The highlights from Thursday’s SONAR reports. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

Lane to watch: Dallas to Indianapolis

Overview: Dallas rejection rates jump over 15% but are still easing in the long run.

Highlights:

- Dallas’s outbound rejection rates have increased from 13.4% to 15.2% over the past six days, but are down four percentage points since the start of the year.

- Rejection rates to Indianapolis are among the highest out of Dallas, hovering around 21.5% over the past month. Spot rates have been relatively stable as well, moving between $2.70 and $2.75 per mile since the start of the year.

- Indianapolis’ outbound rejection rate has been trending higher since the beginning of the year, moving well above the national average at over 25%.

What does this mean for you?

Brokers: Pad your margins in this lane if you are uncertain, capping expectations around $2.90 per mile. Another round of winter weather is hitting this lane this week, but oversupply in west Texas is mitigating the undersupply inherent in Dallas. Spot rates have not been very volatile but contract compliance is relatively low, meaning pay more attention to contracted loads in this lane while spending less time covering the transactional freight.

Carriers: Push rate increases in this lane if too far below $2.50 per mile. Rejection rates are above the national average and well above the Dallas market average. It will make it easier to cover loads in the long run and more reliable, which helps solidify your relationships.

Shippers: Consider a rate increase in this lane if your rates are well below $2.50 per mile and your compliance is less than 75%. Carriers are not prioritizing this lane for contracted loads out of Dallas, making it disproportionately tighter than many other lanes.

Watch: Shipper Update

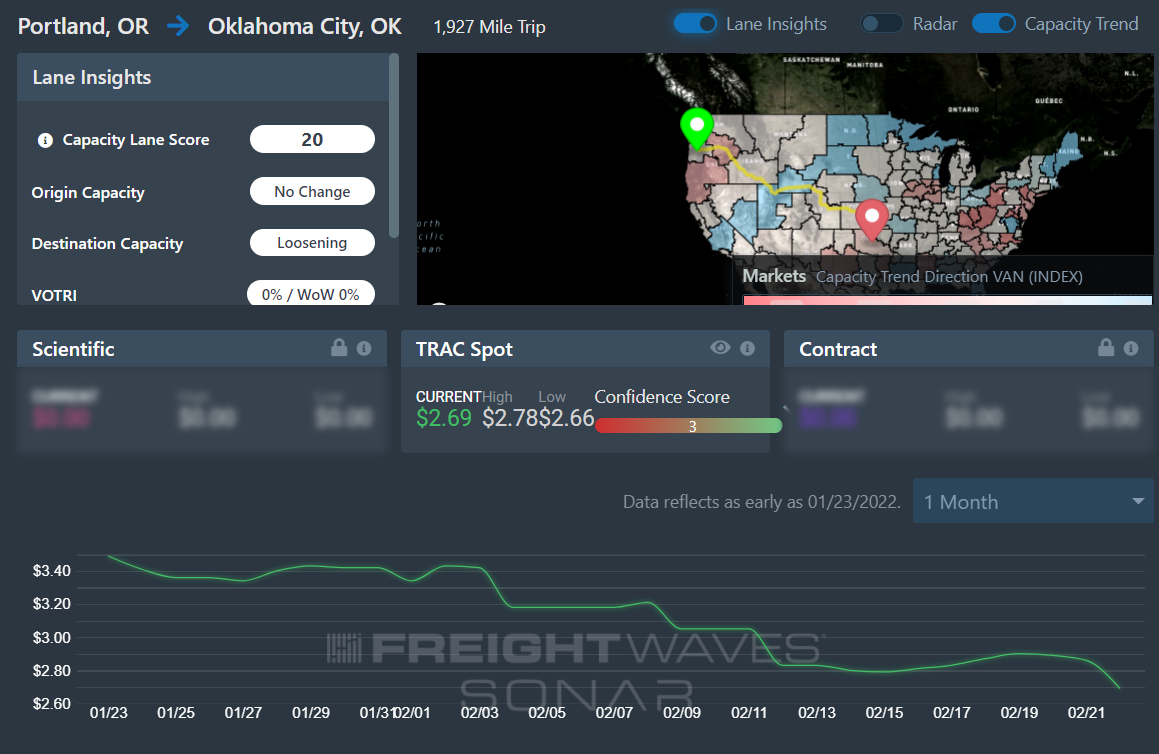

Lane to watch: Portland (Ore.) to Oklahoma City

Overview: Lessening capacity leads to downward pressure on spot rates.

Highlights:

- The FreightWaves TRAC rate is the lowest for the past 30 days at $2.69 per mile.

- Oklahoma City outbound rejection rates are at the month’s highest at 16.46%.

- Outbound tender volumes for Portland are at their lowest to-date this year.

What does this mean for you?

Brokers: Capacity is loosening in Oklahoma City and spot rates are dropping. Winter weather is hitting Oklahoma over the next few days, so prepare shippers for some delays in shipments and pad your margins to reflect the delays and possible extra charges from carriers.

Carriers: Winter weather hitting Oklahoma City could force drivers off the road or into long delays. Hold firm on rates as capacity is loosening and the load balance is still skewed more for inbound loads rather than outbound loads.

Shippers: Outbound tender lead time out of Oklahoma City is at the lowest since December 2021 (at 2.7 days). Portland is still holding at just over three days. With the balance of loads favoring more inbound than outbound, bake some extra time into shipments to get the best rates.

Watch: Carrier Update

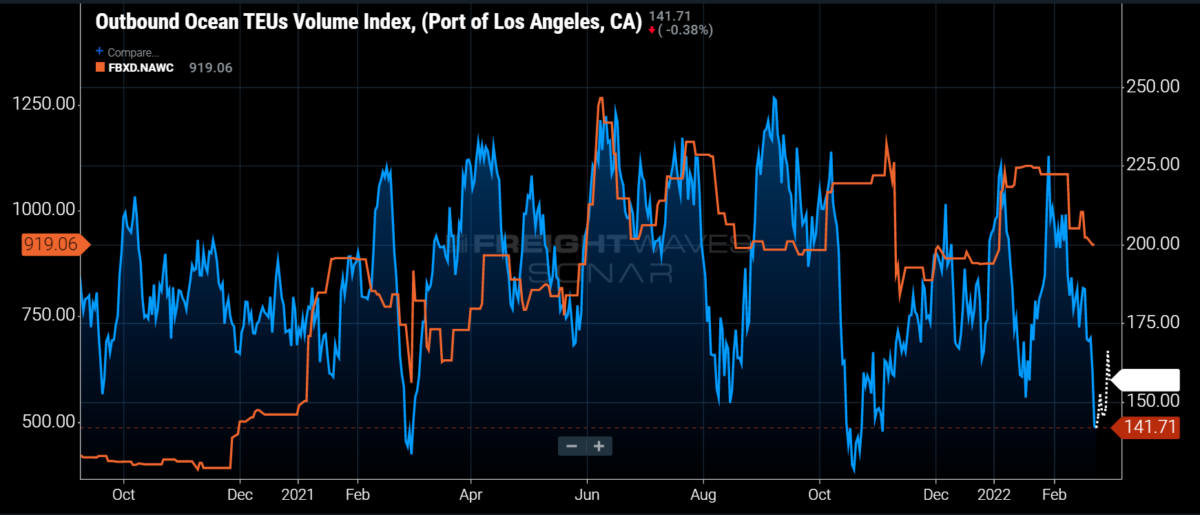

Ocean lane to watch: Los Angeles to East Asian ports

Overview: Volumes to major East Asian ports are on the rise, but capacity is still relatively loose.

Highlights:

- Outbound twenty-foot equivalent unit (TEU) volumes from Los Angeles to ports in Thailand and Japan are at their highest levels since the index was launched on Jan. 1, 2019.

- Ocean carriers are currently declining just over 5% of TEU volumes out of Los Angeles to East Asian ports, signaling that capacity is still relatively loose at the moment.

- Shippers are currently booking about 18 days (on average) in advance of their vessel departures, down from 25 days in advance last month.

What does this mean for you?

Brokers: Export container volumes are starting to gain momentum from Los Angeles to East Asian ports. These are expected to continue to rise in the weeks and months ahead, so it is very likely that this will put significant upward pressure on spot rates. Ocean carriers are currently declining just over 5% of TEU volumes, so securing space should not be a problem at the moment as long as you are able to book 18 days (or more) in advance.

Carriers: Pricing power on these lanes has shifted back towards shippers and brokers over the last couple of weeks, but with volumes expected to rise, it will likely not be very long before you are justified in increasing your spot rates.

Shippers: After experiencing significant delays for containerized exports out of Los Angeles to major East Asian ports over the past 18 to 24 months, you are likely to begin to see carriers more willing to move this cargo in a timely manner. TEU volumes from China to Los Angeles are poised for significant declines in the weeks ahead, so if you are able to submit your bookings 18 or more days in adv