The Cass Freight Index posted its first year-over-year shipments increase in nearly two years during October. Shipments climbed 2.4% during the month with expenditures rising 3.1%. Both were basically flat compared to September.

The Thursday report showed shipments posting their highest year-over-year growth since October 2018 and 27.8% above the April bottom.

“We should see this continue through year-end, assuming current freight trends continue, even with normal seasonal softening month to month,” commented the report’s author, Stifel Financial (NYSE: SF) research analyst David Ross. He pointed to inventories remaining “quite lean” as a catalyst for future volume increases.

Growth in consumer spending, strong import activity, peak air cargo conditions and more freight moving on the rails were cited as reasons for the improvement.

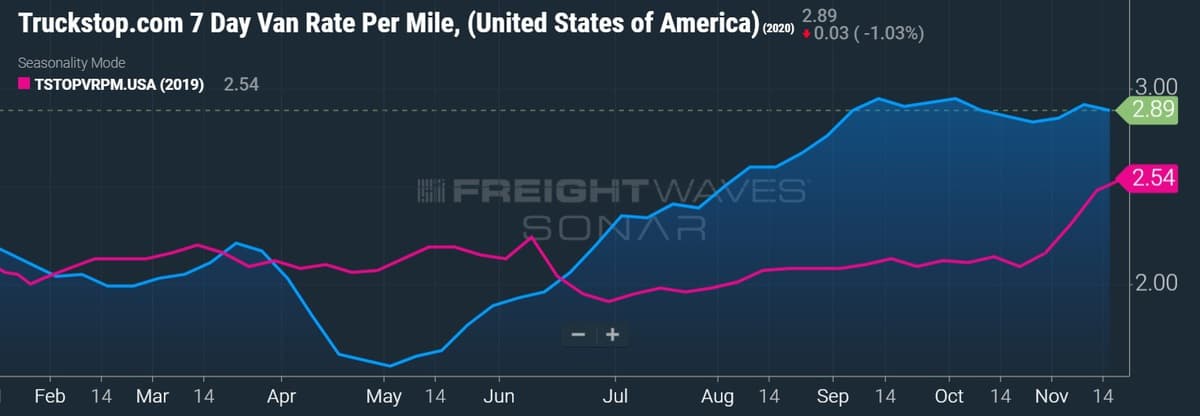

Expenditures, or money spent on freight transportation, recorded the second straight month of year-over-year increases. The index is approaching levels 30% higher than the May trough even with declines in fuel surcharges as diesel prices remain 20% lower compared to last year. A sustained period of tight truck capacity and high demand continues to keep trucking rates elevated.

“The present constraints on drivers and industry supply are real, so even with better demand, fewer trucks are running and rates are rising significantly,” Ross stated. “How much capacity can be coaxed to enter next year in this tight supply/demand environment will play heavily into the ultimate growth in the shipper’s average freight bill.”

The truckload (TL) linehaul index increased 0.8% sequentially but remained in negative territory compared to 2019, down 2.7%. The index measures per-mile linehaul rates excluding fuel and mostly includes contractual rates, which lag changes in the spot market. October was the lowest year-over-year decline recorded in more than a year.

Ross expects the linehaul rate index to improve in the coming quarters as contracts are renegotiated higher. He believes that spot rates still haven’t peaked yet, “so the pricing outlook remains bullish for carrier negotiations with shippers, as spot rates are up substantially y/y (including fuel surcharges) in the dry van, flatbed and reefer markets, with dry van above 2018 peak levels and reefer closing in.”

“More rate increases will be ahead for carriers in 4Q20 and 2021 – the only debate is how high they’ll go, as we’re hearing everything from 6%-12% right now,” Ross added.

The intermodal price index hit a new low compared to 2019, down 23.2%. Declines in fuel surcharges and a lag to changes in TL pricing were cited as the reasons for the decline.

“Due to inventory restocking, we see strong demand well into the first quarter of 2021 and then easy comps to start the second quarter. We expect healthy demand, coupled with supply constraints, to lead to continued higher prices for truckload and intermodal contracts well into 2021,” Ross concluded.

Data used in the Cass indexes is derived from freight bills paid by Cass Information Systems (NASDAQ: CASS), a provider of payment management solutions. Cass processes $28 billion in freight payables on behalf of more than 8,000 subscribers annually.