The highlight reel from Friday’s SONAR reports. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here.

Lanes to watch

By Zach Strickland, director, Freight Market Intelligence

LOS ANGELES to CHICAGO

Overview: Domestic intermodal volume rises likely due to more transloading of imports from 40’ containers to 53’ containers.

Highlights:

- Domestic intermodal volume in the past week averaged 1,204 units/day, the highest level since mid-April. Meanwhile, international intermodal volume of 896 units/day in the past week is towards the low end of its volume range of the past year.

- The domestic intermodal spot rate of $4.01/mile, including fuel surcharges, is 10.2% higher year-over-year.

- The intermodal tender rejection rates for outbound L.A. loads and inbound Chicago loads are 5.9% and 1.9%, respectively, which are both well off their highs.

What does this mean for you?

Brokers: Brokers in this lane will likely have to source highway capacity, rather than intermodal capacity, given the lack of available domestic containers. When negotiating with dry van carriers, cite Chicago’s attractive Van Headhaul Index of 85 which suggests that Chicago is becoming a more attractive destination.

Carriers: Chicago looks like a solid destination for long-haul carriers, and carriers may see more opportunities in this lane in light of the intermodal capacity constraints. While the Chicago van tender rejection rate of 17.6% is 178 basis points below the national van tender rejection rate, the Chicago Van Headhaul Index recently shot up from 25 to 85, suggesting that the Chicago market will likely tighten in the coming days.

Shippers: Unlike in recent months, shippers that have domestic intermodal contracts in place are unlikely to have their tenders rejected. For spot shippers, it will likely be more economic to utilize the highway rather than rail intermodal with carriers protecting intermodal capacity for contracted shippers with intermodal spot rates above $4/mile.

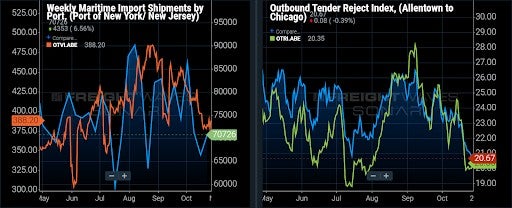

ALLENTOWN (Pennsylvania) to CHICAGO

Overview: Capacity likely to tighten considerably as the Headhaul Index surges 32% week-over-week (w/w).

Highlights

- Allentown outbound tender volumes are up 1.9% w/w, signaling that demand for capacity is increasing slightly.

- The Headhaul Index in Allentown is up 32% w/w, signaling that capacity is likely to tighten.

- Allentown outbound tender rejections are already up relatively flat w/w, signaling that the growing imbalance in volumes has not yet caused a significant tightening of capacity yet.

What does this mean for you?

Brokers: As expected, record import volumes have been slamming the major ports around the U.S., and the Port of NY/NJ is certainly no exception. Massive import volumes have been moving into the major port-side truckload markets, but even though the transition of imported containers to dry van truckloads has been slower than expected, there is still a significant amount of pent-up truckload demand that is about two to three weeks away from being “red-hot” for shippers needing to desperately get their freight in for what is expected to be one of the largest retail seasons on record.

Carriers: Allentown pricing power is shifting even further in your favor as the large surge of over 32% in the Headhaul Index is likely to cause a significant tightening of capacity. With truckload volumes expected to remain strong for weeks to come, there is likely to be a growing deficit of available trucks in the Allentown market. So, keep an eye out for outbound tender rejections and be sure to adjust your pricing accordingly.

Shippers: Your shipper cohorts in Allentown are still averaging 2.9 days in tender lead times, but it is highly recommended to push those out to between 3.5 and 4 days as soon as possible. The record import volumes coming in through the Port of NY/NJ are likely to keep tremendous pressure on available truckload capacity in the days and weeks to come.

MILWAUKEE to CLEVELAND

Overview: Milwaukee rejection rates fall off a cliff.

Highlights

- Milwaukee’s outbound rejection rate has plummeted over six percentage points in just over a week, moving from well over the national average to well under it.

- Rejection rates to Cleveland have also fallen dramatically from near 26% to around 19% in the same amount of time.

- Cleveland’s capacity has been on a wild roller coaster ride over the past few months thanks in part to the wild swings in freight flow balance. Currently they are seeing easing, but the long-term signals point to another reversal in a week or so.

What does this mean for you?

Brokers: Expect easing conditions out of the Milwaukee market with lower pressure on rates, especially in this lane in the short-term. Make extra calls and deepen route guides while you can in what is currently the nation’s fastest changing market.

Carriers: Accept only loads that have strong contracted reload potential in this lane for now unless you are stranded. Diverting capacity to the spot market in lanes like Atlanta should be more fruitful in terms of volume. Cleveland capacity should retighten in the coming weeks so be on the lookout and accept more loads once rejections climb out of their trough.

Shippers: Push freight in this lane while you can. Don’t expect discounts after 3pm on a Friday, but you should be able to get some more reliable pick ups scheduled for early next week.

Latest from … Freightos Baltic Daily Index

From Greg Miller’s story on American Shipper:

The Freightos Baltic Daily Index (FBX) — which does include premiums in its trans-Pacific assessments — put the Asia-West Coast spot rate at $19,478 per FEU as of Thursday. This assessment spiked 21% from the day before, closing in on the high of $20,486 per FEU reached in mid-September. FBX Asia-West Coast rates have bounced back 50% from their recent low of $13,025 per FEU on Oct. 8 and are quintuple levels at this time last year.

FBX Asia-East Coast rates rose to $21,111 per FEU on Thursday, 4.5 times rates a year before and getting closer to the peak of $22,289 per FEU hit last month.

Watch: SONAR on Freightonomics

Zach Strickland and Anthony Smith bring on Henry Byers to discuss the recent problems surrounding the ports of Los Angeles and Long Beach and their downstream impacts on surface transportation.

Spotlight on … Domestic Intermodal Volume

By Zach Strickland

On its third quarter earnings call Thursday, Schneider National, one of the largest truckload-based domestic intermodal companies, said that rail network fluidity has been improving of late. That’s encouraging given how constrained intermodal networks have been in recent months.

However, the company also said that customer delays have not subsided as many shippers continue to struggle with labor availability.

As a way of monitoring intermodal network fluidity, we recommend monitoring daily intermodal volume in SONAR. Amid ample demand, capacity constraints have been the main volume impairment and the reason why domestic intermodal volumes have been below year-ago levels in recent months.

Consistent with Schneider’s perspective that rail network fluidity is improving, average daily domestic intermodal volume climbed 8% in October from August-September averages (left chart below).

While additional transloading of imports from 40-foot international containers to 53-foot domestic containers at the West Coast ports likely played a role in that volume improvement, the widespread nature of the domestic intermodal volume improvement in the past month (see right chart below for volume in the densest lanes) suggests that the recent pickup in volume has been related to network fluidity improvement.