Less-than-truckload provider Yellow Corp., formerly YRC Worldwide (NASDAQ: YRCW), made it official Thursday after the market close. The company will operate under the Yellow banner again. Yellow will begin trading on the NASDAQ under the ticker “YELL” on Monday.

The Overland Park, Kansas-based company reported a net loss of 37 cents per share, worse than the consensus call for a 24-cent per share loss but 9 cents better than the prior-year result.

Yellow is the holding company for LTL brands Holland, New Penn, Reddaway and YRC Freight along with HNRY Logistics. The entities will continue to operate under those respective names until the first half of 2022 when the transformation to a super-regional carrier has been completed.

“As we continue our transformation into a super-regional, LTL freight carrier, it is the right time to reintroduce the Yellow Corporation name and modernize the holding company brand,” CEO Darren Hawkins stated in a press release.

The company’s restructuring has included the streamlining of leadership, sales and technology onto the same network with one point of contact. The turnaround received a boost from a $700 million Treasury loan in July, which allowed the company to catch up on health care and pension benefits payments as well as providing capital to begin replacing its rolling fleet.

“Migrating to one Yellow technology platform and creating one Yellow network are the key enablers of our enterprise transformation strategy, which is to provide a superior customer experience under one Yellow brand,” Hawkins continued.

Fleet replacement accelerates

On a Thursday evening call with analysts, management said it had spent the bulk of the $75 million October draw it received from the $400 million second tranche of the loan. That tranche was allocated for equipment capital expenditures.

Yellow received $176 million in January, which should be exhausted on new equipment purchases — 1,100 tractors, 1,900 trailers and 250 containers — in the next couple of months. The remaining $149 million will be used in 2021 and will include buying out existing leases on equipment. Management guided to $450 million to $550 million in capital expenditures during 2021.

$274 million of tranche A, $300 million in total for the repayment of deferred benefits payments, has been used, with the remainder to be distributed in the first quarter.

Fourth-quarter miss

A full-year net loss of $53.5 million was roughly half of 2019’s $104 million loss, which included $11.2 million in costs associated with its term loan refinancing.

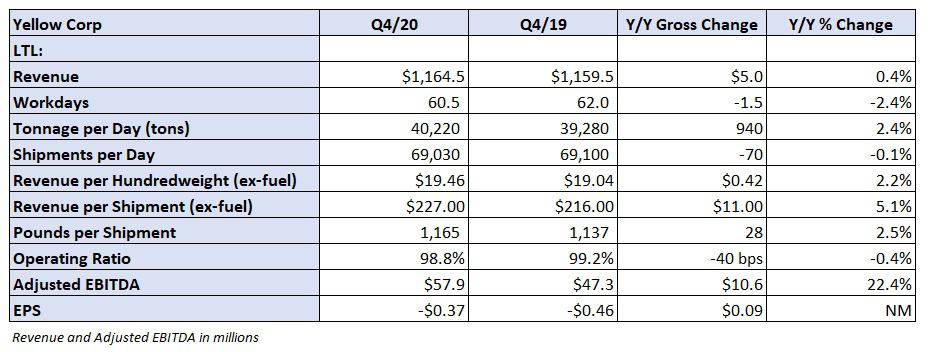

Tonnage per day improved 2.4% year-over-year and revenue per hundredweight, or yield, was up 2.2% excluding fuel surcharges. Revenue was flat as there were 1.5 fewer work days in the quarter and yield was down 0.7% including fuel. Contractual renewals came in 5.6% higher during the quarter.

In January, contract prices increased 6% and tonnage per day was up between 2% and 3% year-over-year. The company implemented a 5.9% general rate increase on Monday.

The fourth-quarter operating ratio improved 40 basis points to 98.8%. Increased purchased transportation, 430 basis points higher as a percentage of revenue, was cited as a significant headwind in the quarter.

A lack of available drivers continues to be a challenge. Yellow will add to its driver school network and plans to have 12 academies operating by March.

Adjusted earnings before interest, taxes, depreciation and amortization increased 22% year-over-year and full-year adjusted EBITDA was $191.9 million, well ahead of the upcoming $100 million covenant, which goes into effect in the fourth quarter.

YRC ended the year with liquidity of $440 million and total debt of $1.28 billion.

“During the fourth quarter, volume and pricing continued to improve in a tighter capacity environment. As the industrial and retail segments of the economy rebound, a shortage of drivers is keeping a lid on LTL capacity. Overall, the industry is stable and well positioned for a strong 2021,” Hawkins added.

EDI

Another article proving the mediocrity that is the entire Yellow umbrella. 20 years, and I can remember when checks were late because the big spenders mismanaged money. Again. Here’s a thought…maybe the company could actually do what they overcharge customers to do. Pick up freight. Move it from one truck to another. Deliver on time, intact and not magically missing. It’s not rocket science, yet can’t be completed even if intra-terminal. Not by YRC, not by New Penn, not by Reddaway and sure as hell not by Holland. Go ahead Yellow, spend more tax dollars changing your name again. The new logo should be a toilet, showing our money quickly flushed. What a waste of diesel and manpower.

JBG

Yellow has suffered from the same problems as many other carriers, they fell into the rate discount trap. Hauling low margin business with high labor cost. Also they lost their focus on what their primary business is, long haul. Trying to compete with regional carriers when the didn’t have the know how. The only carrier that figured it out is Old Dominion, when everyone else was giving away the farm, they held their ground and said no to the customers. They have grown and are the most profitable LTL carrier in the country. Yes the management has made some serious errors but the union should also share in the responsibility.

Michael Shoemake

If they put all the regional together in 2022 to make a next day service. Holland done it better than anybody and YRC screwed that up they will be gone I know because I was at Holland for 25 years retired now.Just pray and hope not for everyone still working.

John

You can call it Yellow, YRC, HNRY. But whatever you name it a TURD is still a TURD. This company exists for one purpose: to make Hawkins, O’Conner and Ware RICH. It is a taxpayer funded strip mining operation plain and simple. ZERO value to the marketplace. Trump deserved to lose re-election for the sheer fact that his administration made the decision to bail this abomination of a company out. Let’s hope when they come begging in four years that Joe tells them to get lost.

JHT

Yeah because 25,000 Teamsters who kept this company alive through wage and benefit cuts deserve to be on the street. Management who has wrecked this company and the regionals deserves to be in jail.

That wasn’t a loan last year, that was a heist.

Don304

Faced with the option of no job or wage cuts in the dark days of 2008 it wasn’t much of a choice. Time ticked away waiting for better days and options which didn’t arrive. The staff is largely older employees who won’t be picked by other companies due to age and anti union sentiments. The union argument is “bull”. UPS Package is union , hardly ailing or under performing. Cant blame employees for poor leadership. Sometimes I think we should have closed them at the start. That said the checks were always on time and properly backed. Hopefully your pompous arrogance doesn’t carry over into your business affairs because on the surface your part of the problem in today’s business climate

Mark Jones

Sir as an employee of this company I am offended by your comments. I know we lack some good freight knowledge leadership but let me assure you that the 35,000 union employees care about the customer service. I have been in the business for 47 years and do not believe that you have a right to wish all of us to be out of work because of your sideline criticism.

Chris Hollandsworth

Chris from Holland. Twenty five years.

Yes, we have worked very hard and sacrificed a lot to take care of our customers and keep this company going!!

EDI

Amen!!