Covenant Transportation Group (NASDAQ: CVTI) sees progress on its strategic plan, which is centered on replacing poorly performing freight, shuttering terminals and trimming its asset-based fleet.

The Chattanooga, Tennessee-based truckload (TL) carrier reported a first quarter adjusted net loss of $1.7 million, $0.09 per share, a penny ahead of the consensus estimate.

Part of Covenant’s organizational refocus is to better allocate capital to higher margin offerings like contract logistics and expedited. In alignment with these efforts, the company plans to reduce its 3,000-unit tractor fleet by 12% to 14% by year-end to improve equipment utilization.

A good portion of asset disposals took place in April. The company has also lowered expenses throughout the organization through layoffs, suspending the 401k match and executive salary reductions. Management expects to see relief on several expense lines – salaries, wages and benefits; taxes and licenses; depreciation; communications; maintenance and interest expense – moving forward given the recent actions taken.

One cost headwind will be the insurance and claims line, which increased by more than $0.05 per mile in the quarter due to claims accruals related to auto liability claims. The carrier’s insurance premiums renewed $500,000 higher in April and it has increased the self-insured portion of its insurance program, presenting a potential source of “earnings volatility” as its risk exposure increases.

Further, fleet leasing company Transport Enterprise Leasing (TEL), in which Covenant holds a 49% interest, resulted in $0.03 per share of the loss in the quarter given declines for truck demand. Management expects TEL to be a headwind until the fourth quarter. There is also the potential for asset impairment charges due to lower values on some of the terminals and equipment the company plans to sell.

On the company’s earnings call, Chairman and CEO David Parker said April was the “worst” operating environment he has seen in his 47 years in the business. April was marked by a swift decline in volumes, pushing spot rates lower. Parker said spot rates have moved to 20-year lows.

The shutdown in the automotive sector resulted in a higher percentage of Covenant’s freight mix coming from the spot market. However, cost actions taken allowed the carrier to essentially break even during the month.

Covenant has seen a stabilization in volumes and price during May. Parker pointed to green shoots like the resumption in automotive manufacturing, strong produce shipments coming out of California and the Southeast and retailers starting to point to the end of May-early June as a time-frame when they will need equipment.

On the auto restart, Parker said the company had roughly 280 to 300 trucks, or 10% to 12% of its fleet, idled when the auto industry closed. Some of that equipment was placed into service in verticals that saw demand spike as stay-at-home orders were issued. Parker said the automotive original equipment manufacturers (OEMs) are coming on-line in one quarter increments, adding 25% of production capabilities per week. He expects the OEMs Covenant serves to be back to 75% to 100% production by mid-June.

First quarter results

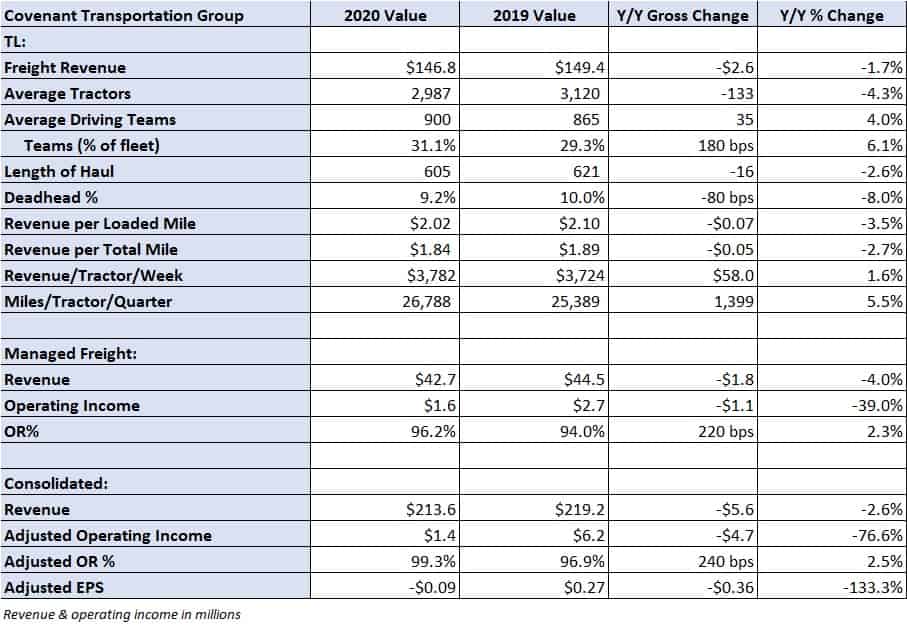

Covenant reported a 2.6% year-over-year decline in consolidated revenue of $214 million. TL Freight revenue declined 1.7% to $147 million as the carrier’s average tractor count declined 133 units compared to the year-ago period. Revenue per tractor per week increased 1.6% to $3,782 as miles increased 5.5% and revenue per loaded mile moved 3.5% lower. Freight revenue per total mile was down 3.7% in the carrier’s highway segment and 1.6% lower in the dedicated offering.

Managed freight revenue declined 4% year-over-year to $43 million as brokerage revenue declined 10.4%. The division reported $1.6 million in operating income, $1.1 million lower year-over-year. The factoring business saw operating income improve $700,000 to $2.2 million in the period.

On a consolidated basis, the company’s adjusted operating ratio deteriorated 240 basis points to 99.3%. As noted above, insurance and claims expense was up by more than $0.05 per mile, partially offset by a more than $0.03 per mile decline in operations and maintenance expense as the carrier is running newer tractors (1.8 year average age compared to a 2.3 year average in the same period of 2019). Operating ratio also benefited from a $1.4 million increase in gains on sale due to the $1.7 million sale of its Orlando, Florida terminal.

Shares of CVTI are up more than 10% in midday trading.

Dave

That’s a big ship to turn but kudos for getting stuck in and doing what’s needed. There’s a lot of good people over there.