Suffering the same cargo malaise as its competitors, American Airlines (NASDAQ: AAL), which saw its cargo revenue top $1 billion in 2018, retreated from that benchmark in 2019 and is forecasting further declines for early 2020.

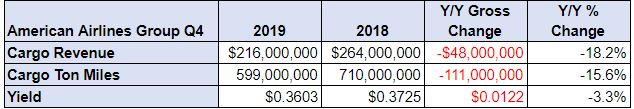

The airline’s fourth-quarter 2019 cargo revenue fell 18.3% from the same period in 2018 to $216 million, mostly due to a 15.6% decline in cargo volume. Cargo yield per ton mile, the average rate paid per mile, fell 3.3% in the quarter. Yield and volume were weighed down by trade concerns and macro economic weakness outside the U.S., company officials said Thursday in a conference call with analysts.

For the full year, American’s cargo revenue fell almost 15% to $863 million from just over $1.01 billion in 2018 on 14.4% lower volume. Yield for the year was essentially flat with 2018, declining 0.4%.

American expects cargo revenue of about $185 in the first quarter, which would represent a drop of 15% from the first quarter of 2019 and an 18.5% decline from the first quarter of 2018, when the carrier’s cargo revenue was $227 million.

The airline, which struggled with labor issues, the grounding of the Boeing 737 MAX and poor operational performance for parts of the year, said fourth-quarter 2019 revenues increased 3.5% to $11.31 billion and operating expenses increased 2.1% to $10.58 billion. Fourth-quarter net income, excluding special items, was $502 million and earnings per share, excluding special items, came in at $1.15, which was in line with expectations. Earnings per share including the special items were $0.95.

For the full year, American posted operating revenue of $45.77 billion, an increase of 2.8% over 2018 and the highest level in company history. Net income for the year was $1.69 billion, and earnings per share were $3.79. Net income excluding special items was $2.18 billion, or $4.90 per share.

Chairman Doug Parker said American’s quarterly results represent solid year-over-year improvement given a tough environment, and he highlighted the carrier’s improved operational performance. “We ended the year with our strongest operational quarter on record.”

In 2020, American is focused on building on its fourth-quarter results by driving improvements in key operational metrics, growing at its most profitable hubs — Dallas/Fort Worth and Charlotte, North Carolina, and driving free cash flow. The company currently is estimating full-year 2020 earnings per share of $4-$6 and capital expenditures of around $3.3 billion, of which $1.7 billion will be spent on non-aircraft items. Unlike competitor United Airlines, which on Wednesday said it expects 2020 capital spending of $7 billion, mostly for aircraft, American is on the tail end of its fleet-renewal program.

Capacity is expected to increase 4-5% for the year, but when that growth occurs depends on when the Federal Aviation Administration lifts the ban on flying the 737 MAX. American has 24 of the grounded planes in its fleet and it will probably be late summer, or early fall, before it can add those planes back into its schedule. Company officials said the pace of growth will increase once the MAX is back in service and, at the same time, its unit costs will go down. In the meantime, the airline is facing increased engine maintenance costs as it keeps older aircraft flying longer due to uncertainty with the MAX, company officials said.

American has 942 aircraft in its mainline fleet, including 20 Embraer E190s. It plans to offload all of the E190s by the end of the year and retire 11 of its aging 767-300s. The carrier also said it plans to add 18 Airbus A321neos, 22 MAXes and 12 787s this year. Company officials said they have been told by Boeing that 13 of American’s MAX aircraft have been built and are in storage and that once the grounding is lifted they hope those aircraft will be among the first delivered.