- TuSimple launches an Autonomous Freight Network with UPS, Penske, U.S. Xpress and McLane Co.

- President Cheng Lu describes the initative as the “5G network of autonomous trucking”

Autonomous trucking technology startup TuSimple announced on Wednesday the launch of a national transportation network that it says is designed to help bring self-driving trucks to market safely and efficiently.

The Autonomous Freight Network (AFN) consists of self-driving trucks, digital mapped routes, shipping terminals and TuSimple Connect, an autonomous operations monitoring system.

Partnering with TuSimple on the launch are UPS (NYSE: UPS), Penske Truck Leasing, U.S. Xpress (NYSE: USX) and McLane, a supply chain services company.

Until now, the startup has focused primarily on its self-driving technology, Cheng Lu, TuSimple’s president, told FreightWaves. Ushering in a new era, its virtual driver software has developed to the point where the company is preparing to put it into action and bring it to market.

Lu reaffirmed earlier statements that TuSimple in 2021 will put a Level 4 truck on the road without a safety driver — which would make TuSimple the first autonomous trucking company to execute on that goal.

A truck is not a network

One of the biggest misconceptions around autonomous trucking, according to Lu, is that “you build the truck and it can go anywhere in the world.” In reality, bringing self-driving big rigs to market requires an entire ecosystem — terminals, maintenance operations, mapped routes — so that shippers can be assured of adequate coverage, not to mention reliable prices.

“The AFN is a scalable way for users to ensure they have access to autonomous freight capacity anytime and on demand,” Lu explained. The network has a concrete rollout plan, he said, and new partners will bring additional routes as well as varied fleet services.

Penske Truck Leasing, which operates more than 750 service facilities throughout North America, will provide over-the-road service and preventive maintenance for the autonomous trucks.

U.S. Xpress will provide new lanes to help improve TuSimple’s L4 technology learning. “It is a broker carrier agreement where they are moving freight on behalf of our customers,” Justin Harness, U.S. Xpress chief revenue officer, told FreightWaves.

The partnership between TuSimple and U.S. Xpress dates back a few years, according to Harness, but this is the first time the startup is moving freight for the Chattanooga-based carrier. “The allure, the excitement for us is continuing to deliver on the leading edge of technology development,” Harness said, “and understand how the developments can and will impact our industry and more specifically us as a carrier, our customers and drivers.”

Drawing a comparison between the AFN and a 5G cellular network, Lu said TuSimple is essentially building a new 5G phone with its Tier 1 suppliers and original equipment manufacturers (OEMs), with the startup supplying the operating system.

“But for the 5G phone to work, you need a 5G network,” Lu said. “If you don’t have a 5G network, what does the customer do? That’s the Autonomous Freight Network.”

A nationwide rollout

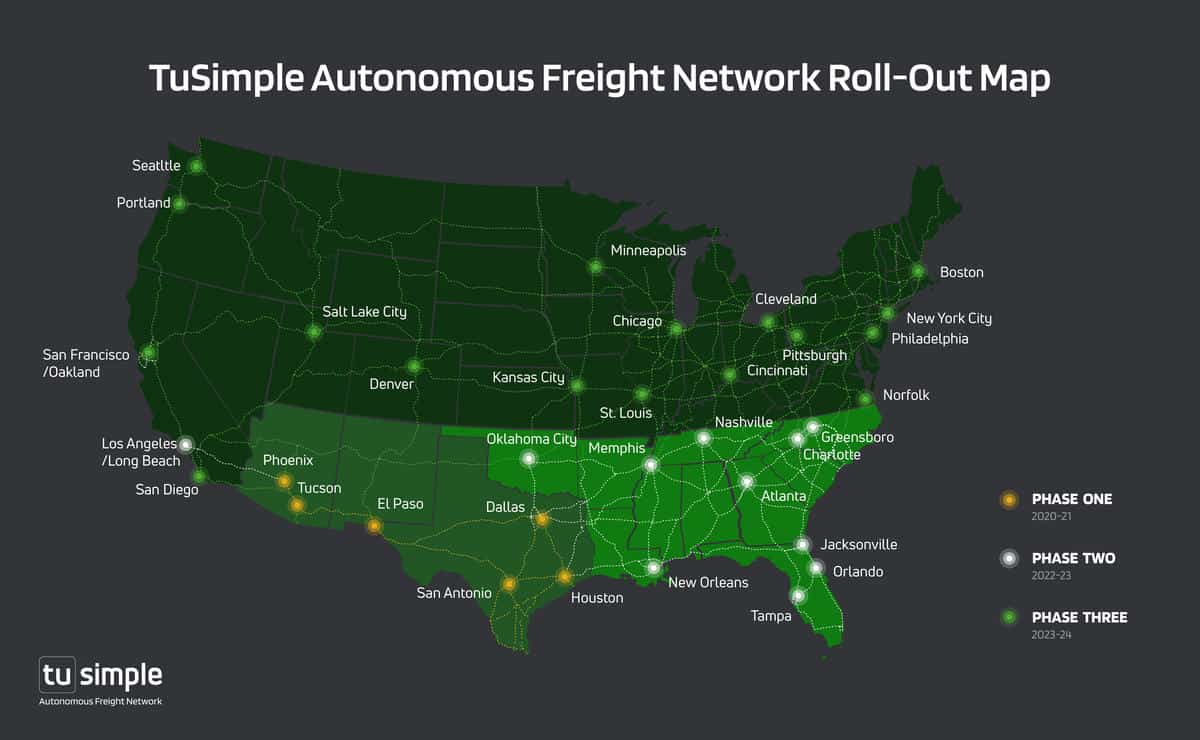

The Network will take shape in three stages, the company said, with a goal of having self-driving autonomous trucks become commercially available by 2024:

● Phase I (2020-21) will offer service between Phoenix and Tucson, Arizona, Dallas, Houston, San Antonio and El Paso, Texas.

● Phase II (2022-23) will expand AFN service from Los Angeles to Jacksonville, Florida, connecting the East and West coasts.

● Phase III (2023-24) will expand driverless operations nationwide, adding major shipping routes throughout the lower 48 states, which will allow customers to utilize their own TuSimple-equipped autonomous trucks on the AFN by 2024.

TuSimple says it will eventually replicate the strategy in Europe and Asia.

The AFN isn’t materializing out of thin air. A growing number of autonomous vehicle companies are building out their operations, as the technology matures and the rise in e-commerce and fast shipping along with the pandemic accelerate interest in autonomous logistics solutions.

In a Waymo press briefing on Tuesday, for example, the Alphabet-backed self-driving vehicle company described a plan for bringing its delivery division Waymo Via to market. The roadmap includes partnering with OEMs, Tier 1 suppliers and fleets, for which Waymo will provide its software and other services, including mapping and remote assistance.

With offices in China and the U.S., TuSimple (along with Waymo) has some of the deepest pockets of its self-driving trucking peers and already operates autonomously (with safety drivers) on seven routes between Phoenix, Tucson, El Paso and Dallas.

The company has moved freight for large commercial customers including USPS and UPS, the latter of which took an undisclosed stake in TuSimple last fall.

Lu declined comment on a report published in TechCrunch last week that the company was seeking an additional $250 million in venture capital.

As part of the Autonomous Freight Network, TuSimple will open a new shipping terminal in Dallas. The company’s technology allows its trucks to drive on local streets as well as highways, Lu noted, opening up more possibilities for terminal locations and allowing the company to leverage facilities from existing partners.

“One terminal could be a UPS facility, because they are a customer with a lot of scale,” he said. But TuSimple can also rent a shipping yard or a parking lot for use as a terminal for autonomous operations, he said.

For high-volume customers, TuSimple will continue to map routes and deliver directly to their distribution centers.

The final piece in the Network is the launch of TuSimple Connect, a monitoring system intended to ensure the truck is operating safely and allow customers to track their freight in real time.

Put all these pieces together and you get a scalable way to make sure all businesses have autonomous freight capacity, said Lu. That’s good for its shipper customers — and for TuSimple as it aims to beat the (stiff) competition in getting trucks on the road and into the market.

“Our destiny,” Lu observed, “is tied to the adoption of our Autonomous Freight Network.”

Related stories:

UPS buys stake in self-driving outfit TuSimple

Another autonomous trucking startup announces layoffs

Butter in tow, Plus.ai completes cross-country commercial freight run