The highlights from Friday’s SONAR reports are below. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

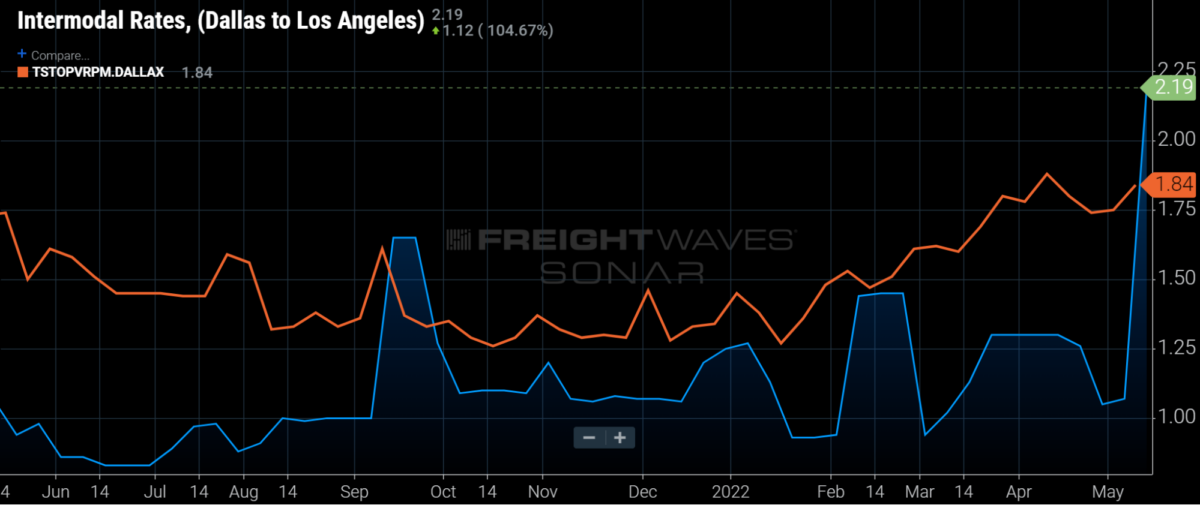

Lane to watch: LA to Dallas

Overview: The Class I railroads evidently want domestic containers back in LA quickly; they have raised intermodal spot rates above dry van spot rates.

Highlights:

- The intermodal spot rate to move 53-foot containers door to door increased 104.5% in the past week – from $1.05 a mile to $2.19 a mile, including fuel.

- The current dry van spot rate in the lane is $1.87 a mile, including fuel.

- The dry van tender rejection rate in the lane is 3.7% currently, down from 6% one month ago.

What does this mean for you?

Brokers: Unlike most lanes where spot rates have continued to fall, spot rates in the lane are currently higher than they were in the first quarter. That is likely a result of the sharply softening freight markets on the West Coast and carriers’ growing reluctance to head there. Therefore, contrary to usual circumstances, you may want to prioritize covering loads in this lane.

Carriers: While carriers heading to Los Angeles will encounter a freight market that is looser than the last time they were there, it should still be easy to get reloaded given the LA Van Headhaul Index of 148. This is within LA’s normal range and indicates that the market, as usual, has far more outbound than inbound freight.

Shippers: In the past week, the Class I railroads changed from pricing spot loads very competitively with dry vans in this backhaul intermodal lane to no longer encouraging spot shippers to use domestic intermodal. Therefore, spot shippers will use the highway. The data suggests the Class I railroads want to get domestic containers back to the West Coast quickly to move more transloaded imported goods rather than having the containers take time to reload with backhaul freight.

Watch: #WithSONAR

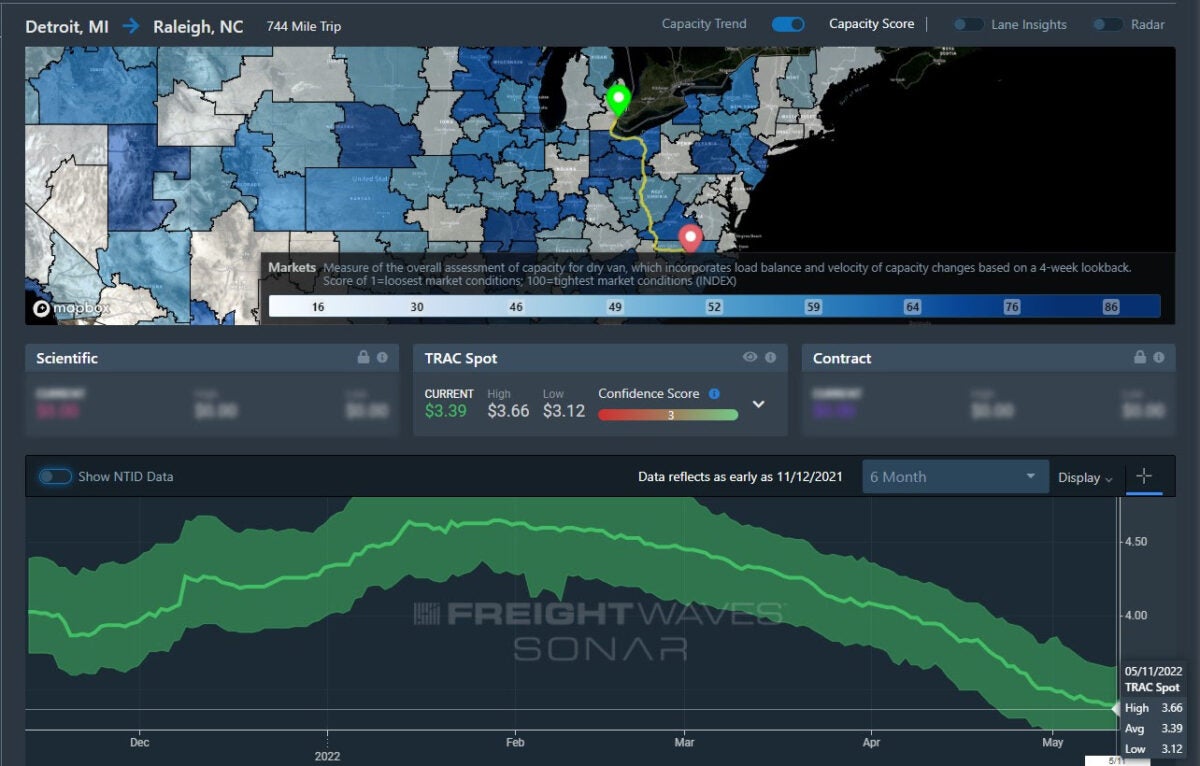

Lane to watch: Detroit to Raleigh, North Carolina

Overview: Spot rates continue downward despite volatile outbound tender rejection levels.

Highlights:

- Spot rates continued downward but moderated slightly in May, falling from an average rate of $3.94 per mile to $3.39 per mile in the past 30 days.

- Outbound tender rejection levels from the Detroit market continue to decline but remain volatile, alternating from a range between 13.5% and 8% during the past month. Current outbound rejection rates from Detroit stand at 9.14%.

- The Detroit to Raleigh outbound tender rejection levels have surged in the past three days, increasing from 7.5% on Sunday to 11.6%.

What does this mean for you?

Brokers: Volatility in tender rejection rates and declines in spot rates present opportunities for increased margins. Focus on driving rates downward on both contracted and spot lanes, as more carriers in the market continue to drive down rates due to competition. Focus on service levels if committed rates are above market average to try to hedge the potential for shippers to ask for a rate decrease now that spot rates are falling below contract rates for many lanes.

Carriers: The Detroit to Raleigh lane often routes through West Virginia, which can pose difficult terrain if the loads are near maximum weight. Focus on a customer mix of multiple lanes, as customers that ship lighter loads could help reduce wear and tear on equipment now that spot rates are falling, causing reduced margin and potentially requiring additional out-of-route miles if attempting to avoid the routing through West Virginia. If committed lanes, continue to keep an eye on load tender volumes, as some customers may attempt to ship contracted lanes on the spot market or with brokers or other carriers for greater cost savings.

Shippers: Declining spot rates and rejection rates are putting shippers in a favorable position to push down rates. Now that additional capacity is available relative to declining volumes, the extra competition should drive down costs and increase service levels. Continue to expand your routing guide now that the market appears to be loosening, as carriers will be looking for more load opportunities due to declining spot volumes.

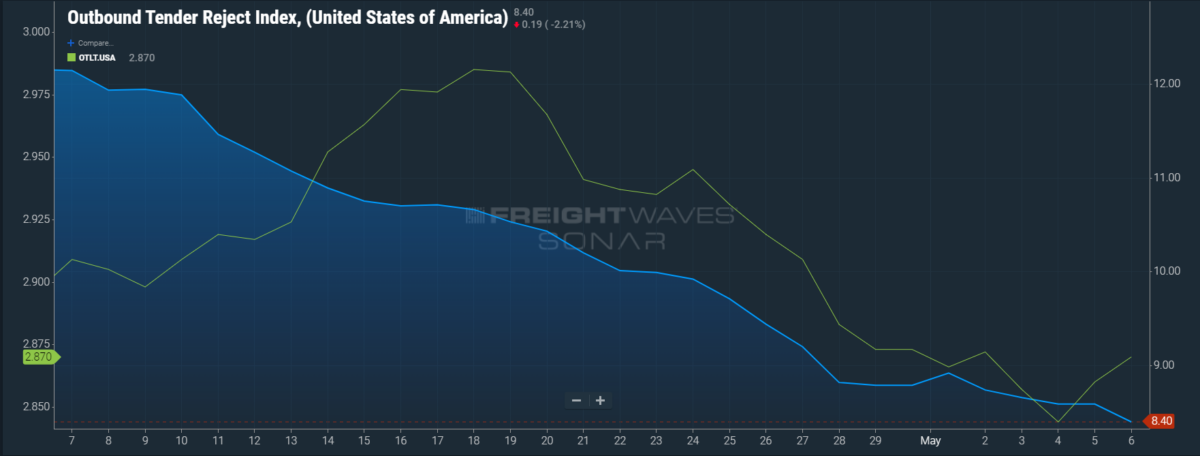

The national average for outbound tender rejections has continued its downward trend again this week and likely will do so during the upcoming week as well. As the looming freight recession begins to settle in, outbound tender rejections will still be low and carriers will be looking for good freight more than ever. That said, a large number of carriers are hanging up their keys due to rising operational and fuel costs. As outbound tender rejections continue to decline, outbound tender lead time will keep increasing. To continue to have high-quality carriers haul freight, it’s imperative to keep tender lead times out as much as possible to ensure nothing slips through the cracks.