The recent slowdown in spot truckload rates, when seen through the perspective of data history, could be setting the market up for a surge in rates just before Thanksgiving.

That was the conclusion of FreightWaves CEO and managing director Craig Fuller in the company’s monthly market update, conducted by both Fuller and FreightWaves chief economist Ibrahiim Bayaan. Drawing on data from the company’s SONAR data base offering, Fuller was able to pinpoint just when that surge might be: the week of November 16-23.

Referring to DAT rate indices, Fuller noted that the trucking market has been rife with discussion about recent weekly declines.“We saw really high peaks in June and we’ve fallen off in July and August,” he said. “What the industry forgets is that this happens every single year.”

The question then, Fuller said, is to look at present market conditions, compare it to past data and figure out if the recent decline says anything about the future. The predictive model from SONAR is that a decline that begins sometime in July generally fades by mid-August, Fuller said, “and then we’re off to the races.”

The subsequent runup generally goes for 20-21 weeks, Fuller said, “and then we consistently see a peak again in the second part of the cycle.” That November date range for a projected peak is derived from the 20-21 week history.

Based on data, the increase from the trough to the peak has been as small as 27% (in 2015) and as high as 75%, set last year. Fuller said the comparisons were made on the Los Angeles to Dallas lane, given its volume and traditional volatility.

Noting that the current price in that lane is $1.82 per mile, “you can actually project that it will be between $2.30 and $2.40 at the peak,” Fuller said. Potentially, if there is a “major capacity crisis,” or a “black swan” event, a $3 mark could be reached, though Fuller stressed that was not his prediction.

In a discussion in which the current addition of tariffs into the market mix came up several times, Fuller pointed to data on container prices out of China into both the U.S. West Coast and East Coast as a sign that so far, the tariff wars are not impacting the freight market. For example, the FreightOS Baltic Index for China to the western U.S., which is available in SONAR, currently stands at 2064, the highest level in recent months. It was at 1200 as recently as early July. The corresponding China-East Coast number of 3090 has plateaued of late, but still is the highest in many months as well. “The indicators are still showing that freight is coming across the water,” Fuller said. “The shipping lines have pricing power in those lanes and they are able to get much higher spot prices out of China into North America.”

Economist Bayaan noted that the goods that have been caught up in the tariff disputes and whose movement, if constrained, might have pushed those numbers down constitute a relatively small portion of GDP, less than 2%. On that basis, he said he does not anticipate a significant impact on the strong economy from their imposition.

But any impact is more than just numbers, Bayaan noted. “When you listen to business leaders and purchasing managers, their concern is more that rather than taking action, they just don’t know what to expect, and it has complicated things that didn’t have to be complicated,” he said. But if they do take action, Bayaan said it could come in the form of pre-buying of products and importing goods earlier than they might have otherwise, as a hedge against future tariff-driven price increases.

In other issues discussed in the webinar:

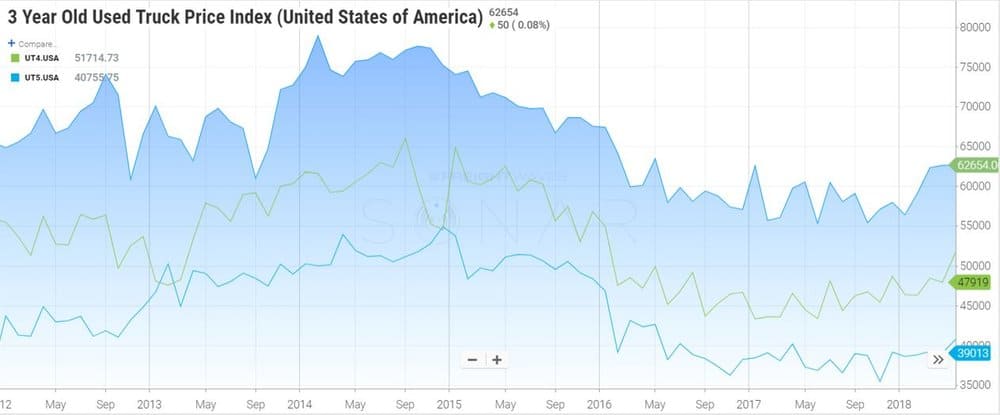

- Fuller said the relatively flat level of used truck prices is one indicator that the market is not going to get hit with a surge in capacity from heavy buying of second-hand vehicles. “We’re not nearly at a point where it looks as if there is a lot of demand for used trucks and a lot of new capacity coming into the market,” he said. “I’m not worried about oversupply from small operators.” “Runaway” used truck prices in 2013-2014 that were up to $80,000 for the most recent model year at that time are now sitting at about $62,000, he said. As far as the strong level of new truck orders, Fuller reiterated what has become a widely-held sentiment in the industry: that it won’t be used to feed new capacity, because the drivers aren’t there to fill those seats, but will aid in such things as driver retention and fuel efficiency.

- That the previously mentioned FreightOS numbers are holding up on the West Coast aligns with the indications coming from FreightWaves’ Outbound Tender Volume Index, which measures freight moving out of various ports. It has shown a significant upward spike from San Francisco, and a solid level from Los Angeles, though not as dramatic as the Bay area.

- The data research that has been done with the recent launch of the SONAR product revealed something unexpected: a lack of clear correlation between volume and rejection rates. Fuller said that clear correlation does not exist on a broad scale, though it can be seen in individual regions due to conditions that are unique to that market. Rather, Fuller said, the link is “that when you have high volume and you have high volatility in rates, you will see tender rejections go up because capacity is nomadic.” Given that, imbalances in markets can be smoothed over by capacity moving itself from one place another, being “able to absorb localized tension,” Fuller added. “So as volume goes up, it does not necessarily mean rejections go up.”

- The recent 11% year-on-year increase in the producer price index for long-distance truckload movement is a record high for that number, going back to the history of the series that begin in 2003, Bayaan said. “This is no small piece of news,” he added. Local rates up 6.6% are more than other parts of the economy, but are still significantly less than the upward movement in truckload prices.

- With various data points—including the Cass Indices—pointing to double-digit increases in contract trucking rates, Fuller said a “normalization” is in the offing. Many shippers booked in contract rates of that much of a gain after the “massive shock” in spot prices, “and in many ways the shippers corrected to the upside.” Fuller said he did not expect it would drop completely, but that the market should “get into a more normalized pattern,” with 4% to 6% year-over-year price increases for contractual agreements. “I don’t think we will see runaway spot prices,” he added.