BorgWarner (NYSE: BWA) posted adjusted earnings per share (EPS) of $1 for the first quarter of 2019, beating analysts’ estimates of $0.94. However, the company’s adjusted EPS is down from $1.10 in the first quarter of 2018 and $1.21 last quarter.

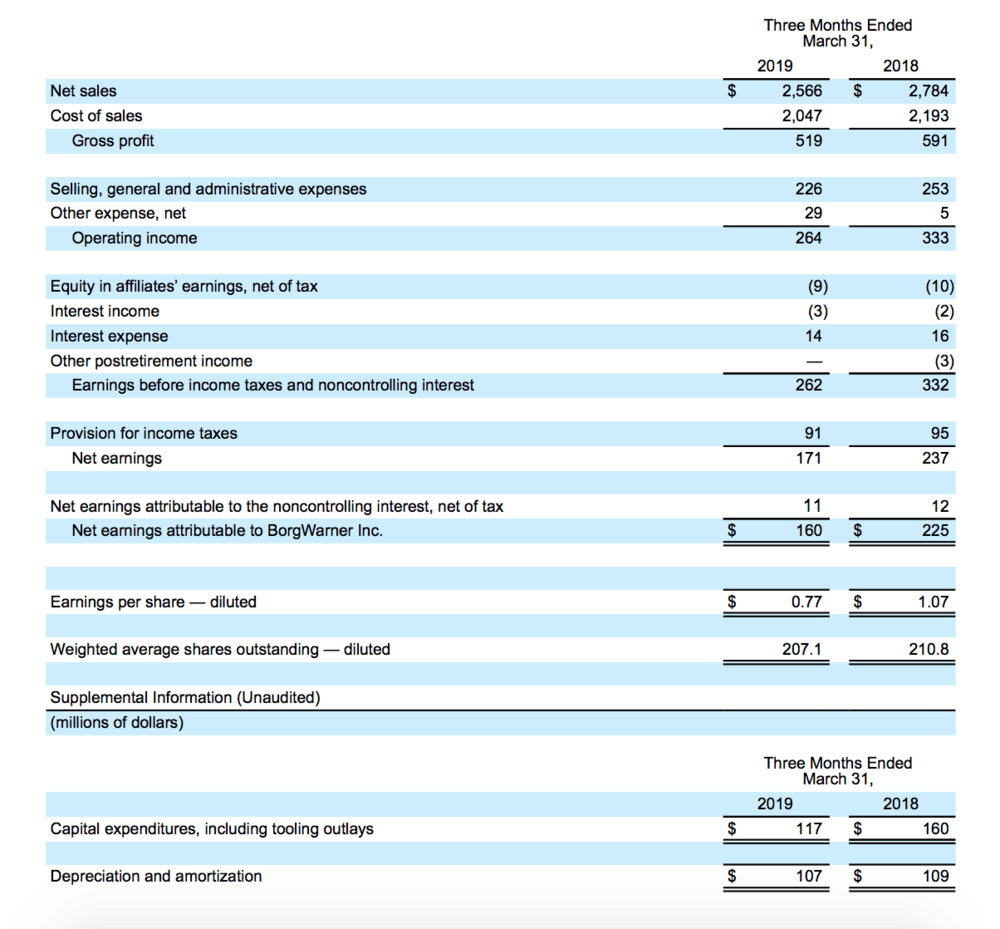

The company reported about $2.57 billion in net sales for the first quarter of 2019, down 7.8 percent from $2.78 billion in the same quarter last year. Net income also dropped in the first quarter, coming in at $160 million compared to last year’s $225 million.

BorgWarner attributed the drops in both net sales and net income primarily to the impact of foreign currencies during the first quarter.

The company reported $40 million in net cash provided by operating activities in the first quarter, up from $35 million in the first quarter of 2018.

“Investments in capital expenditures, including tooling outlays, totaled $117 million in first quarter 2019, compared with $160 million in first quarter 2018,” the earnings release reads. “Balance sheet debt decreased $27 million and cash and restricted cash decreased by $222 million at the end of first quarter 2019 compared with the end of 2018. The company’s net debt to net capital ratio was 26.6 percent at the end of first quarter 2019 compared with 24 percent at the end of 2018.”

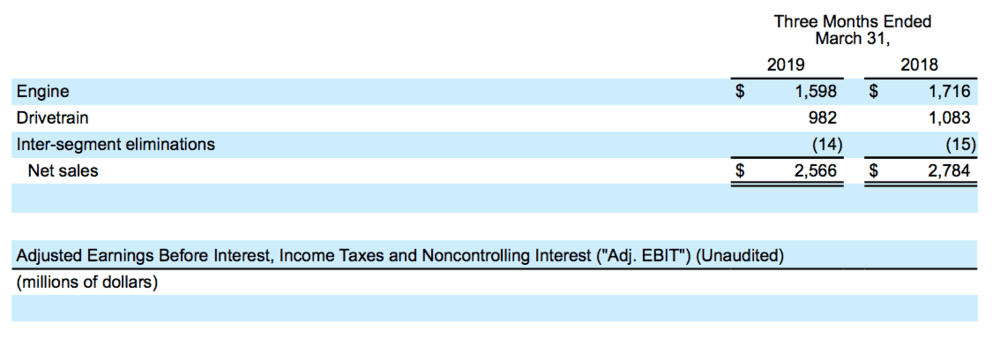

Engine segment net sales dropped 1.8 percent, from $1.72 million in the first quarter of 2018 to $1.6 million in the first quarter of 2019. Adjusted earnings before interest (EBIT) came in at $241 million in the first quarter, dropping a full 10 percent from the first quarter of last year.

Drivetrain segment net sales also fell in the first quarter, coming in at $982 million. The segment saw net sales of $1.08 billion in the first quarter of 2018, a 5.6 percent decline. Adjusted EBIT was $105 million in first quarter 2019, down 9.9 percent from the same quarter last year.

The company issued soft second quarter guidance, expecting organic net sales to range anywhere from flat to down 2.5 percent from the second quarter of 2018. The company also expects adjusted EPS to fall next quarter.

“Foreign currencies are expected to decrease sales by $100 million,” the earnings release read. “The divestiture of the thermostat product line will decrease sales by approximately $33 million. Adjusted net earnings are expected to be within a range of $0.99 to $1.05 per diluted share.”

The company reaffirmed its full-year 2019 guidance, anticipating full-year organic growth over the company’s market to come in between 250 and 400 basis points. Full-year net sales are expected to be in the range of $9.9 billion to $10.37 billion.

“This implies year-over-year organic sales change of down 2.5 percent to up 2 percent,” the earnings release reads. “The company expects its market to decline in the range of 2 percent to 5 percent in 2019. Foreign currencies are expected to decrease sales by $280 million, primarily due to the depreciation of the Euro and Chinese Renminbi. The divestiture of the thermostat product line will decrease sales by approximately $98 million.”

The company expects full-year adjusted operating margin to come in between 11.9 percent to 12.2 percent. Adjusted EPS are still expected to be within a range of $4.00 to $4.35. Full-year 2019 free cash flow is expected to be in the range of $550 million to $600 million.

Over the course of the next two years, BorgWarner will be implementing a cost restructuring plan. These actions are expected to result in restructuring costs in the $80 million to $100 million range through the end of 2020.

“The resulting annual gross cost reduction is expected to be in the range of $40 million to $50 million by 2021,” the earnings release reads. “The company plans to utilize these savings to sustain the company’s overall operating margin profile as it simultaneously increases investment to support future growth in hybrid and electric propulsion.”

BorgWarner is a global product leader in clean and efficient technology solutions for combustion, hybrid and electric vehicles. With manufacturing and technical facilities in 68 locations in 19 countries, the company employs approximately 30,000 worldwide.

The company’s stock was down 0.08 percent in pre-market trading.