Yellow Corp. expects to reduce the number of terminals in its network from 316 to 300 by year-end as the less-than-truckload carrier looks to further cut costs, company executives told analysts.

Speaking after Yellow reported first quarter financial results Tuesday, chief operating officer Darrel Harris said the terminal reduction would not affect the company’s ability to move freight.

“I just want to make it clear that we’re not giving up geographical coverage, and we’re also going to protect capacity for our customers because we do plan on growing when we complete One Yellow,” Harris said, referring to the company’s restructuring effort.

Yellow’s plan to close nine terminals emerged last week after it issued a notice to the Teamsters. The proposal also calls for the consolidation of 20 YRC Freight and Reddaway facilities and the realignment of ZIP codes in the West.

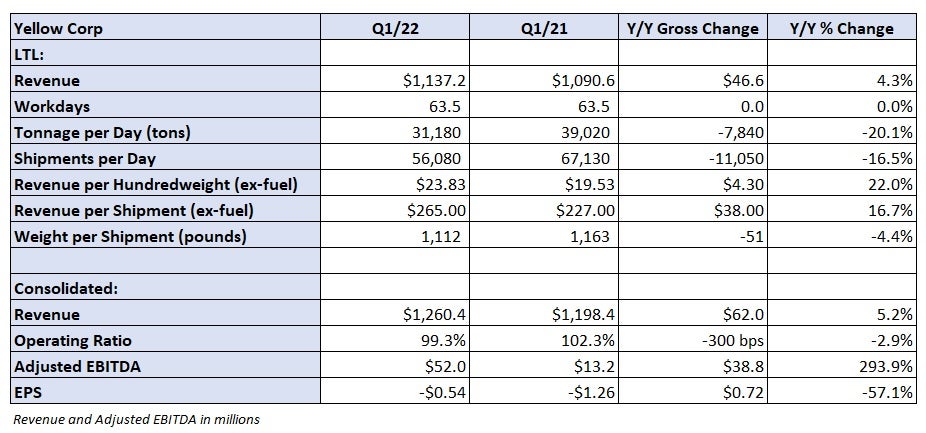

Yellow (NASDAQ: YELL) reported its best first quarter in six years after the market closed Tuesday. The period came in slightly better than breakeven on the operating line at a 99.3% operating ratio, which was 300 basis points better year-over-year. However, it reported a net loss of 54 cents per share, which was less than half the loss recorded in the 2021 first quarter but worse than the consensus estimate calling for a 41-cent-per-share loss.

Terminals closing in the West as One Yellow turnaround advances

A restructuring called “One Yellow” brought all of the company’s separately-run LTL carriers and logistics company onto the same tech platform. The next phase of the integration includes a terminal-by-terminal overhaul in the West.

In addition to the terminal rationalization, the change of operations also call for the addition of 11 velocity distribution centers, a new linehaul network and 260 utility driver positions.

Phase two is slated at carrier New Penn in the third quarter with phase three at carrier Holland taking place in the fourth quarter. When the process is complete, the carrier will be operating approximately 300 facilities.

The changes will provide cost savings immediately on 28% of its network starting in the third quarter.

“When this transformation is completed, our customers will benefit by interacting with North America’s second-largest super-regional LTL network for both regional and long-haul shipments,” CEO Darren Hawkins stated in a press release. “We expect the network transformation to also lead to improved asset utilization, enhanced network efficiencies, cost savings and create capacity without the need to add new terminals.”

Demand remains strong into Q2

Demand from both Yellow’s industrial and retail customers remains healthy, according to Hawkins.

“Looking ahead, demand for LTL capacity still appears to be strong with inventory levels remaining below normal and a manufacturing sector playing catch-up from supply chain disruptions and a tight labor market, Hawkins said.

Revenue was 5% higher year-over-year at $1.26 billion in the first quarter. Tonnage per day was down 20%, but revenue per hundredweight excluding fuel increased 22%. Yellow is using a favorable demand backdrop to replace lower-margined freight with more profitable shipments.

The tonnage declines peaked during February, down 27% year-over-year. March was off 18% with April down between 14% and 15%. COVID-related labor headwinds and poor weather required Yellow to limit shipments at some terminals during February.

Pricing on contracts renewed during April increased by 10% to 11%.

First-quarter margin improvement was driven by yield growth and a 400-bp decline in salaries, wages and benefits as a percentage of revenue and a 200-bp decline in purchased transportation expenses. Trailing 12 months’ adjusted earnings before interest, taxes, depreciation and amortization doubled from a year ago to $341 million.

Normally the company sees between 350 bps and 400 bps of sequential OR improvement from the first to the second quarter each year. Management expects to outpace that level of improvement due to turnaround initiatives and its yield improvement strategy. The improved outlook includes a roughly 5% increase in union wages and benefits, which presents a 40- to 50-bp cost headwind.

The comp increases went into effect on April 1.

Yellow ended the quarter with $277 million in available liquidity, compared to $423 million a year ago. Outstanding debt increased 10% year-over-year to $1.61 billion. The company’s debt load jumped following the full drawdown of a $700 million COVID relief loan agreement with the government. The deal allowed it to upgrade its fleet and buy out leases.

Cash used in operations was 14% lower year-over-year at $34 million in the quarter.