Citing a “tremendous amount of uncertainty surrounding COVID-19 and the rapidly changing environment,” management on YRC Worldwide’s (NASDAQ: YRCW) first-quarter 2020 earnings call excluded questions from analysts.

The less-than-truckload (LTL) carrier reported net income of $4.3 million in first quarter 2020, 12 cents per share on a diluted basis and well ahead of the consensus estimate of a 57-cent-per-share loss. The result included $39.3 million in gains on property sales versus a $1.6 million loss on property disposals in the prior-year period.

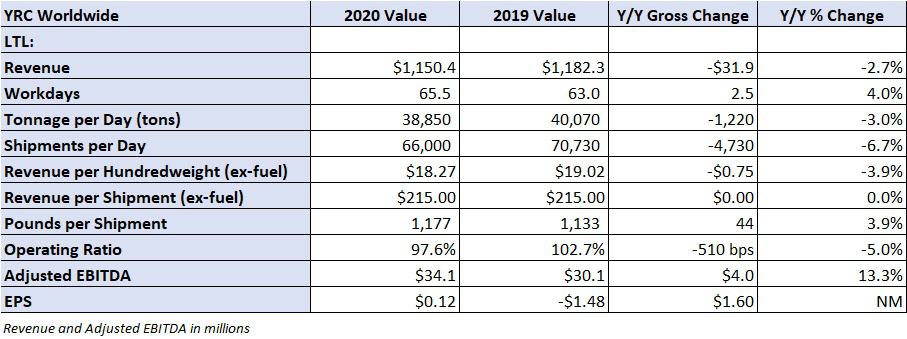

Excluding the impact of gains/losses on disposal of assets and adjusting for noncash and nonrecurring items, adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) increased $4 million year-over-year to $34.1 million.

On the call, management said LTL volumes were off nearly 24% year-over-year in April after seeing a sharp correction in mid-March.

As part of the carrier’s reorganization, all of its LTL segments previously reporting under two separate segments, YRC Freight and Regional, have been consolidated.

Revenue declined 2.7% year-over-year to $1.15 billion as tonnage per day declined 3% and revenue per hundredweight excluding fuel was down 3.9%. This was partially offset by a 3.9% increase in weight per shipment and 2.5 more operating days in the first quarter 2020 period compared to the 2019 quarter. Operating ratio improved 510 basis points to 97.6%.

The company ended the quarter with $103.9 million in cash and equivalents and $879.9 million in debt. Available liquidity increased $37.6 million from the end of 2019 to $118 million at the close of the first quarter as the carrier reduced its capital expenditures, opting to purchase equipment on lease. Cash used in operations was only $15.6 million during the first quarter compared to $41.7 million in the same period of 2019.

Term loan refinancing and covenant waiver

The company successfully refinanced its term loan debt in a new $600 million agreement in September, providing it with additional liquidity and less restrictive financial covenants, namely that YRC maintain adjusted last 12 months’ (LTM) EBITDA of $200 million. However, as freight markets slumped, the carrier was granted a waiver on the covenant from lenders for the remainder of 2020 and converted most of its cash interest payments for the first half of 2020 into noncash payable-in-kind.

In the press release, the carrier said it was unlikely to meet the covenant during the first quarter of 2021 and would likely seek another waiver.

“Based on our current expectations and in conjunction with the COVID-19 pandemic, we think it will be unlikely that we [will] be in compliance with the Adjusted EBITDA covenant when it becomes applicable again at the end of first quarter of 2021 or possibly the liquidity covenant required by the amendment to our term loan facility over the specified period that covenant is applicable. As a result, we will need to either seek an extension of the waiver period or otherwise modify the covenant.”

YRC reported LTM adjusted EBITDA of $214.6 million for the period ending March 31, which would have satisfied the covenant for the first quarter.

Contribution delinquency and deferrals

In a Friday letter to local unions with YRC members, the Central States Health and Welfare Fund noted that YRC was delinquent paying health contributions owed for the month of March and that the carrier advised them that they would be unable to make these payments in April and May. The fund estimates the three-month period will result in a nearly $75 million delinquency, in addition to the more than $48 million already owed by YRC to the pension fund from a prior debt restructuring.

Previously, YRC received a grace period for health and welfare and pension fund contributions to its union employees. The original grace period was for March contributions to be paid in April, but International Brotherhood of Teamsters management warned in a letter to the rank and file that additional extensions may be sought.

Shares of YRCW on Monday were up more than 40% in after-hours trading on the better-than-expected headline result.