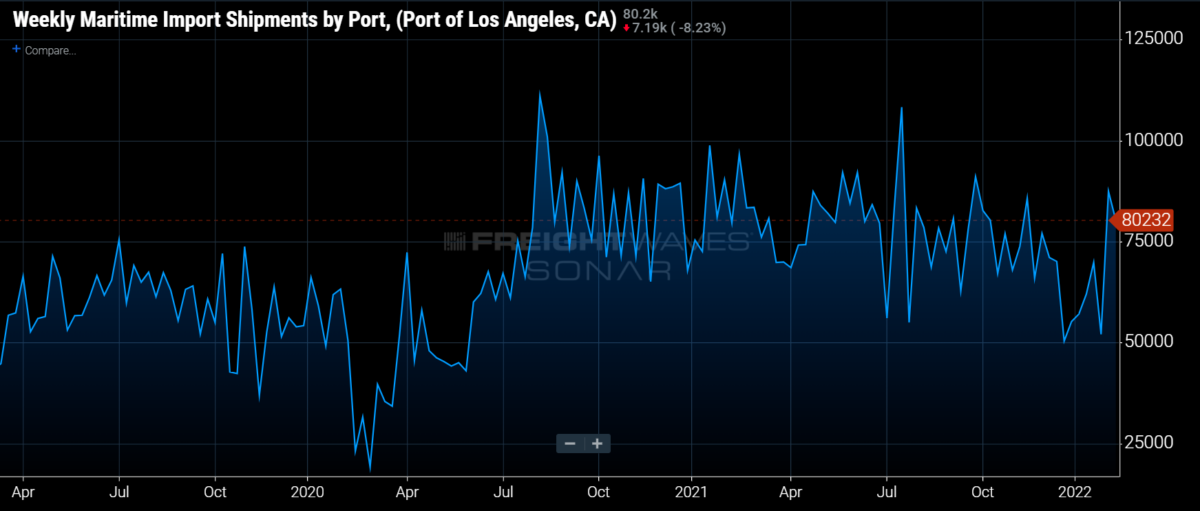

The ports of Los Angeles and Long Beach rebounded from year-over-year December volume drops and reported January records.

The Port of LA handled 865,595 twenty-foot equivalent units last month. It was the best January in the port’s 115-year history and 3.6% better than the first month of 2021, when the port moved 835,516 TEUs.

“We also eclipsed our January 2019 record of 852,000 container units, when cargo owners were trying to get ahead of the tariff deadlines set by the previous administration,” Port of LA Executive Director Gene Seroka said during a press conference Thursday.

“Among the contributors to our fast start are strong consumer demand [that] continues to drive imports. Retail sales jumped 3.8% from December to January. Early Lunar New Year, which began Feb. 1, created a rush of cargo to get out of Asia before the holiday slowdown. And we continue to reposition a tremendous amount of empty containers as demand for those boxes remains high,” Seroka said.

January loaded imports totaled 427,208 TEUs, off 2.4% from last year’s “exceptional showing” of 437,609 TEUs, he said. In December, the port handled only 385,251 TEUs of imports, down 16% year-over-year and widely attributed to San Pedro Bay congestion.

“Meanwhile, exports continue their abominable slide, showing a nearly 16% decline year-on-year” from 119,326 TEUs in January 2021 to 100,185 TEUs this year, Seroka said. “They’ve now dropped 35 of the last 39 months.”

The Port of LA ended 2021 with its lowest export output since 2005, he continued, pointing out that the U.S. trade deficit grew 27% last year, the largest increase on record.

“The 2020 phase one trade agreement brokered by the previous administration to boost U.S. exports has fallen well short of expectations. China bought none of the incremental $200 billion of American exports committed to in the pact,” Seroka said, stressing that the United States “must find a way to improve American exports.”

He said the push to get empty containers back to Asia continues, with 338,202 TEUs processed in January, a year-over-year increase of 21.4%. And the gap between loaded and empty exports continues to widen. “In January, for every loaded export leaving Los Angeles, nearly 3.5 empty containers went along for the ride as well.”

There were some 90,000 empty containers on Port of LA docks or yards in December, Seroka said. “Today that number has dropped by about a third to 64,000 units, so we’ve seen significant improvement in recent weeks.”

He said there had been great success clearing the port of containers, and the average dwell time has declined from 11 days to five.

Capacity ‘finally opening up’ at Port of Long Beach

The Port of Long Beach also credited its January success to the clearing of the docks. It reported last week that it had its busiest January on record, “boosted by efforts to successfully move aging cargo out of shipping terminals.”

The Port of Long Beach moved 800,943 TEUs, up 4.8% from January 2021. The port said it was the first time it had processed more than 800,000 TEUs in the month of January.

Imports were up 6.9% year-over-year to 389,334 TEUs. The Port of Long Beach had handled 358,687 TEUs of imports in December, which was down 12% year-over-year.

Exports in January also were up, by 5.9%, to 123,060 TEUs. Empty containers moved through the port increased 1.8% year-over-year to 288,550 TEUs.

Port of Long Beach Executive Director Mario Cordero attributed the busy January to terminal capacity “finally opening up.”

“We expect to remain moderately busy into the spring as we make significant progress to clear the docks and process the backlog of vessels waiting offshore,” Cordero said in a press release.

The port noted that import activity traditionally slows in February as Asian factories close for Lunar New Year celebrations, “but this month may be busier than usual as work continues to clear the docks and reduce the number of ships waiting to enter the port amid a historic cargo surge.”

More work to be done

Seroka said there is more that must be done to improve efficiency and throughput at the San Pedro Bay ports.

“Fifty-five percent of available truck gates at the Port of Los Angeles marine terminals go unused every day since we began monitoring this data back on Oct. 9,” he said. “We’re not singling out truckers; this is a multidimensional issue and we have to get to the root causes. It could be that some importers are still using the port and containers for storage. It could be that we need process improvements at our terminals that scale to market requirements. Or it could be we need to find ways to attract, recruit and retain drivers in our industry.

“Whatever the reasons, we must address them to improve efficiency at our truck gates. We have the ability to move more cargo if we use the truck gates that are available to use today. More than half the truck gates going unused is a failure of the system. We need to dissect this glaring issue and that’s what we’re doing right now with some of our key stakeholders.”

Seroka said the use of rail also needs to increase.

“We estimate that currently 30% of our capacity goes unused in this segment. Intermodal cargo shifted away from the ports … to ease congestion at their Midwest hubs, and we haven’t seen this business return in full.

Making money isn’t a problem, but Hapag-Lloyd’s CEO still has worries

Port of Long Beach smashes annual record despite December ‘speed bump’

CMA CGM acquiring Port of LA’s Fenix Marine Services

Click here for more American Shipper/FreightWaves stories by Senior Editor Kim Link-Wills.