In an update to a status report issued earlier this week, the U.S. Treasury Department revealed Friday that transportation and warehousing accounted for $10.6 billion of the $342 billion in loans secured through the Paycheck Protection Program (PPP) that Congress passed and President Trump signed into law on March 27.

The program was designed to provide loans that could mostly be forgiven to companies with 500 employees or fewer, with 75% of the money to be used to maintain payroll for roughly 10 weeks. Small and mid-size trucking companies have been attempting to take advantage of the program to help keep drivers paid as the effects of the COVID-19 emergency begins to hit freight volumes.

“Nearly 5,000 lenders participated in this critical program, including significant lending by community banks and credit unions,” commented Treasury Secretary Steven Mnuchin in a statement. “Nearly 20% of the amount approved was processed by lenders with less than $1 billion in assets, and approximately 60% of the loans were approved by banks with $10 billion of assets or less.” No lender accounted for more than 5% of the total dollar amount of the program, he said.

A breakdown of the PPP program provided by the Treasury Department’s Small Business Administration shows that the five states receiving the highest amount in loans were California ($33.4 billion), Texas ($28.5 billion), New York ($20.3 billion), Florida ($17.9 billion) and Illinois ($16 billion).

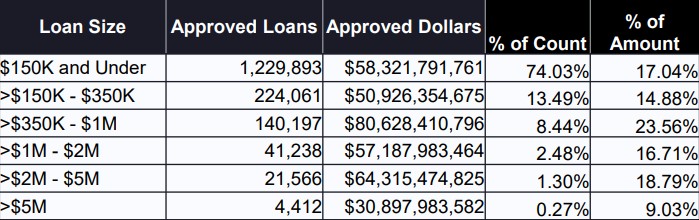

The overall average loan size is $206,000, but 74% of the loans were for under $150,000, “demonstrating the accessibility of this program to even the smallest of small businesses,” according to Mnuchin.

The construction sector, with 177,905 loans approved totaling $44.9 billion, accounted for most of the loan funds (13.1%) among 20 industry categories.

With the program now tapped out just two weeks after the SBA began processing loans, Congress is haggling over the terms for potentially replenishing it with an additional $250 billion. Nydia Velazquez, D-N.Y., who chairs the U.S. House Small Business Committee, wants the SBA to exert more oversight of the loans after reports that the Ruth’s Chris Steakhouse chain received a $20 million loan from the program.

“Big companies shouldn’t use up resources intended for struggling neighborhood small businesses, which are suffering so severely,” Velazquez said in a recent tweet.

Jgar

So much for the love, told you guys your shit days will return sooner than later

Darryl Roberts

What about these Brokers not paying over-the-road drivers trump they are taking everything that we have $900 for 900 miles need to be a cap put on a broker’s they need to be paying $2 a mile or dollar eighty per mile these Brokers are paying $0.98 he can’t make a living like that we are the one that needs help they’re killing us