The biggest names in autonomous trucking scored major wins by recruiting top officials from the Trump administration into their ranks over the past 12 months. But with so much riding on shifting gears within this multibillion-dollar industry from testing to commercial production — and with former regulators able to leverage government connections to help guide policy — will safety take a back seat to profits?

At least seven top-level federal officials in position to influence truck safety policy have moved into the autonomous vehicle (AV) sector — trucking in particular — over the past 12 months. The first, Jim Mullin, former acting administrator of the Federal Motor Carrier Safety Administration, was hired by TuSimple [NASDAQ: TSP] in September 2020 to serve as the San Diego-based company’s chief legal and risk officer.

Most recently, in July, former U.S. Secretary of Transportation Elaine Chao joined the board of directors of Embark Trucks to provide “extensive public and private sector leadership experience that will further strengthen Embark’s position in the AV industry,” the company stated.

In between Mullen and Chao, at least five other officials serving at agencies responsible for vehicle safety went directly from their government posts to companies involved with autonomous vehicles:

- February: Finch Fulton, former deputy assistant secretary of policy, U.S. Department of Transportation, hired by Locomation as vice president of policy and strategy.

- March: Nicole Nason, former administrator of the Federal Highway Administration and the National Highway Traffic Safety Administration, hired by Cavnue as chief safety officer and head of external affairs.

- May: Wiley Deck, former deputy administrator, FMCSA, hired by Plus as vice president of government affairs and public policy.

- June: Sean Rushton, former communications director, NHTSA, hired by Locomation to lead corporate communications.

- July: Jacqueline Glassman, former acting administrator, NHTSA, appointed as general counsel, Ghost.

The danger, some suggest, is that safety could be compromised when such a lengthy slate of former federal officials move so quickly into the private sector from agencies tasked with overseeing that industry.

Powerful access

In a 2019 blog post with colleague Caralyn Esser, Craig Holman, a lobbyist for consumer advocacy group Public Citizen and an expert on government ethics, wrote that the “government-to-lobbyist revolving door” can hurt government integrity in three ways:

- Public officials may be influenced in official actions by the implicit or explicit promise of a lucrative job in the private sector with an entity seeking a government contract or to shape public policy.

- Public officials-turned-lobbyists will have access to lawmakers not available to others — access that can be sold to the highest bidder among industries seeking to lobby.

- Special access and inside connections to sitting government officials by former officials-turned-lobbyists comes at a hefty price, providing wealthy special interests that can afford to hire such individuals with a powerful means to influence government — means unavailable to the rest of the public.

These ethics issues apply to the relatively new and fast-developing AV industry as much as any other industry, Holman told FreightWaves.

“This is particularly a concern for those officials in positions of regulating safety. The prospects of lucrative employment in the very industry an official oversees may well taint regulatory actions taken by that official,” he said.

“And when you go from a regulatory agency into the private sector, the company knows you can pick up the phone and get calls returned right away. So it’s not only a concern while the official is in office, but they can provide the wealthiest companies with special access that the rest of us don’t have.”

That access can provide autonomous trucking companies extra horsepower in informing and shaping safety policy, now in the beginning stages of creating long-term rules on how trucks with automated driving systems will operate on public highways.

Policy drivers

The National Transportation Safety Board, the independent federal agency responsible for investigating transportation accidents and issuing safety recommendations, declined to comment. However, former NTSB Chairman Robert Sumwalt, who retired from the agency in June, told FreightWaves that while “that’s a lot of people” moving from regulatory agencies into private-sector companies that those agencies regulated, it is also “probably not too unusual.”

“All presidential appointees, going back to the Obama administration, have had to sign an ethics pledge. The pledge outlines what appointees can and can’t do while in office, and once they leave office. The thought of [these appointees] chumming up to industry never crossed my mind — and my record of criticizing companies following accidents is well known.”

Sumwalt’s criticisms while at NTSB, however, also included concerns that NHTSA was already allowing AV companies too much leeway in driving autonomous trucking policy.

Commenting in a 2018 DOT docket titled “Preparing for the Future of Transportation: Automated Vehicles 3.0,” Sumwalt stated that he supported efforts by NHTSA to work with industry to formulate AV policy and regulations.

“However, NHTSA’s general and voluntary guidance of emerging and evolutionary technological advancements shows a willingness to let manufacturers and operational entities define safety,” he said. “We urge NHTSA to lead with detailed guidance and specific standards and requirements.”

Industry’s knowledge base

An overriding principle in proposals issued so far by government agencies has been voluntary test reporting and self-certification by the autonomous trucking companies involved in creating the technology. Companies argue that AV promises significant safety improvements by eliminating human error.

“If we can build trucks that won’t get tired, won’t get distracted, won’t make the familiar human errors that cause over 90% of all vehicle crashes, we have a moral imperative to put those trucks on the road safely and as rapidly as possible,” Embark CEO Alex Rodrigues stated in June.

Companies like Embark that have much at stake in the self-driving freight game — the company received over $600 million in financing through a special purpose acquisition company merger announced this year — assert that with AV technology developing so quickly, voluntary safety assessments should be a priority in the federal government’s existing approach to AV regulation.

However, the Owner-Operator Independent Drivers Association, which represents small-business trucking companies, warns that this partnership approach with industry could be detrimental to safety. “The continued reliance on voluntary safety reporting from AV manufacturers will not effectively build public trust, acceptance and confidence in the testing and deployment of these vehicles,” OOIDA President and CEO Todd Spencer commented in March.

Death rates on the rise

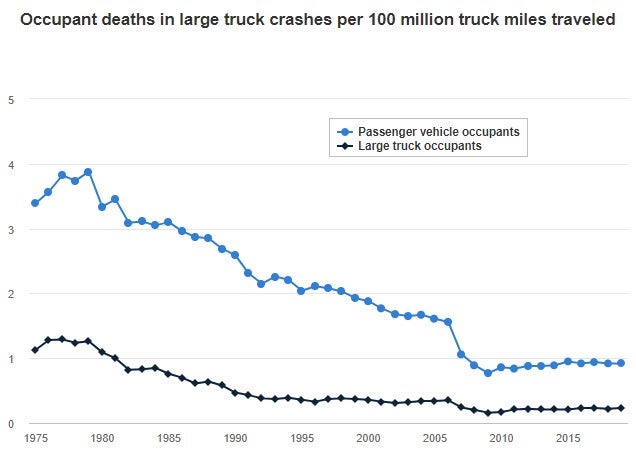

Crash trends in commercial trucking may pressure regulators to take a more hands-on approach as AV regulations are developed. While the number of vehicle-occupant deaths from crashes involving large trucks has declined over the past 20 years, fatalities as well as the death rate — when vehicle miles are taken into account — has slowly increased since 2009 (see chart, below).

Taking on the issue of crashes related to autonomous trucking, NHTSA in June ordered 108 manufacturers and operators of trucks equipped with Level 2 advanced driver assistance systems or Levels 3-5 automated driving systems to report crashes sooner after they occur.

“By mandating crash reporting, the agency will have access to critical data that will help quickly identify safety issues that could emerge in these automated systems,” said NHTSA Acting Administrator Steven Cliff. “In fact, gathering data will help instill public confidence that the federal government is closely overseeing the safety of automated vehicles.”

With respect to the effect on truck driving jobs, labor unions contend that worker displacement must be considered when promulgating autonomous trucking regulations, particularly given the profit and operating cost benefits being touted by industry. FMCSA Deputy Administrator Meera Joshi earlier this year emphasized that it was a priority of the Biden administration to “understand that there are extremely real and broad impacts to automation on people’s livelihoods.”

Maintaining momentum

But with so much federal knowledge and expertise now on their side of the lobbying door, AV manufacturers are in a strong position to maintain and increase their leverage over how AV regulations are promulgated.

On Monday, the Self Driving Coalition, which represents the largest autonomous trucking companies, along with the American Trucking Associations and 12 other industry groups, urged the Biden administration to maintain momentum on adopting and streamlining regulations affecting autonomous trucking.

Efforts to mitigate or remove barriers, including regulatory items already underway, “should continue and, to the extent possible, be accelerated,” the groups stated in their letter to DOT Secretary Pete Buttigieg.

“As the AV industry moves from research and development to deployment, we urge the Department to use its authority to foster a pathway for near-term AV deployment. Providing for the widest range of deployment options in the near term will also help the Department gather key data on the performance of AVs to inform permanent safety standards that are both practical and effective.”

James+Stephens

I thought the whole point behind accepting an appointed position or a position that almost universally changes staffing with every new presidential administration is that once your out you can become a highly paid lobbyist. Without that, why would someone who has already achieved success in their chosen field want to accept a temporary government gig?