The size of the US goods trade deficit with the rest of the world increased again in October, as a large decline in exports and a small gain in imports pushed the deficit near record levels. The total value of traded goods fell slightly during the month but is still considerably higher than at this point last year despite significant changes to trade policy.

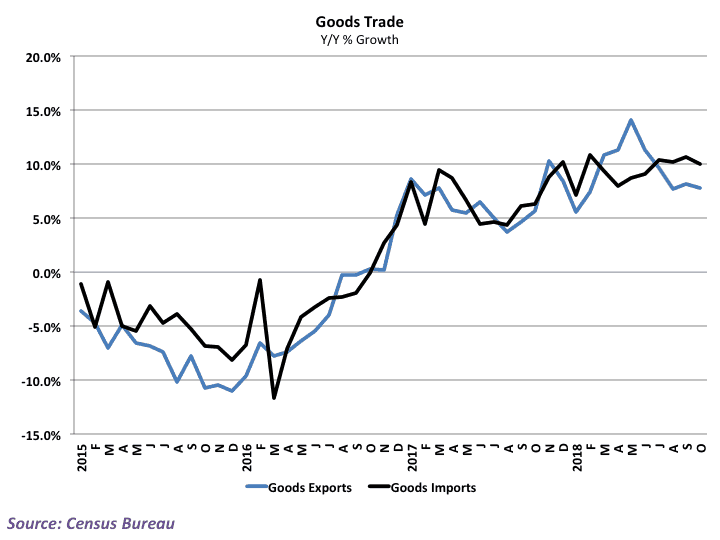

Advance readings from the Census Bureau show that the US trade deficit in goods widened to -$77.2 billion from a revised -$76.3 billion in the previous month. This marks the fifth consecutive increase in the size of the goods trade deficit and pushes the goods trade balance to the lowest point since mid-2008. Export growth struggled at the start of the 4th quarter, falling 0.6% in October from September’s levels. Year-over year growth has now fallen to 7.8% after enjoying double-digit growth during the middle part of the year.

As has been the case over the past few months, much of the decline was driven by declines in agricultural exports. Recall that China began instituting tariffs on US exports of agricultural products such as soybeans and sorghum in July of this year. In response, many US producers rushed to exports these agricultural products out of the country in the 2nd quarter, earlier than they would normally. Now that the tariffs have been implemented, exports of these products have struggled, dropping 6.8% in October after an 8.0% decline in September and weighing down overall export performance.

On the import side, the value of goods brought into this county rose 0.1% in October as year-over-year growth maintained a double-digit pace at 10.0%. Like exports, it appears as though tariff concerns altered the performance of goods imports over the past few months. The US is likely going to ratchet up tariffs on goods imported from China at the start of 2019, and many US retailers and wholesalers seem to be importing more than they normally would before the tariff situation gets worse.

Not all of this recent performance in trade has been tariff-related, however. The US economy is growing at a healthier clip than much of the rest of the world, which typically encourages imports while making the export environment comparatively tougher. In addition, the US has gained strength in recent months, making US-made goods comparatively more expensive and further guiding the economy to a widening trade gap. These issues are likely to remain well into 2019 and will continue to influence trade behavior outside of any changes to policy.

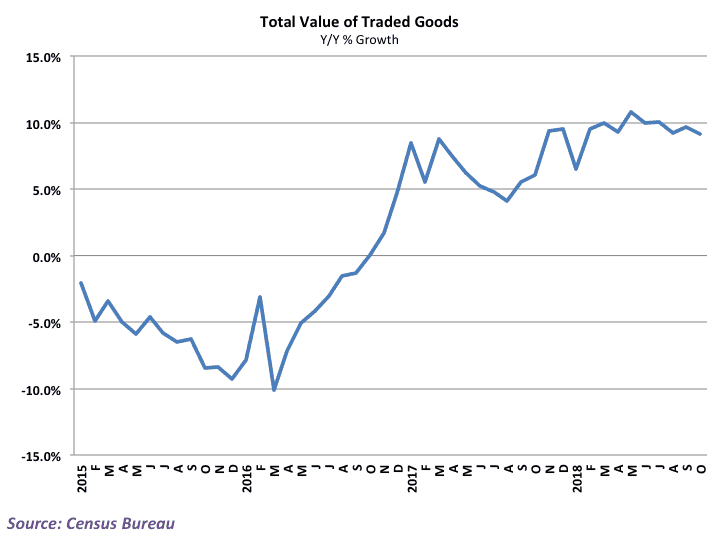

Total trade slipped, growth remains strong

A widening trade deficit is not necessarily bad news for freight demand, however. Both import and export movements are good for ocean, air, and surface freight demand, so as long as overall trade is growing, it is generally good news for carriers. October’s results were a bit of a disappointment in this regard, as the decline in goods exports outweighed the gain in imports. Still, year-over-year growth in to the total value of traded goods (exports plus imports) is growing at al healthy clip despite all of the global concerns over US trade policy. Growth has hovered near double digits since the end of 2017, and has yet to show any real signs of slowing. With US growth expected to moderate in 2019 and global growth already showing some signs of easing, trade volumes will likely not continue to grow at the same rapid pace as we head into next year. For now, however, trade performance looks healthy even if trade policy concerns are disrupting the usual timing of shipments.

Behind the numbers

The concerns over US trade policy have introduced quite a bit of noise from month to month into the trade numbers. The initial threats of tariffs on steel and aluminum imports were announced at the end of February of this year, and ever since it has been difficult to distinguish what is happening to underlying trend vs. what is happening because of trade policy.

This is likely going to continue well into next year. Right now import growth is surging at least in part because of fears of a January hike in tariff rates. Business are getting these good into the country before the start of the year and storing them in inventories until needed. If the tariffs go into effect as planned, expect a significant drop off in import volume in early-2019 as businesses draw off of existing inventories.

From a growth perspective, this doesn’t mean much in aggregate; the decline in imports will be offset by a decline in inventory building. From a freight perspective, however, it likely means that there will be less volume coming into ports and less surface freight dispersing imported goods throughout the country. The trade deficit may come down at that point, but expect some downward pressure on freight demand as a result.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.