The current supply chain crisis is caused by an unprecedented demand for physical goods flowing through major chokepoints, combined with a lack of labor and a limited supply of transportation capacity. While global economic turbulence due to COVID is an immediate catalyst, the crisis has been decades in the making and the lack of investment in supply chain infrastructure is a fundamental cause. The Infrastructure Investment and Jobs Act, promoted by President Joe Biden and recently passed by Congress, has the potential to address some of these concerns.

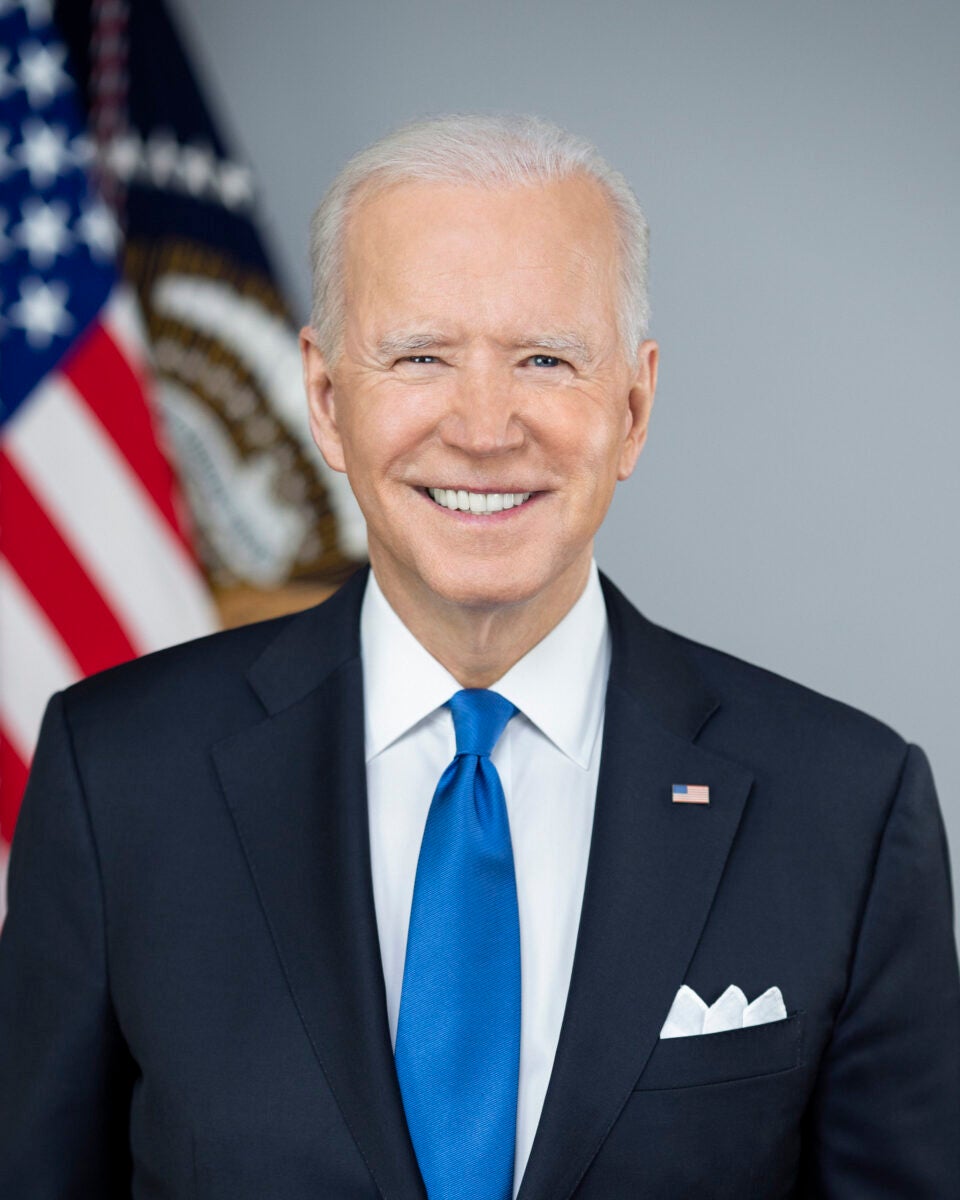

(Photo: Adam Schultz/The White House)

The good news is that if you fix the supply chain infrastructure, you will fix the labor shortage and lack of transportation capacity. To understand why the labor supply and transportation capacity are linked, you have to understand the economic model that drives the supply chain industry.

Freight transportation — whether by airplane, ship, train or truck — is the liquidity of the supply chain industry. Raw materials must be transported from their original source to processing facilities, then on to production facilities where they are combined with other raw materials to create finished goods, and then further downstream to a system of distribution centers. All of this happens before products reach retail stores or are available through e-commerce. Without sufficient freight transportation capacity, the entire supply chain grinds to a halt.

The supply chain issues we are currently facing (with some notable exceptions to include semiconductors) are largely a result of a lack of freight transportation capacity.

The freight transportation industry generates revenue by hauling goods from an origin to a destination. Transportation providers are paid to move goods based on a combination of time, distance and weight. These carriers, in turn, pay their drivers and operators under a similar arrangement. For truck drivers this could be on a per-mile basis, while other modes pay on a per-trip, per-hour or tonnage basis, but only when the vehicle (airplane, train or ship) is in transit.

If freight is being slowed at chokepoints (like it currently is at seaports) or due to congestion, then shipping lines, railroads and trucking companies are not making money and their crews aren’t either. If crews aren’t making money, they will leave the industry and find employment elsewhere.

In addition to money, a primary reason that people leave the transportation industry is the frustration of dealing with traffic, schedule inconsistencies and delays. For truck drivers this could be highway traffic or delays caused by inefficient operations (at ports, rail yards or shippers’ facilities). The more time drivers spend in traffic, the less they make per hour, and the less time they have to do other things – like spend time with family.

All of this creates an endless cycle of turnover – delays lead to lower pay, which pushes drivers out of the industry, which in turn leads to more delays. This turnover costs the transportation industry billions and slows the growth of transportation capacity. After all, transportation providers only get paid when they complete a trip.

The other major reason why transportation providers don’t add capacity is the lack of returns they see on their capital assets – airplanes, trucks, railcars and ships. The most important variable that determines profitability for transportation companies is asset utilization, or how much money is generated by an asset over a period of time.

The faster a trucking company can complete a trip, the more availability it has for the same truck to take other shipments. If trucks are bogged down in traffic or at ports, then carriers are making less money than they would if they didn’t have to face these obstructions and inefficiencies. Decrease the time it takes to complete a trip and you increase the money a carrier makes. If they are making more money, they will go out and buy new trucks, grow their fleets and hire additional drivers.

(Photo: Customs and Border Protection)

The infrastructure bill can also lead to an improvement in domestic manufacturing.

One of the challenges that have been facing supply chains throughout the past few years is the lack of domestic manufacturing. Industrial demand tends to be more cyclical than the rest of the economy, so it has been hard for companies to make significant long-term investments in manufacturing production. They have decided to outsource this to manufacturers and suppliers overseas.

But with the infrastructure bill, we may see a domestic manufacturing renaissance; companies will be able to mitigate their exposure to economic cycles as the government provides a consistent customer for manufactured goods that are used to build domestic infrastructure.

As goods start to be manufactured domestically instead of imported, this will take some pressure off our ports. Any volume that is moved off the ports will help improve the state of affairs throughout the supply chain, particularly for companies that must remain reliant upon imports from overseas.

The issues in the supply chain are not going to be fixed overnight, and the infrastructure bill is not going to be an immediate answer to all the challenges facing the industry. But it does show long-term planning and smart investment on behalf of our government that will likely be matched by private-sector leadership in industries throughout the supply chain, something that many in the industry have been working toward for years.