record. The volume performance is highlighted by the fact that the top nine intermodal volume weeks for U.S. railroads have occurred since late August 2024, with three of the top five, including the leading two, occurring in November. In other words, peak season started off strong and then sustained beyond the point when goods on a train would be in stores in time for Christmas.

Resilient consumer spending, supported by a strong job market and stable inflation, is driving year-over-year growth in retail this holiday season. In response, U.S. ports have experienced increased activity, with aggregate year-to-date volume at the 10 largest U.S. ports up 13% through September. Diversion of shipments from East Coast ports due to labor concerns and shippers’ anticipation of potential tariff increases under the incoming Trump administration may be fueling this year’s long peak.

Despite heavy volumes, networks only slightly slower

Despite the surge in volumes, Class I rail networks have held up pretty well. Network velocity (measured in miles per hour) for most Class I railroads has declined only slightly year over year, with variations by carrier. BNSF and Union Pacific both slowed by 2% over the past four weeks compared to last year, while Norfolk Southern was 9% faster. Canadian National has slowed the most during peak, with average system train speed down 8% over the past four weeks compared to the same period last year.

Dwell times are a different story.

Recent trends in dwell times reveal a mixed picture across different rail carriers, but most rails are experiencing more congestion and longer dwells than last year, and in some cases the increase in dwell time is significant. BNSF has managed to reduce its dwell time by 4% in the trailing four-week average, and Union Pacific has seen a 5% reduction over the same period. Conversely, CSX has faced a significant increase, with dwell times rising by 24%. Norfolk Southern has improved, matching Union Pacific’s 5% reduction. However, both Canadian National and Canadian Pacific Kansas City (CPKC) have reported increases in dwell time, with respective rises of 12% and 13% in the trailing four-week average. These variations underscore the ongoing challenges and improvements in operational efficiency across North American rail networks.

The data suggests that while railroads are handling increased volumes, there are capacity constraints and service challenges in some areas of the network.

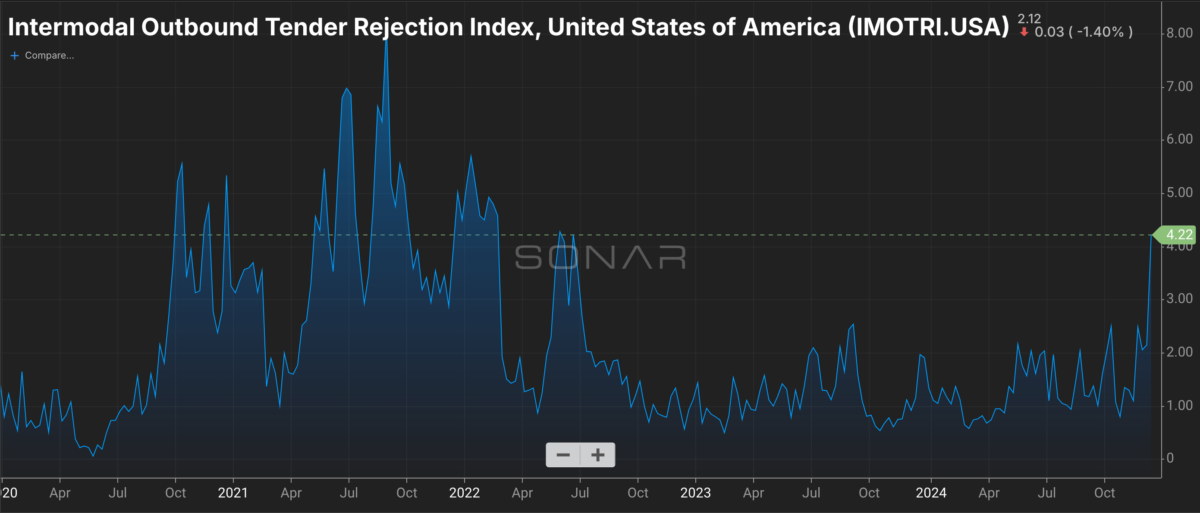

That’s borne out in SONAR data, which is registering a spike in intermodal tender rejections. While the vast majority of intermodal freight moves on the contract market according to pre-agreed rates, occasional capacity tightens quickly enough to trigger a jump in tender rejections, when the railroads and intermodal marketing companies cannot move certain loads.

(National average percentage of intermodal shipment tenders rejected by railroads and IMCs. Chart: SONAR. To learn more about SONAR, click here.)

Railroads are investing in infrastructure again

To address growing demand and enhance service, railroads are engaging in strategic investments focused on infrastructure and technology advancement.

The completion of a $100 million second span by CPKC over the Rio Grande at the Laredo, Texas, gateway is highly significant to U.S.-Mexico trade, particularly the automotive and industrial manufacturing industries. This bridge has effectively doubled cross-border intermodal capacity in Laredo and eradicated the previous need for directional running windows. In addition, the Port of Los Angeles is actively developing a goods movement campus aimed at training new workers while also offering upskilling opportunities for older employees, potentially boosting port-to-rail efficiency. Beyond that, various Class I railroads have announced investments in automation across key terminals, although this has yielded mixed results in terms of productivity improvements so far.

Higher rates in 2025 almost certain

Looking at 2025, the landscape for intermodal rail rates is shaped by a variety of factors. A primary driver is the anticipated robust volume growth which, coupled with capacity constraints, could exert upward pressure on rates. Railroads are cognizant of these pressures and are actively working to enhance service and efficiency standards. These improvements could serve to temper potential rate hikes, balancing cost with the quality of service offered to shippers.

Another key consideration is the potential imposition of new tariffs by the upcoming Trump administration. This could reshape trade flows significantly, influencing rail pricing structures. Concurrently, ongoing labor negotiations, particularly on the East and Gulf coasts, inject an element of uncertainty into the equation. Changes here could cause shifts in cargo routing, affecting rate dynamics in ways that are not yet clear.

Truckers will also have their say on the overall pricing environment, alongside broader economic conditions, and will play pivotal roles in the rate-setting process. As railroads aim to capitalize on operational efficiencies while maintaining profitability, shippers can expect a dynamic and competitive pricing landscape. While it’s likely that intermodal rates will increase, the degree of these hikes will vary depending on specific lanes and carriers as railroads strive to accommodate growth and innovate their services.

Shippers should expect a competitive pricing environment as railroads seek to balance volume growth with service improvements and profitability.

What to watch for in 2025

As the intermodal market fully emerges from the post-COVID era, it faces a dual landscape of challenges and opportunities. Among the key challenges are managing capacity constraints during peak periods — already far improved compared to the pandemic — and improving service consistency across the network. There’s the looming threat of labor disruptions, particularly on the East and Gulf coasts, if the ILA negotiations in mid-January get stuck.

Intermodal will continue capitalizing on the shift toward nearshoring, and the surge in manufacturing activities in Mexico and north-south routes will keep growing its share, notably with the new CPKC rail network.

The North America intermodal market is poised for continued growth in 2025, driven by strong consumer demand, strategic infrastructure investments and shifting global trade patterns. While capacity constraints and service challenges persist, railroads are actively working to improve efficiency and expand their networks. Shippers should expect a dynamic pricing environment and should closely monitor service metrics, labor negotiations and potential policy changes that could impact intermodal rail transportation in the coming year.