Heading into the Hanukkah – Christmas holiday period, trucking capacity is tightening across the country and sending spot rates higher.

The national average tender rejection rate (OTRI.USA), a measure of how many contracted loads from shippers are being rejected by carriers, has spiked to 9.35%, the highest it’s been since the middle of January.

The Passport Research team’s Trucking Markets report published yesterday found that there were essentially two factors contributing to current market conditions. The first is that drivers are exercising their options to limit their lengths of haul and the regions they run in so they can be sure to be home for Christmas. The second is that unlike in 2018, which saw a steady deterioration in volumes following Thanksgiving, truckload volumes have held up this December.

Learn more about Passport Research here.

Southern Californian markets, including Los Angeles and Ontario, have tightened appreciably, especially compared to market conditions earlier in the year. While the region is always a fountain of freight, producing far more than it consumes due to its busy container ports, trucking carriers are well aware of the market’s characteristics. In soft freight markets like 2019’s, carriers ‘camp out’ in Los Angeles and Ontario to source freight, which tends to saturate the market with capacity and drive down rejection rates and outbound spot prices.

“Southern California always gets a little hot before Christmas, but it has not been nearly as bad as usual for us,” one Chicago-based brokerage executive said. “Timelines for coverage are extending but the top line rates are remaining relatively stable.”

In our view, the approach of the Christmas holiday may have bled capacity away from Los Angeles as drivers take fewer transcontinental long-haul runs and try to operate closer to home.

Still, freight brokers yesterday cited perplexing tightness in markets as far apart as Yuma, Salt Lake City, and Minnesota, with one Chicago broker complaining that it cost him more than $5,000 to move a load from Minnesota to the East Coast.

“The market is f–ked today,” he said. “Anyone who said otherwise must’ve given back quite a bit of freight. Minnesota was the worst I’ve seen in a while.”

But an Atlanta-based brokerage executive said that his customers were moving low volumes this week and that he didn’t have to look outside of his core carriers to find capacity to move freight.

As new December tariff fears evaporate, trans-Pacific freight volumes could be unleashed and keep assets moving through the New Year. We expect capacity to continue tightening into the New Year holiday, but believe that the first quarter will return to soft conditions, barring an economic or trade surprise to the upside.

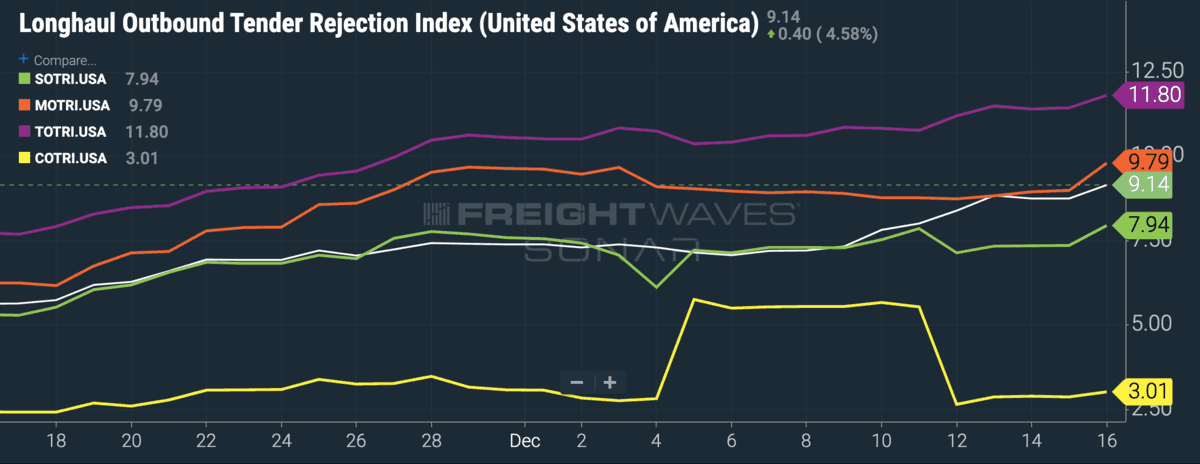

Capacity measured by length of haul displays some trends that haven’t shown up in overall tender rejections. All lengths of haul except local (COTRI.USA) have seen a steady tightening of capacity. Overall outbound tender rejections, OTRI.USA, is a weighted average of the length of haul outbound tender rejections with length of haul volumes.

Tweener length of haul, so-called because it is typically ‘in between’ a day’s drive and two days’ drive, is defined as a length of haul between 450 and 800 miles. Tweener lanes have had the tightest capacity since the ELD mandate and have tightened further from mid-November. City length of haul (i.e. local length of haul), has seen capacity remain loose after a bump in early December. Carriers operating on local lengths of haul are not rejecting their contracted loads in search of better rates. They are limited as to where they can operate as their networks are not as diverse as those carriers who operate on mid-haul, tweener, and long-haul lengths of haul.