A surge of passenger-to-freighter aircraft conversions in response to heightened shipping activity since the pandemic is raising questions about whether the boom cycle can be sustained or will lead to oversupply that lowers lease and freight rates.

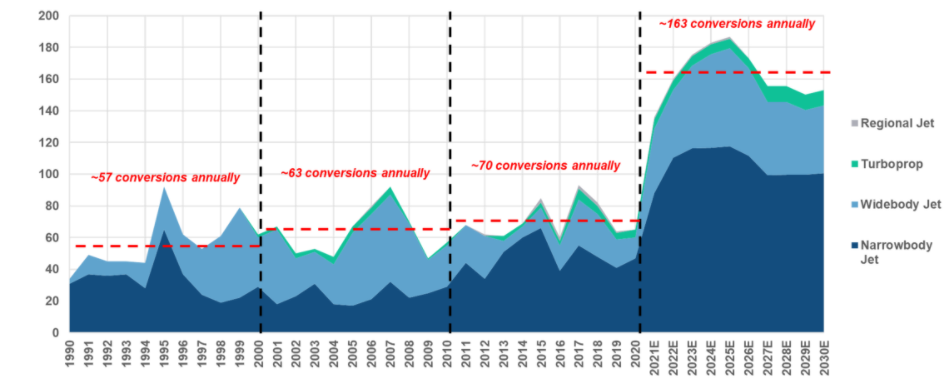

The number of aircraft reconfigured for main-deck cargo storage is estimated to exceed 180 by 2025, a 150% increase compared to the average annual production of 70 units last decade, according to a recent analysis by AeroDynamic Advisory. Thirty years ago, the conversion rate was about 50 aircraft per year.

The narrowbody fleet, in particular, has been the focus of unprecedented expansion during the past two years, with cargo retrofits expected to top 110 units this year — more than double the annual pre-pandemic output. Conversions for the Boeing 737-800, the most popular cargo candidate in the standard segment, are expected to top 80 units in 2022, a two-thirds jump in the existing fleet size of 112, Fortune Aviation Services said in a report released this week. It warns there could be too many small narrow freighters for several years.

Driving the trend are leasing companies that, faced with losing revenue from idle passenger assets early in the COVID crisis, hurried to repurpose aircraft as freighters and speculative investors entering the narrowbody conversion market for the first time.

“The rush by owners and lessors to push so many aircraft, such as the 737-800, through freighter conversion is running headlong into a period of slower economic growth and a short-haul air freight market that already faces stiff competition from less costly road and rail options as well as passenger belly space,” said Steve Fortune, whose firm provides strategic guidance to investors, lessors and overhaul shops about market opportunities, in a preamble to the report.

The AeroDynamic Advisory study — which examines the entire market: standard, widebody, turboprop and small regional jets — forecasts converted freighter production will soften by mid-decade as stakeholders try to avoid an oversupply scenario.

“If conversion rates keep going the way they are now and don’t slow down, then lessors could definitely find themselves in a sticky spot, especially those that are converting aircraft on a speculative basis,” Mike Stengel, AeroDynamic’s senior associate, told FreightWaves.

Last year, cargo volume moved by air increased 7% compared to 2019, despite an 11% shortage of capacity related to international passenger airlines flying less to preserve cash during the pandemic. North America was the strongest region, with 20% growth, according to the International Air Transport Association.

A shift in spending by socially distanced consumers from services to online goods, boosted by government stimulus and wage increases, turbocharged an already strong e-commerce market and demand for all-cargo aircraft. Conditions favoring air cargo include the need for COVID-related medical equipment, extremely low retail inventory levels, robust merchandise trade and industrial growth, and severe ocean shipping delays that sent companies looking for alternative transportation.

Analysts say air cargo throughput would have been even higher in 2021 were it not for COVID outbreaks, labor shortages and airport congestion that also disrupted air logistics.

Conversion architects report they are busier than ever. These companies engineer how to gut and ruggedize aircraft interiors, install cross beams and reinforced flooring to support containers, add a large cargo door and cockpit barrier, secure regulatory approval for changing the aircraft’s design and license their designs to body shops. Depending on the aircraft type, production slots are sold out for several years with nonrefundable deposits.

Freighter Conversions by Aircraft Type – 1990 to 2030

Fortune Aviation Services reports that the imbalance between supply and demand was already underway before the pandemic in the small freighter segment. Between 2015 and 2020, it said, the number of small freighters in service (mostly 737s) grew more than three times faster than shipment volume — mostly because of e-commerce and Amazon.com building out its own cargo airline.

Boeing conversions are veering to the 737-800 as the feedstock of older 737-400s dries up, market watchers say.

Conversion bonanza

Rapid investment in converted freighters is also being fueled by an abundance of quality aircraft and lower asset prices with airlines parking many aircraft during the COVID crisis and mostly reintroducing the most fuel-efficient, economical models for financial and environmental reasons.

Leasing companies typically flip planes to cargo mode after about 20 years of flying, but low market values for popular models means younger planes are now available. DHL Express, for example, recently acquired a pair of medium-size Boeing 767s that are less than 10 years old and recently converted a Airbus A330-300 built in 2013, according to the AeroDynamic report.

Widebody values are currently suffering the most from COVID disruption of international travel, with aircraft available for 30% to 40% less than before the pandemic, AeroDynamic Advisory said.

Valuations for single-aisle aircraft have nearly recovered from pandemic lows.

London-based aircraft management and appraisal firm IBA last October put the all-in value of a used 737-800 at $18 million to $19.5 million – with conversion work accounting for $4.3 million to $6 million of the total. A typical lease rate is about $180,000, depending on the operator’s credit and country risk.

Robert Convey, senior vice president for sales and marketing at Aeronautical Engineers Inc., said during an IBA webinar at the time that 737-800 values collapsed to $10 million to $12 million as COVID spread in early 2020. AEI’s conversion cost is less than $4 million, he added.

The Airbus A321 converted freighter is also receiving rave reviews from industry professionals as the latest aircraft to the conversion party. Only a few have been produced so far, but experts describe its lower-deck container capability, payload capacity and fuel efficiency as strong points. The A321 is competing against the 737-800 and also is viewed as a replacement for the aging Boeing 757 fleet.

IBA values the A321 at $21 million to $24 million, including a conversion price just north of $6 million. It can fetch about $225,000 per month on lease. As more fuel-efficient “neos” replace older A321 passenger aircraft, the values will come down, making conversions more feasible.

License holders are rapidly opening more conversion centers to meet the demand.

Boeing (NYSE: BA), for example, this year plans to open two 737-800 production lines at a partner facility in Costa Rica and two lines for the 767 medium-size widebody freighter in Guangzhou, China. Elbe Flugzeugwerke, a joint venture between Airbus (DXE: AIR) and Singapore’s ST Engineering, recently said it has more than 80 slots reserved for the Airbus A330 and is increasing capacity to about 30 conversions per year for the A330, plus 30 for the new A320/A321 narrowbody freighter by 2024. Airframe shops under its program recently opened conversion hangers in Shanghai, San Antonio and Mobile, Alabama.

Last month, Hong Kong Aviation Engineering Co. began transforming A321s for U.S.-based 321 Precision Conversions at its aircraft maintenance facility in Xiamen, China.

Aeronautical Engineers Inc., an independent provider of conversion kits based in South Florida, plans to add another conversion center soon but has not made a final decision, Convey said in an email message. The company has a two-year waiting list for production slots, with 65 firm orders for the 737-800. The pipeline includes eight 737-400s and 16 other small jet aircraft.

AeroDynamic Advisory estimates that nearly 30 new conversion lines will be opened worldwide by 2025 from 2020.

Overcapacity?

Experts say the air cargo market will eventually cool off, and with it red-hot demand for freighters, but could still be poised for better long-term performance because of relentless, double-digit annual growth in e-commerce sales.

On the demand side, global economic growth is expected to moderate to 4.4% in 2022 from 5.9% last year, according to the International Monetary Fund. The Russia-Ukraine war could erode output even further. Once ports and other freight stakeholders correct supply chain bottlenecks, which experts say may take another year, some air cargo shipments could revert to ocean transport.

Meanwhile, as passenger carriers rebuild their networks, there will be more lower-deck space for cargo, especially on key international routes. Extra capacity and softer volume will dampen yields, which have been so strong for 18 months that many passenger airlines continue to operate cargo-only flights with half-empty planes.

The recovery in passenger fleets will reduce the aircraft surplus and strengthen values, reducing feedstock candidates for conversion, AeroDynamic Advisory said.

Still, even after a market correction, annual conversions of 160 aircraft will be at historic levels, the aerospace consulting firm said.

Some industry professionals say there is plenty of room for more long-haul, widebody freighters. Airbus and Boeing (NYSE: BA) nearly halved production of large passenger aircraft since 2019 while many airlines permanently retired all, or part, of their 747 jumbo jet, 777, A330, 340 and A380 fleets, noted Yuriy Tokarev, vice president of asset management at Aerovista, on LinkedIn. Many large aircraft are due for major maintenance checks or degraded during storage and will take longer to bring back to service with repair shops also backed up, he said.

Fortune argues that narrowbody lessors will be disappointed because it could take years for a capacity correction to work through the industry.

“With a limited number of retirements and a moderation in air cargo growth, speculative 737NG investors who recently decided to jump into the conversion market will struggle to achieve a compensatory return from lower than assumed lease rates and freighter aircraft values,” he wrote.

Market capacity is part of the reason Canadian airline WestJet is starting out small with its first freighter division of four converted 737-800 aircraft later this year.

“It’s certainly something we’re monitoring. We don’t want to get so many that we contribute to an overcapacity problem,” Charles Duncan, the company’s executive vice president for cargo, said in an interview.

“In our forecasting and modeling we assume yields come down, but we do expect demand for air cargo to continue to grow, largely because of e-commerce. We don’t see that slowing down or reverting back to pre-pandemic levels,” he said. “We’re a long way from overcapacity, but if we’re making long-term investments it’s something we’re mindful of.”

Click here for more FreightWaves/American Shipper stories by Eric Kulisch.

RELATED NEWS:

Astral Aviation to be launch operator for A320 converted freighter

Boeing, IAI expand production lines for 737, 777 freighter conversions