One way to measure the health of global trade is to follow ocean shipping rates, on the assumption that higher rates equate to higher cargo demand. Another way is to watch the number of marine containers in global circulation – a leading indicator that can flash early signals on market conditions ahead.

The most famous shipping rate indicator – the Baltic Dry Index (BDI) – has often failed as a global barometer due to “noise” from the vessel supply side of the equation. The BDI has collapsed at times when cargo demand is rising because ship owners and investors ordered far too many vessels.

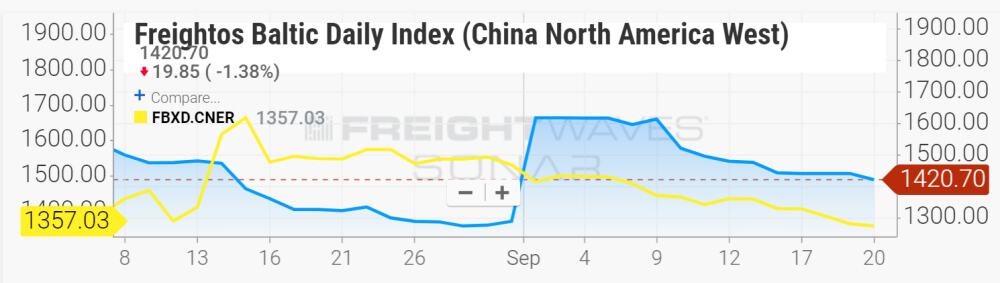

In the container-shipping sector, the most timely rate gauge is the Freightos Baltic Daily Index, which measures the cost to ship a 40-foot container on a wide variety of routes. The index covering the two largest container-shipping trades – China to Northern Europe (SONAR: FBXD.CNER) and China to the U.S. West Coast (SONAR: FBXD.CNAW) – both show faltering rates.

The decline in rates, from mid-August in the case of the European trade and from mid-September for the trans-Pacific, is transpiring at a time when rates should be improving due to peak-season demand.

In fact, this year’s disappointing peak season was foreshadowed by comments made during the latest quarterly calls of U.S.-listed container-equipment leasing companies Triton International (NYSE: TRTN), Textainer (NYSE: TGH) and CAI International (NYSE: CAI).

There were an estimated 41.7 million 20-foot-equivalent units (TEU) of containers in circulation at the end of last year, with container-leasing companies owning about 53% of the total. Of boxes owned by lessors, Triton estimated that it owned 28%, Florens 17%, Textainer 16%, Seaco 11%, CAI 7% and other lessors 21%.

Given their market footprint, U.S.-listed equipment lessors know when large orders for newbuild containers are made beyond liners’ need to replace older boxes (estimated at 5% of the world fleet per year). They know when liners need additional used units to meet incremental demand, when carriers need to unload some of their equipment inventory due to falling demand, and when container manufacturers (all of which are Chinese-owned) shutter some of their factory capacity due to deteriorating market conditions.

Prescient quarterly calls

The comments made on the second-quarter calls with analysts by these companies back in July and August are particularly telling, in retrospect, given how container rates are trending in late September.

During the quarterly call on Aug. 6, a month and a half ago, Textainer CEO Olivier Ghesquiere acknowledged that “there have been very few significant deals [for containers] from shipping lines” and that new container prices were being driven down by “weaker new container demand.”

“If you look at the market today, there have been very, very few open tenders,” he continued, stating that activity was low in both the second and third quarters and that this would likely result in factory closures. Ghesquiere also presciently stated that “we are very much thinking we are not going to see a typical peak season” and that there was unlikely to be “a typical surge.”

Victor Garcia, CEO of CAI International, said on his company’s call on Aug. 7, “We have not seen the traditional peak season demand [for boxes] that would normally commence during the second quarter.”

On an even earlier call by Triton International, on July 25, CEO Brian Sondey commented, “Our lease transaction and container pickup activity remains low” and “we’re not seeing a rush for additional orders.”

The price to produce a container mirrors the price of steel, and Sondey pointed out that pricing was “very low relative to steel prices” in the second quarter – “very close to historical lows; in fact, there were probably only a few quarters in the last 12-15 years in this range.”

Regarding the visibility of equipment-leasing companies, he explained, “We see where containers are picked up and dropped off. We don’t have great real-time visibility into how trade patterns are changing, but we do see how the overall demand and supply of containers is changing.”

Container equipment vs. container ships

The differences in the market dynamics of ship ownership and container-equipment ownership were highlighted during a panel at the Marine Money Week conference in New York in June.

The key difference is that the container-equipment business is far less likely than vessel owning to see supply completely out of step with demand. This averts the biggest pitfall in using charter rates as a bellwether, i.e., charter rates may at times reflect too much supply, not falling demand.

Jason Braunstein, managing director (MD) of transport at Hudson Structured Capital, said at the Marine Money event, “In the box market, you have just three manufacturers and a handful of lessors, whereas in shipping you have hundreds of owners and many shipyards producing vessels. That really leads to a much more stable market for boxes.”

The shipping investment mentality is much more speculative than in the container-owning sector, another reason the former is more volatile. Frank Pray, MD at Alinda Capital Partners, explained that in ocean shipping, the residual value (what you eventually sell the asset for) “is largely dictated by the economic and supply-demand conditions at the time” the asset is sold, whereas in the container-owning business, the residual value is closely linked to steel, “which makes the residual value more predictable and less magical.”

Indeed, residual-value risk is a key part of the appeal to shipping investors; they are making a “buy low sell high” bet on market timing. “In the vessel market, investors are taking a much more opportunistic view; that type of volatility just doesn’t exist in the box market,” said Braunstein.

In markets where investors are driven by market-timing upside as opposed to steady returns over time, supply is more prone to being overbuilt by over-exuberant investors.

Another major difference between container equipment and container ships: It takes a lot longer to build a ship. According to Pray, “Manufacturers [of containers] have the short-term ability to adjust supply to demand. If you’re looking for dry boxes or reefer boxes, the lead time is six to eight weeks, not a year or two [as it is for vessels]. Because of that, you don’t have these massive overhangs from the supply perspective.”

Due to the longer production lags in ocean shipping, it is common for the positive supply-demand balance that incentivized the shipyard order in the first place to evaporate before the vessel even hits the water. The short turnaround time in the container-equipment production cycle largely removes this risk and reduces volatility.

Add all of these factors up and the number of containers in the global transport system turns out to be a telling indicator of international trade and global economic health – one that’s much more closely matched to current demand than the vessel count. Thus, upcoming quarterly disclosures of U.S.-listed equipment lessors could offer an important view on container shipping and global trade at a time when conditions are highly uncertain. More FreightWaves/American Shipper articles by Greg Miller

Editor’s note: Freightos has a business agreement with FreightWaves that includes editorial coverage.