Less-than-truckload carrier XPO said Thursday it has completed the expansion of its Salt Lake City terminal, which serves the Pacific Northwest market.

A total of 58 doors and 170,000 square feet of yard space were added to the site. The addition is part of a multiyear expansion, which will add 900 doors on a net basis to its national network of roughly 15,000 by the first quarter of next year.

At the end of 2022, XPO (NYSE: XPO) had added six terminals and 369 net new doors.

“At XPO, we’re focused on adding capacity where it’s most effective in driving efficiency, growth and returns for our business,” Dave Bates, chief operating officer, stated in a news release. “Our investment in the Salt Lake City facility will allow us not only to better serve our existing customers but will support new business growth in a market that’s a major hub for freight.

The site currently employs more than 200 people, a number XPO plans to increase through the addition of dockworkers and driver sales representatives.

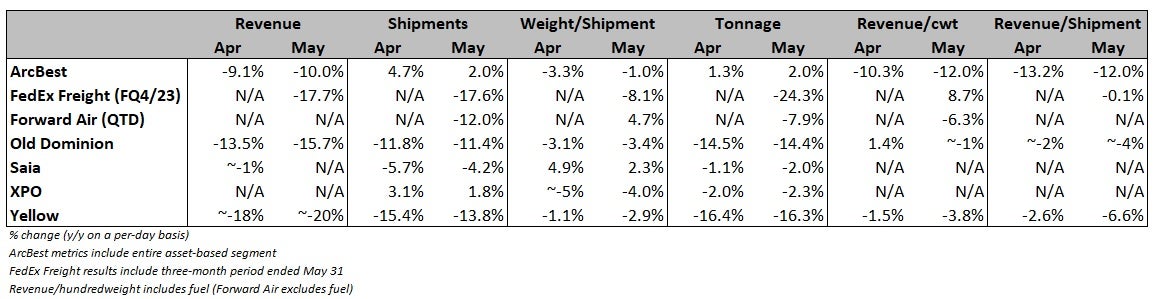

XPO has been expanding its market share in recent quarters. Through the first two months of the second quarter, the company’s tonnage declines were just a fraction of that seen by some of the nation’s biggest LTL carriers.

More FreightWaves articles by Todd Maiden

- Yellow asks to defer health care, pension contributions

- Roadrunner adds lanes into Virginia, Las Vegas

- ABF’s new labor deal calls for $6.50 hourly wage increase by 2027