Last week, two big trades in the trucking freight futures market on the Nodal Exchange were executed on the Los Angeles to Dallas lanes, on the October and November 2019 contracts (FUT.VLD201910, FUT.VLD201911). The October contract traded at $1.90/mile and the November contract traded at $2.103/mile.

The buyer hopes spot rates on those lanes go above the price he paid, while the seller hopes prices go below the price he received. Trucking freight futures are cash-settled, meaning that physical trucks are not involved — but money will flow into traders’ accounts based on how the physical market closes out those months.

What makes these trades interesting is that they’re effectively a bet on the United States’ peak holiday retail season. Enormous volumes of retail freight — apparel, electronics, home goods, and toys — are imported from Asia every year through the ports of Los Angeles, Long Beach, New York and Jersey, and Savannah.

Retail shippers are the biggest importers of containerized freight: Walmart, Target, Home Depot, and Lowe’s top the list, with Dole Foods a close fifth. When that freight hits American shores, intermodal and trucking spot rates peak, even though carriers anticipate the seasonal surges and position their assets ahead of time.

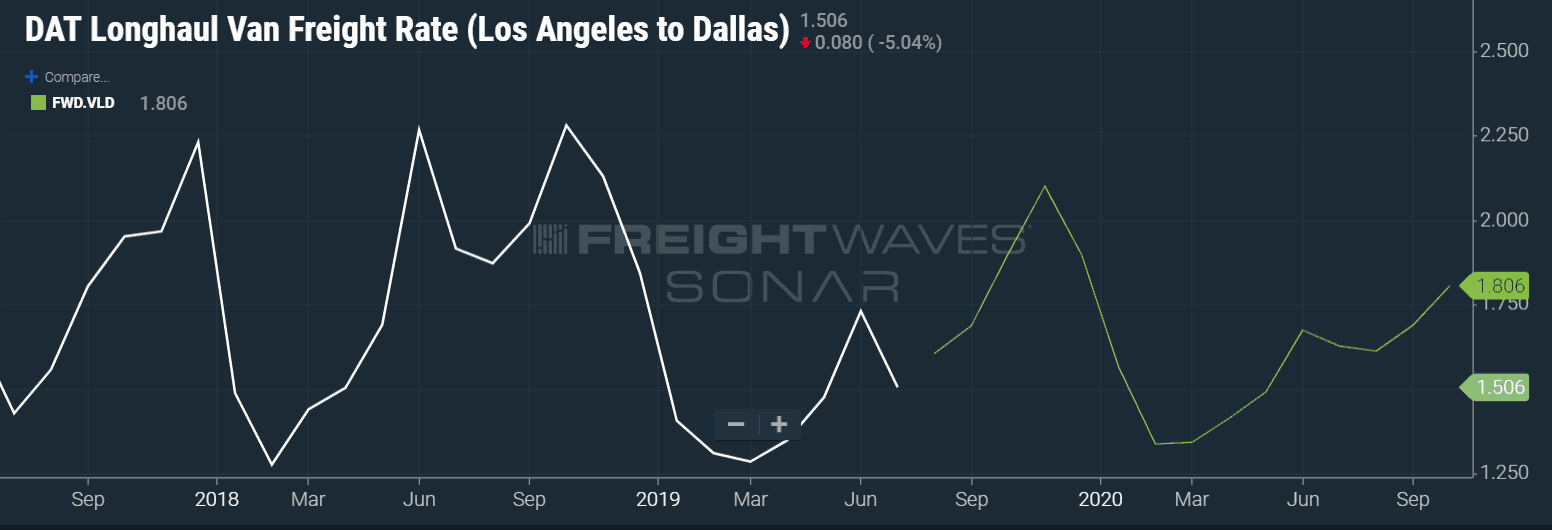

In both 2017 and 2018, trucking spot rates hit close to $2.25/mile from Los Angeles to Dallas by December, when demand for transportation was most urgent.

This year has been different: weak freight demand combined with overcapacity — especially of dry van equipment — to plunge rates far below 2018 levels. It stands to reason that carriers hauling outbound freight from the Los Angeles and Ontario markets may still enjoy some seasonal rate inflation, but the magnitude is unclear.

Rates will go up, but how high?

An observer of the goods economy could do worse than by dividing it into two large buckets: industrial and retail. Data from the industrial side has looked weaker and weaker. The Purchasing Manager’s Index, a monthly survey of manufacturers where a number above 50 indicates expansion and a number below 50 indicates contraction, slowed to 51.2, its lowest level in three years. It was the fourth consecutive month of PMI declines.

On the other hand, the retail side of the goods economy has a pretty good set up. Consumer confidence is healthy and personal income growth is accelerating. Personal income growth is essentially wage growth plus investment growth: the blended number is growing above 4 percent year-over-year.

The decoupling of manufacturing activity from retail — and remember that consumer spending is responsible for approximately 70% of U.S. gross domestic product — means that the fourth quarter could be retail’s time to shine, despite freight demand that lagged 2018 for most of the year.

Another development last week will play into demand for transportation services this peak season and especially rates out of Los Angeles. President Trump announced new tariffs of 10% on $300 billion worth of Chinese imports beginning September 1. Most of the goods affected are consumer goods.

A significant pull-forward effect may materialize where shippers try to beat the 10% tariffs by rushing freight onto steamships. Shippers may also anticipate those tariffs rising to 25%, as happened with previous rounds of tariffs on Chinese goods.

If that happens, the demand for transportation services out of major West Coast ports will increase dramatically: although warehousing markets have recovered a little from last year, there isn’t much slack. Los Angeles vacancy rates are around 2 percent, for example, well below the national average of 4.5 percent, which itself is still tighter than the long-term average of 5.8 percent.

Whoever went long on the Los Angeles to Dallas November contracts may be feeling a lot better about their aggressive bet right about now. Time will tell how the freight markets play out.