As commodity prices surge around the globe, marine fuel is getting a lot more expensive. That’s bad news for ship operators on the cost side, and, in the container business, yet another headache for cargo shippers.

Marine bunker prices are “soaring,” said Alphatanker on Thursday. “This has not just impacted 3.5% [high-sulfur fuel oil or HSFO] but also 0.5% VLSFO [very low sulfur fuel oil].

“There are expectations that crude, and therefore marine fuel, could move higher in the coming weeks as oil markets tighten further,” warned Alphatanker, adding, “This will undoubtedly clip gains in tanker earnings.”

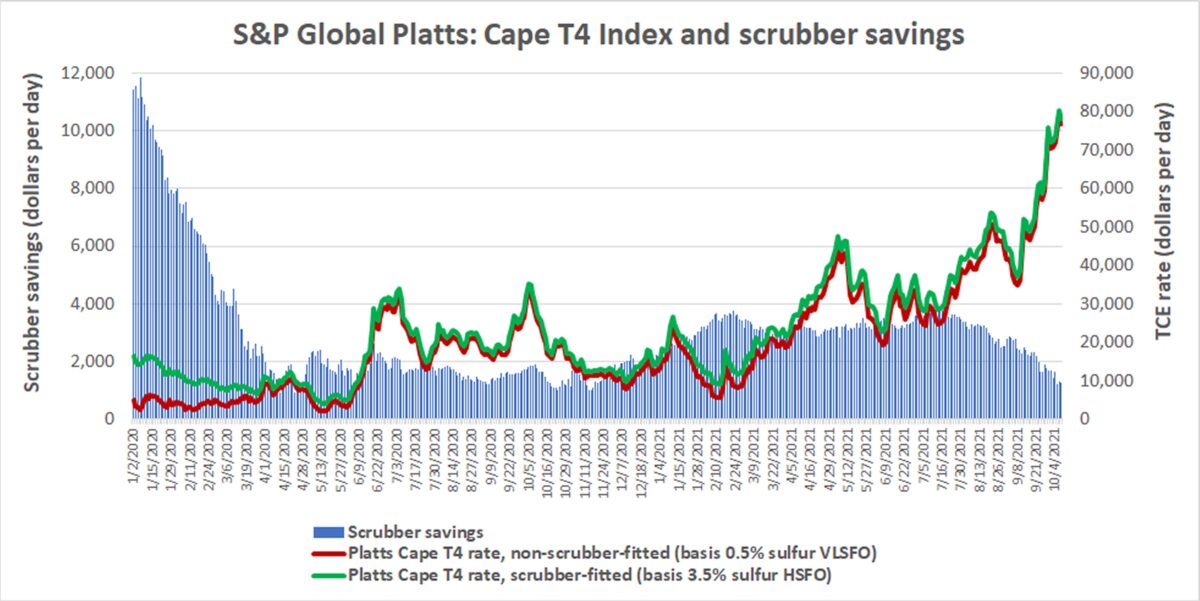

All ship categories, not just tankers, are taking a cost hit. On Thursday, the S&P Global Platts T4 index estimated that a Capesize (a dry bulk ship with capacity of around 180,000 deadweight tons) burning VLSFO was spending $24,596 per day on fuel.

Ships equipped with exhaust-gas scrubbers are still able to burn cheaper HSFO under IMO 2020, a regulation that went into force for all commercial ships on Jan. 1, 2020. According to the Platts’ T4 Thursday assessment, scrubber-equipped Capes were paying $22,815 per day for fuel.

Why pricing is up and where it’s going

“The main driver for bunker pricing is the price of oil — that’s the key,” said Martyn Lasek, managing director of Ship & Bunker, a company that provides pricing data. “If you look at the relationship between Brent and VLSFO, it’s now pretty solid. There’s an established price trend.”

American Shipper asked Richard Joswick, head of global oil analytics at S&P Global Platts, where the price of crude — and thus ship fuel — is going.

Joswick replied: “In the very short term, it’s all sentiment and sentiment can shoot either way. Sentiment is generally bullish now. People are wondering where the future supply will come from and they’re doubting that a deal with Iran will be reached anytime soon.

“The fundamentals suggest we’ve already overshot a little bit. S&P Global Platts’ outlook is that the price of crude oil stabilizes and maybe eases a little bit from where it is now through the winter into the first half of next year. That said, there are risks. If there were some unexpected disruption, it would be harder to cover. So, the risks are probably more to the [price] upside than downside.”

How much fuel prices have risen

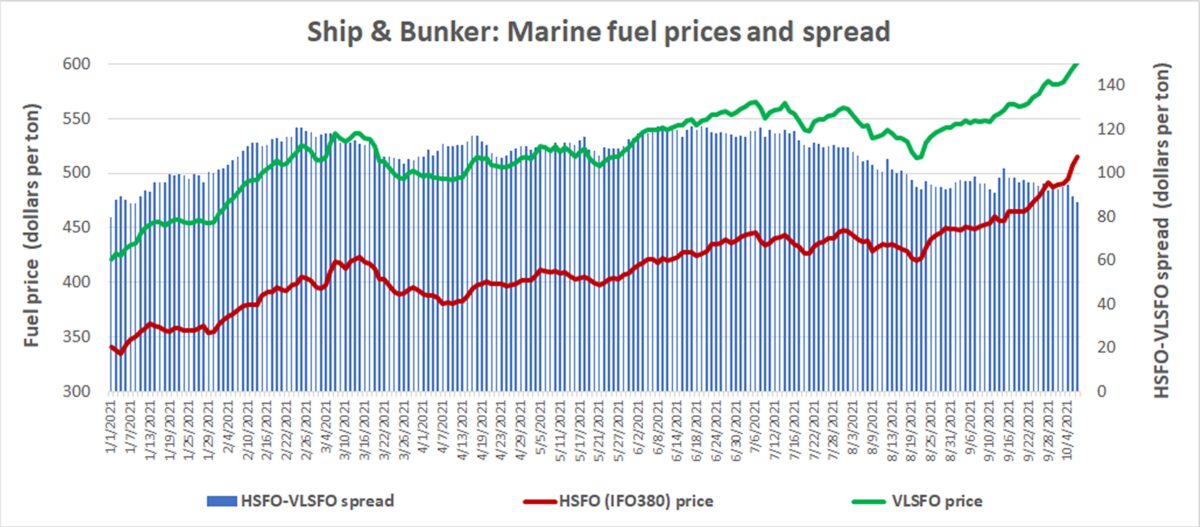

According to Ship & Bunker data, the average price (at the top 20 ports) of IFO 380 HSFO burned by ships with scrubbers had risen to $514.50 per metric ton on Wednesday, up 51% since the beginning of the year.

The average price of VLSFO, the fuel used by most commercial ships since IMO 2020, was $601 per ton on Wednesday, up 42% since the beginning of the year.

HSFO pricing hasn’t been this high since October 2014. Lasek told American Shipper that the most important historical comparison is between HSFO prior to 2020 — the fuel that ships burned back then — and VLSFO from 2020 onwards, the fuel that most ships now use.

VLSFO prices were only higher than current levels for a few weeks amid the IMO 2020 regulatory transition, when the numbers were artificially inflated. To find naturally occurring HSFO prices that were as high as today’s VLSFO prices, you have to go back over seven years.

Excluding the brief one-off exception caused by the regulatory transition, Lasek said, “Bunker prices in real terms are the highest they’ve been since July 2014.”

Meanwhile, the spread between HSFO and VLSFO has unexpectedly narrowed over recent months, meaning that scrubbers are at least temporarily providing less savings.

Ship & Bunker data showed that the spread was down to $86.50 per ton on Wednesday for the top 20 ports, compared to a recent high of $121.50 on June 21 and an all-time high during the IMO 2020 transition of $315 per ton on Jan. 2, 2020.

Impact to container shipping

The price rise is translating into higher bunker surcharges for containerized cargo shippers; to the extent it is not passed along, it reduces carrier profits.

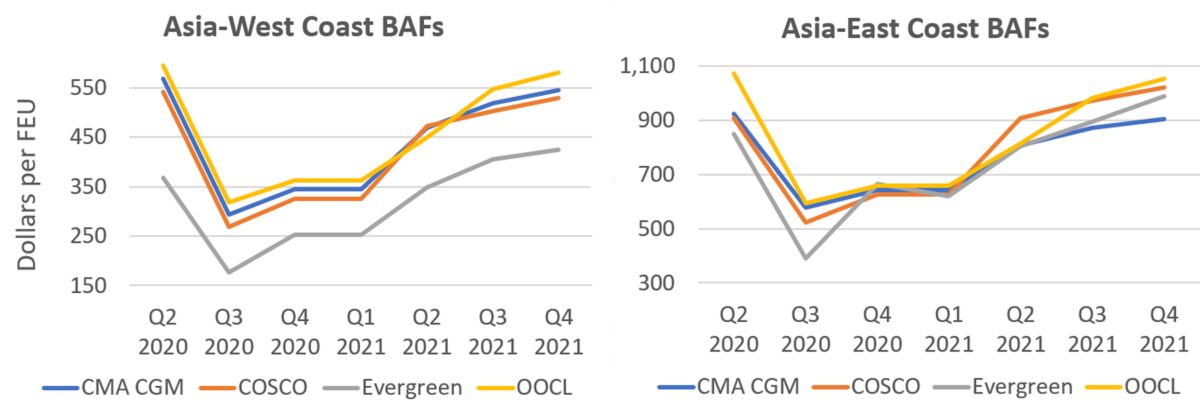

Carrier bunker adjustment factors (BAFs) plummeted in Q3 2020 due to the COVID-induced collapse in oil pricing in the previous quarter. BAFs are now back up to Q2 2020 levels.

Carrier BAF filings to Distribution Publications Inc. (DPI) show that the average Q4 2021 Asia-West Coast BAF of CMA CGM, Cosco, Evergreen and OOCL is $519 per forty-foot equivalent unit, up 96% from Q3 2020 lows.

On the Asia-East Coast route, the four carriers’ average BAF is much higher — due to the longer sailing distance — at $991 per FEU in Q4 2021, up 90% from Q3 2020 lows.

Although a negative for cargo shippers, BAF increases of several hundred dollars per FEU over recent quarters are less impactful than they’d normally be. The reason: Freight rates are now so high that the added BAF expense is a small fraction of the overall cost.

Impact to dry bulk and tanker shipping

In the dry bulk sector, rising fuel costs are being completely overshadowed by extremely high freight rates. Capesize spot rates just topped $80,000 per day for the first time since 2009.

According to the Platts T4 index assessment, Capesizes with scrubbers earned $1,256 more per day as of Thursday due to fuel-cost savings. That compares to a recent high of $3,930 per day in scrubber savings on July 13 and an all-time high of $11,831 per day on Jan. 7, 2020.

Of all shipping sectors, tanker shipping faces the most painful fallout from higher fuel prices, because tanker rates are still well below breakeven. The only advantage for tankers with scrubbers is that they’re bleeding less cash.

The sector has taken a “double whammy,” said Alphatanker on Thursday. First, higher bunker costs, and second, this week’s decision by OPEC+ not to increase production at a faster pace.

On a positive note, spot cargo rates for crude tankers have been improving off the worst market in three decades. “Despite high bunker prices, tanker earnings are creeping up in the wake of a nascent recovery in freight rates,” said Alphatanker. “This puts the onus on freight rate increases to offset higher bunker costs.”

Click for more articles by Greg Miller

David Mitchell

It’s a shame that it’s went this way but it has, fuel of all degrees has become more expensive and that’s why a much more sustainable option needs to be developed