Change in sourcing and labor rules borne by auto makers.

Major car manufacturers are still sifting through how, where, and with what they will make their products amid a rejiggered North American Free Trade Agreement (Nafta).

Canadian Prime Minister said in a statement Monday that he “welcomed the progress” in negotiating a new Nafta deal between the U.S. and Mexico and that he hoped the U.S. and Canada could also come to a “successful conclusion of negotiations.”

This afternoon I spoke with President Trump – get the details on our call: https://t.co/yQBs0nXGQF

— Justin Trudeau (@JustinTrudeau) August 27, 2018

To that end, Canada’s foreign minister Chrystia Freeland has been meeting in Washington D.C. this week with U.S. Trade Representative Robert Lighthizer over how Canada can take part in a new trade bloc.

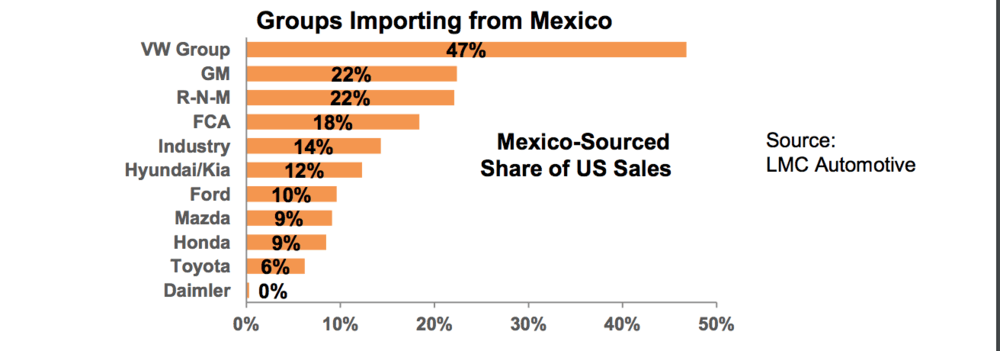

Auto industry analysts at LMC Automotive says Canada would have to be included in any new agreement, which it dubs “Nafta 2.0.” Otherwise, a well-integrated supply chain honed over the 24 years of Nafta 1.0’s existence would be upended.

But with Congressional approval needed for a new deal and mid-term elections, a Nafta 2.0 could “be delayed . . ., adding to the uncertainty of the proposed agreement getting finalized.”

While the new deal with Mexico, and potentially Canada, includes new rules on intellectual property, textiles and financial services, Nafta 2.0 is creating the most uncertainty in the North American automotive industry, which became tightly integrated through Nafta 1.0.

One provision requires that a higher percentage of vehicles imported to the U.S. be made at factories that pay up to $16 per hour. LMC says the provision “could significantly impact cost of OEMs and suppliers doing business in Mexico” where wages are up to 75% less than in Canada and the U.S.

The new deal reached with Mexico includes provisions on the sourcing of parts used in vehicles sold on a tariff-free basis in North America. Among the main provisions are that 75% of the parts going into cars be sourced in either the U.S. or Mexico to qualify as tariff-free, up from the original 62.5% domestic content requirement in Nafta 1.0.

Kristin Dziczek, vice president of the Center for Automotive Research, says the domestic content requirement like needed updating as the list of parts going into cars and light trucks has changed since Nafta 1.0 was enacted.

Nafta 1.0’s tracing lists for parts included “cassette players and distributor caps that are not in cars anymore,” Dziczek said. “Now cars have lidar and sensors.”

Many of these newer electronic components are being assembled in Southeast Asia and Mexico. Dzizeck says the evolving nature of car technology and parts sourcing means these supply chains are still fluid.

As for the current state of vehicles coming to the U.S., Mexican officials have said close to one-third of the roughly 2.3 million cars and light trucks may not meet the 75% threshold for domestic content.

Dzizeck says car makers can boost the domestic content in cars to meet the new threshold or decide to pass the 2.5% tariff cost on to consumers should domestic content costs be too high. The third option would be to just sell the car outside the U.S.

But a much higher tariff of 25% may also face Mexican auto imports, according to a Reuters report. It says a side deal may cap Mexico’s auto imports at 2.4 million units, with anything above that facing the 25% tariff, a “problematic if true” development, LMC said.

Dzizeck says it’s not certain if Mexico would surpass that level. Moreover, many of the 800,000 or so cars from Mexico that do not meet the domestic content requirements are smaller, low-end vehicles that are seeing flattening sales in the U.S.

“Many of the low content vehicles are not that popular in the U.S.,” Dzizeck said.