This fireside chat recap is from Day 2 of FreightWaves LIVE @HOME.

TOPIC: How shippers can navigate port and supply chain congestion

DETAILS: The global supply chain faces an unprecedented deficit of container-ship capacity and container equipment in relation to cargo demand — and this capacity crunch won’t end anytime soon. In this environment, shippers need to move fast and be creative.

SPEAKERS: Nerijus Poskus, vice president of global ocean, Flexport, and Greg Miller, senior editor, FreightWaves and American Shipper.

BIO: Poskus leads long-term ocean strategy at global logistics platform Flexport. Since joining in 2015, Poskus has scaled up Flexport’s global ocean-carrier partnerships, trade-lane coverage and internal freight operations. Prior to Flexport, he worked on the trans-Pacific trade lane management team at Kuehne+Nagel.

KEY QUOTES FROM POSKUS:

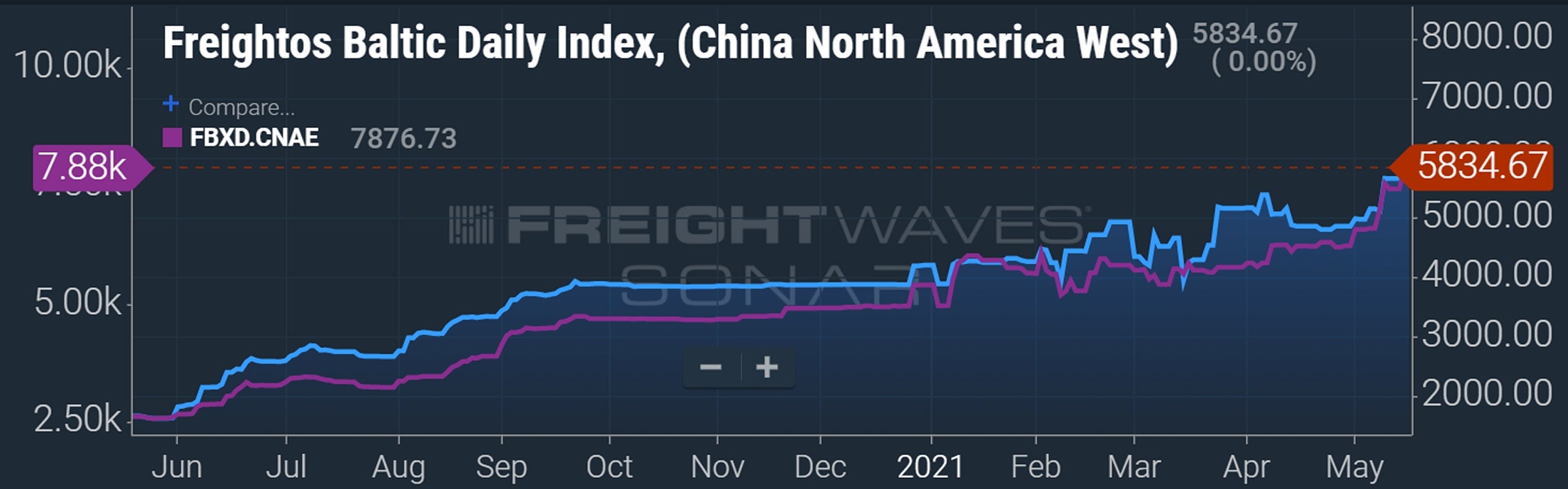

“It’s almost an auction now out there. Indexes show high $4,000s [per forty-foot equivalent unit or FEU] to the U.S. West Coast and high $5,000s to the U.S. East Coast [as of mid-May]. But in many cases, cargo has to pay big, big premiums in order to get moving. The premiums can be to secure equipment, to ensure no-roll or to ensure early booking releases. So, $3,000 to $5,000 on top of what you’re seeing on the indexes is not unusual to pay. I have an example of one client that was trying to get space last minute and they have been offered $19,000 per one 40-foot container from Vietnam to New York. So, the prices are all over the board for the trans-Pacific.”

“Booking 14 days in advance used to be a normal practice. Now we are talking about 30 days and in some cases 45-plus days of wait times just to get your SO [shipping order] released. It really varies by service and contract type. Premium contracts get space released, in some cases, twice as fast as regular contracts. At the same time, there is a queue building. So, that 30-45 days was probably 25-30 days 10 days ago. The queue is getting longer every single week, which tells me there is a big, big backlog building in Asia. I would predict there are a few hundred thousand containers getting rolled every week. And it’s getting worse.”

“What’s driving it? Record consumption is one — retail sales are up. Restocking is a very big one and there are two reasons for restocking. One is that inventories are low. Two is that companies owe goods to consumers. There are so many people that bought something that hasn’t been delivered. So, it’s not even restocking. It’s like a debt. And a third reason is e-commerce. If you are competing with Amazon and you want to compete with one-day fast delivery, you have to have more inventory across the country to be able to do that.”

“One of the largest commodities that’s coming into the U.S. on the trans-Pacific is furniture. Retail [furniture] sales are up 25% this year compared to last year but if you look at the actual TEU [twenty-foot equivalent unit] count, it’s up three times year-over-year and up two times over 2019 year to date. What this is telling me is that restocking has been much larger than the actual [sales] growth. This would indicate to me that once restocking is complete, things should improve. However, rising costs and a shortage of raw materials at origin are delaying production, causing backlogs for new orders. I have actually discussed this with quite a few importers and some of them are waiting 60 days, 90 days, in some cases 300 days for POs [purchase orders] to even start being manufactured. That tells you it’s going to last a while.”

Click for more articles by Greg Miller

Related articles:

- Time to start prepping for Christmas shipping capacity crunch

- Why stratospheric container rates could rocket even higher

- Container shipping rates have just spiked yet again

- Importers lost their pricing power. How should they adapt?

- Flexport: Trans-Pacific deteriorating, brace for shipping ‘tsunami’