It’s still early in the reporting cycle, but preliminary announcements by ocean carriers point to history-making profits in Q4 2021, trouncing already stratospheric expectations.

Supply chain congestion — the bane of cargo shippers — has proven to be an unprecedented money-making machine for carriers. And with congestion expected to persist, liner companies could follow up blockbuster fourth-quarter results with even more highs.

“The container shipping sector looks set to continue its extraordinary profitability cycle in 2022,” affirmed Drewry Maritime Financial Research. “Clearly, the pandemic and ensuing supply chain crisis … has supercharged carrier profits.” Fresh disruptions caused by omicron should “drive further gains.”

According to Deutsche Bank analyst Andy Chu, “We expect ongoing supply chain disruption” and “conditions for the container shipping [to] remain very good.”

Ocean Network Express

Results released Monday by Japanese carrier group Ocean Network Express (ONE) follow the pattern seen throughout the industry: Congestion is curtailing volumes, yet rates have risen so much due to congestion that carrier profits keep escalating, so much so that single-quarter earnings now easily exceed full-year earnings pre-COVID.

For the third quarter of its fiscal year (ending Dec. 31, 2021), ONE reported profit of $4.9 billion, up 418% from the same period in 2020.

For its full fiscal year, ONE now expects profits of $15.4 billion, over 4.4 times more than 2020 profits of $3.48 billion. Underscoring how quickly the market is improving, ONE had predicted a much lower full-year result — $11.8 billion — just three months ago.

ONE broke its quarterly profit record despite a drop in volume due to congestion. Global liftings fell by 8% year-on-year to 2.9 million twenty-foot equivalent units in Q4 2021, with liftings in the heavily congested Asia-U.S. trade plunging 22% to 564,000 TEUs.

Hapag-Lloyd

Germany’s Hapag-Lloyd preannounced “extraordinarily strong” fourth quarter and full-year results on Tuesday, hitting the top end of its guidance range. Audited results will be released in March.

Hapag-Lloyd reported that earnings before interest, taxes, depreciation and amortization for full-year 2021 totaled $12.8 billion, over four times the $3.1 billion in EBITDA earned in 2020.

EBITDA in Q4 2021 was $4.7 billion versus $1 billion in Q4 2020. Quarterly volume fell 6% year on year, to 2.9 million TEUs, but freight rates more than doubled, reaching $2,577 per TEU in Q4 2021 versus $1,163 in the same period the year before.

Evergreen

Taiwan’s Evergreen has yet to release its fourth-quarter results, but it has posted operating revenues through December. The upward climb in Evergreen’s revenues highlights how worsening supply chain disruptions have delivered more cash to liners.

Evergreen posted preliminary operating revenues of $156 billion New Taiwan dollars ($5.6 billion) for Q4 2021, more than triple operating revenues of NT$47.9 billion in Q4 2019, pre-COVID.

Cosco and OOCL

Last week, quarterly and full-year unaudited results were announced by the world’s fourth-largest liner operator, China’s Cosco Group, and its Hong Kong-based subsidiary, Orient Overseas Container Line (OOCL).

Cosco reported that group profits for 2021 would total 89.28 billion yuan ($14 billion), nine times 2020’s profits of 9.93 billion yuan.

OOCL reported $4.88 billion in revenues in Q4 2021, up 101% year on year. Revenues steadily climbed through 2021; they totaled $4.31 billion in Q3, $3.47 billion in Q2 and $3.03 billion in Q1.

OOCL said revenues hit a new record in Q4 “despite severe congestion around the network, which drove down liftings by 16.9%.” Trans-Pacific liftings fell 25% in Q4 2021 versus Q4 2020. However, revenue per TEU surged 142% globally to $2,625 per TEU, and by 136% in the trans-Pacific to $3,668 per TEU.

For the full year, OOCL reported revenues of $15.68 billion, up 110% from 2020, with liftings up 1.7% to 7.59 million TEUs and revenue per TEU up 107% to $2,067.

Earlier releases: Matson and Maersk

Earlier this month, the world’s second-largest carrier group, Denmark-based Maersk, and Hawaii-based trans-Pacific specialist Matson (NYSE: MATX) reported fourth-quarter results.

Maersk announced preliminary results on Jan. 14 and will release final numbers on Feb. 9. Fourth-quarter volumes fell 4% year on year but rates jumped 80%. Maersk expects Q4 2021 EBITDA of $8 billion and full-year EBITDA of $24 billion — yet again topping its previous guidance. Last year’s results were almost triple the $8.2 billion in EBITDA Maersk earned in 2020.

Chu at Deutsche Bank, who is far more bullish than the consensus, predicts that Maersk’s EBITDA will surge another 42% higher this year, to $34.1 billion.

Matson announced preliminary Q4 guidance on Jan. 19; final results will be announced Feb. 19. According to Stifel analyst Ben Nolan, who refers to the company as “The Matson Mint,” the pre-announcement put Q4 earnings per share at $8.70-$9.10 versus a consensus of just $5.37. “For reference, Matson posted $8.90 of EPS for 2018, 2019 and 2020 COMBINED,” wrote Nolan.

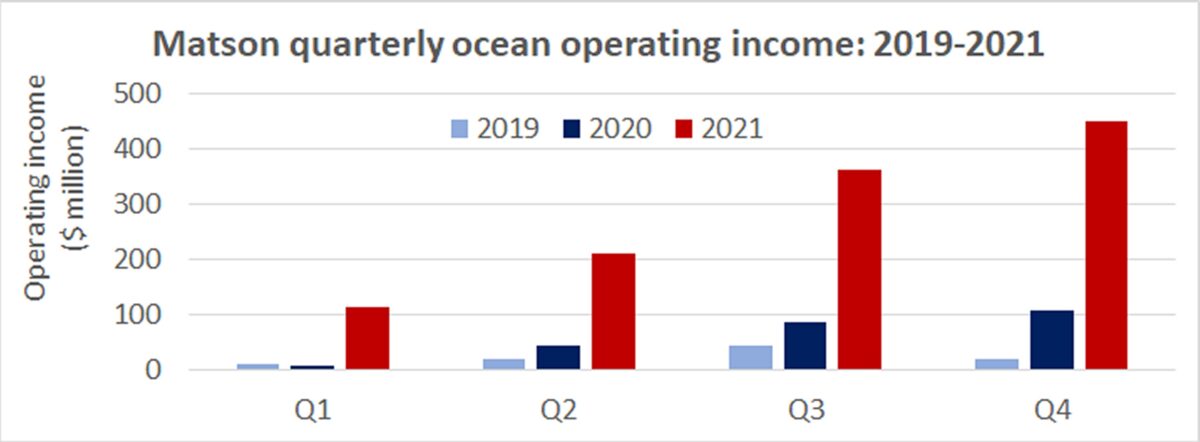

The midpoint of Matson’s guidance puts Q4 2021 net income at $373.8 million, up 337% year on year, and full-year net income at $906.7 million — 4.7 times 2020 net income. Operating income for Matson’s ocean transportation division was estimated to be $445 million-$455 million in Q4 2021, more than quadrupling from the year before.

Matson CEO Matt Cox expects congestion and elevated consumption patterns “to remain largely in place through at least the October peak season, and elevated demand for our China service for most of the year.”

Click for more articles by Greg Miller

Related articles:

- Los Angeles imports slump further as congestion throttles volume

- Imports take ‘dramatically longer’ to reach US as bottlenecks bite

- New year brings new all-time high for shipping’s epic traffic jam

- New index measures supply chain pressure — and it’s really high

- Inside container shipping’s COVID-era money-printing machine