At FreightWaves LIVE Chicago, founder and chief executive officer Craig Fuller unveiled the latest version of FreightWaves’ freight markets data platform, SONAR 5.0. One of the features Fuller demonstrated was the trucking rate predictor, which has been released as a public beta.

FreightWaves built a trucking rate predictor for very simple reasons – it filled a significant gap in the toolkit available to transportation market participants and our customers asked us to do it.

“The available tools have information based on what carriers and brokers report, and it’s dependent on how they choose to report it,” said Michael Caney, executive vice president of customer success at FreightWaves. Caney formerly served as the president of logistics at Riverside Transport in Chattanooga, Tennessee.

Caney said that freight brokerages tend to go about price discovery in two ways. Either they have well-funded operations with a large number of carrier reps who can make non-revenue-generating telephone calls to ask about truck prices and build data sets that way, or they use the available benchmarks and add or subtract based on market sentiment.

“Brokers and asset carriers take the benchmark assessment, their own lane history, and their own ability to procure, their perception of fixed and variable costs and they mark it up,” Caney said.

FreightWaves knew there was a better way – a method of calculating real-time trucking rates based not on voluntary and fragmentary reporting but on empirical market conditions. The FreightWaves rate predictor builds dynamic base rates and then adjusts them according to daily conditions in both the origin and destination markets.

“We have all of these assessment tools that aggregate historical rates,” said Scott Worland, director of data science at FreightWaves, who built the rate predictor. “They’re showing what the rates were and giving you some sort of average on a lane, but they swing wildly. For one lane in one month you might see swings of $0.50 per mile. How much does a ‘mean’ actually matter when you’re looking at ranges that wide for the lane?”

There are other issues with assessments based on reporting of historical transactions. In order to get dense enough data to make the rate meaningful, legacy tools dramatically expand the boundaries of a market, and extend the data set far backward into time. A broker trying to discover price to move a truck from Nashville to Casper, Wyoming, may find himself working based on a month of reports that include up to four states, Worland said.

“We took a scientific approach to answering the question of why the rate is what it is,” Worland said. “Is it based on anything about the market, is it just based on ‘historically, I’ve gotten the rate so I should continue getting it?’”

There are three base components to calculating a rate: the per-day operating cost of a truck; the total mileage of a trip (per mile rates tend to be lower the longer the length of haul); and a lead time premium. The shorter the lead time on a load, the more expensive the rate tends to be.

But each of those components are weighted differently, and those weights or coefficients are dynamic, Worland explained.

“There’s a nonlinear premium on lead time,” Worland said. “It starts high and rapidly decreases, so that there’s a huge difference between a one- and two-day lead time, but just a small difference between a four- and six-day lead time.”

The way the predictor pulled data for origin and destination markets also needed to be dynamic, Worland said, because drivers are willing to deadhead further for a pickup if the load will yield a lot of miles. Once the definition of the origin and destination markets is set for the purposes of calculating their characteristics, other adjustments are made to the base rate to reflect carriers’ willingness to leave a backhaul market for a headhaul market and their reluctance to do the opposite.

“We learned these coefficients, or ‘weights,’ empirically,” Worland said. “They’re informed by regression modeling on historic rate data. But we don’t use historic rate data just so that we can recreate it; that’s not the point. We merely use it as a frame of reference.”

SONAR’s rate predictor displays trucking rates exclusive of fuel surcharges, but those can also be calculated separately and added to the all-in rate for any given lane.

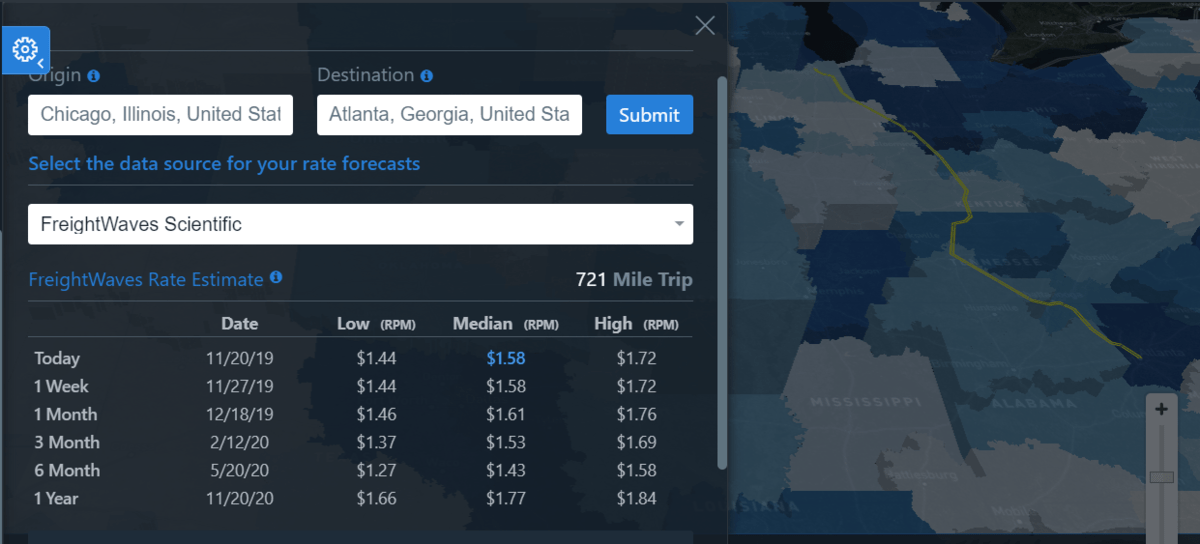

That’s part of what generates SONAR’s daily rates, but the predictor in SONAR 5.0 also generates rates for a week, a month, three months, six months and a year out. Those forecasts are built by 3,500 machine learning models that run every night and interact with each other. Each forecast is refreshed daily based on the newest information; the one week and one month forecasts will adjust more responsively than the one year forecast.

“We have no skin the game and we don’t care about taking a margin on a load,” Worland said. “What we’re trying to say is that based on operating cost and the characteristics of the markets, this is what a market rate should be.”

SONAR users can find the beta version of the trucking rate predictor, “Predictive Rates,” in the “3D Maps (Beta)” Global Page under Widget Tools.

To learn more about SONAR’s Predictive Rates, sign up for a demo here.