(UPDATE: New U.S. Coast Guard aerial video of container-ship traffic jam released: see link here)

In the movie “Falling Down,” the character played by Michael Douglas is stranded in a Los Angeles traffic jam. He abandons his car, starts walking with briefcase in hand and ultimately has a mental breakdown. Cargo shippers trying to get their containers through the ports of Los Angeles and Long Beach can relate.

The pileup of ships offshore in San Pedro Bay and congestion onshore at the terminals have reached epic proportions.

And the situation could become even more maddening in the weeks ahead.

32 container ships at anchor

American Shipper interviewed Kip Louttit, executive director of the Marine Exchange of Southern California, to get the latest on ships in San Pedro Bay.

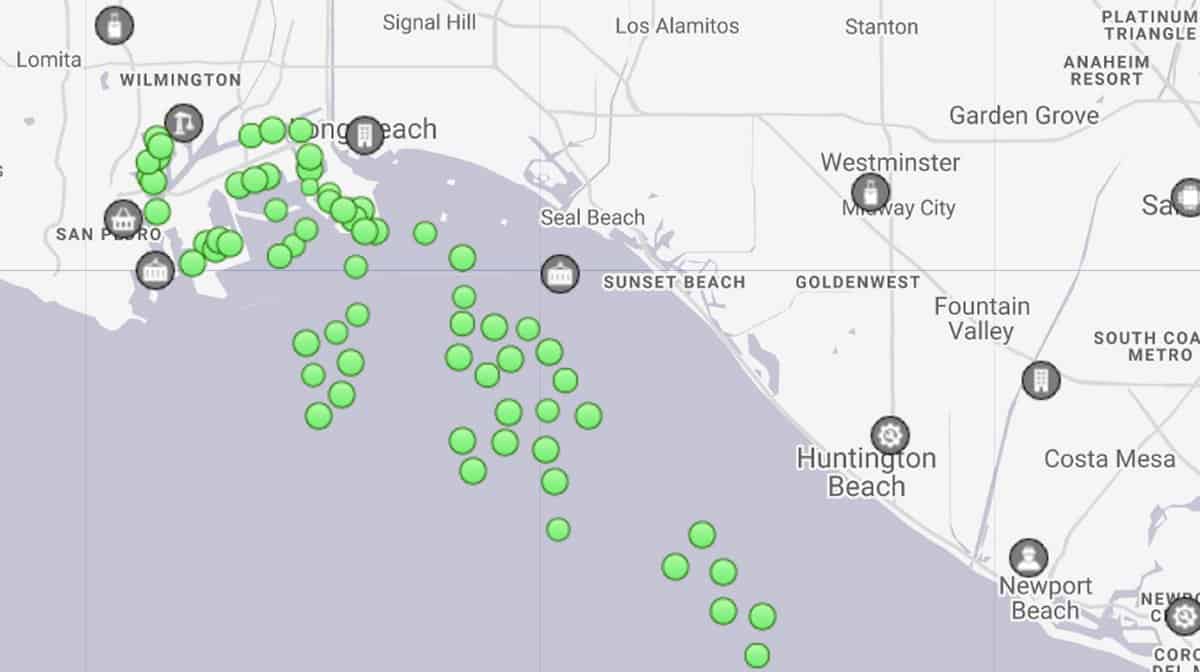

He reported that as of midday Wednesday, 91 ships were in port: 46 at berth and 45 at anchor. Of those, there were 56 container ships: 24 at berth and 32 at anchor. Between Wednesday and Saturday, 19 more container ships will arrive, with the same number due to depart.

There were a few more container ships at anchor on Friday —37 in total. Yet Louttit said “there has been no significant change between the first of January and today.”

Louttit confirmed that ships have effectively filled all of the usable anchorages off Los Angeles and Long Beach. Ships have also taken six of the 10 contingency anchorages off Huntington, the next town south.

If all the anchorages and contingency anchorages fill up, ships will be placed in so-called “drift boxes” in deeper water. These are actually circles not boxes. Unlike ships at anchorages in shallower water, ships in drift boxes would not anchor, they’d drift. “When you drift out of the circle, which has a radius of 2 miles, you start your engine and go back to the middle of the circle,” explained Louttit.

Historical perspective on traffic jam

Given the drift-box option, container ships are not about to hit any kind of maximum capacity offshore of California. Nor is there a higher safety risk. “There are a lot of ships, but they’re all very carefully watched and managed,” affirmed Louttit.

The significance of so many anchored ships is what they reveal about the extent of the logistics logjam on shore.

The most recent comparable anchorage level occurred during the labor dispute between the International Longshore and Warehouse Union (ILWU) and their employers in 2014-15.

“On March 14, 2015, there were 28 container ships at anchor. We’ve blown through that record,” said Louttit. The all-time record for ships at anchorage off California occurred in 2004 during a rail staffing shortage.

“Normally, if you want a baseline, there’d be a dozen and rarely are they container ships,” he said.

Signal still flashing red

The Marine Exchange does not look past the coming four days’ arrivals. But there are other ways to see what’s headed this way across the Pacific.

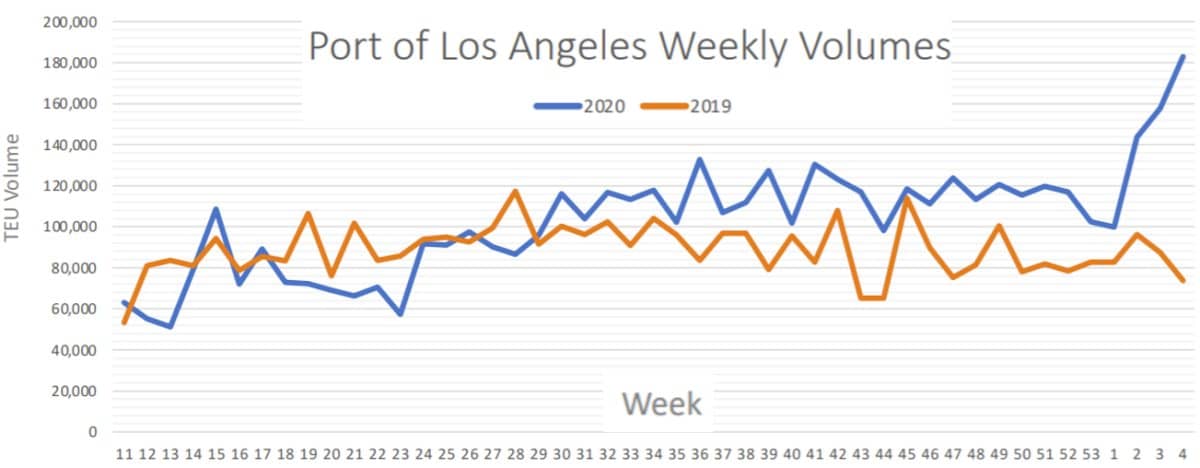

It takes two to three weeks for containers to cross the ocean from China to California. The Port of Los Angeles developed The Signal, a daily digital tool powered by Port Optimizer, to indicate what’s en route. The system uses manifest data from nine of the top 10 carriers calling in Los Angeles.

The Signal data updated on Wednesday showed no letup in sight. Imports are expected to rise from 143,776 twenty-foot equivalent units (TEUs) this week to 157,763 TEUs next week to 182,953 TEUs the week of Jan. 24-30.

Importantly, the data does not solely include TEUs arriving in a particular week. It also includes TEUs arriving in prior weeks that the port expects to handle in the stated week.

Consequently, the data provides an indirect indicator of how much cargo is getting delayed. For example, on Monday, Jan. 4, The Signal indicated the port would handle 165,000 TEUs that week. But by Friday, Jan. 8, the assessment for that same week had plunged to 99,785 TEUs — implying that over 65,000 TEUs were pushed to the following week (i.e., this week). This pattern also suggests that the forecast for 182,953 TEUs the week of Jan. 24-30 will ultimately be revised downward.

Congestion causes

In an alert to customers this week, carrier Hapag-Lloyd reported, “All terminals [at Los Angeles/Long Beach] continue to be congested due to the spike in import volumes and [this] is expected to last until February.

“Terminals are working with limited labor and split shifts,” it said, asserting that this is related to COVID. “This labor shortage affects all terminals’ TAT [turnaround time] for truckers, inter-terminal transfers and the number of daily appointments available for gate transactions and delays our vessel operations.”

As a result of “lack of terminal space” to service vessels, “there is a constant switching of terminals that must be kept in mind” given that containers are ending up “in the wrong terminal,” said Hapag-Lloyd.

Congestion woes are now spreading well beyond California ports, confirmed Hapag-Lloyd. The carrier reported “heavy congestion” in Canada and “berth congestion at Maher Terminal and APM Terminals [in the Port of New York and New Jersey] impacting all services with delays of several days being experienced upon arrival.”

Little relief ahead

Liner companies traditionally cancel numerous sailings during the Chinese New Year period to account for decreased Chinese exports. If they did so in 2021, it would allow U.S. terminals time to clear some of the inbound congestion. Unfortunately for terminals, liners are opting against canceling sailings during the Chinese holiday period next month.

Ports could also see congestion relief if U.S. consumer demand slowed. However, that does not appear to be happening.

Analysts believe the “blue sweep” scenario — with Democrats winning the presidency as well as both houses of Congress — will spur $1 trillion-$2 trillion in new stimulus during the first half of this year.

Investment bank Evercore ISI predicted, “Additional checks will reach consumers at a time when unemployment is lower [than during the 2020 stimulus round], mobility has significantly improved, the overall willingness to spend of the general public is up significantly, confidence levels are higher, housing is strong and the savings rate is still extremely high. That is a set-up for a consumer boom.” Click for more FreightWaves/American Shipper articles by Greg Miller

MORE ON CONTAINERS: ‘Blue wave’ could spur stimulus on top of stimulus: see story here. Liners highly unlikely to slash service for Chinese New Year: see story here. Container shipping 2021: hangover or party on? See story here.