For an alleged cartel accused by President Biden of ripping off Americans, the container shipping oligopoly is sure doing a lousy job of managing its future capacity.

The price of newbuild container ships keep rising, yet liner operators and ship-owning companies keep placing more orders at Asian yards, guaranteeing an ever-larger deluge of new vessels in 2023-25.

Capacity on order has now reached 27.9% of on-the-water capacity, according to Alphaliner. The ratio was a mere 8.2% at the cycle low in October 2020.

Total capacity on order now tops 7 million twenty-foot equivalent units. The next two years will see major capacity infusions, according to Clarksons Platou Securities: 2.45 million TEUs in 2023 and 2.74 million TEUs — 9.8% and 10.9%, respectively, of on-the-water tonnage.

As orders mount, tonnage for 2025 delivery is rising too. It’s now up to 1.13 million TEUs. That’s almost quadruple what was due for delivery in 2025 at the beginning of this year.

“Last week, 13 more container ships were ordered, bringing the total for the year to 239,” Stifel shipping analyst Ben Nolan wrote in a new research note. “This is already the fifth largest year on record for container-ship orders and we are only halfway through the year.”

‘You know it’s coming, but you can’t look away’

“Orders still keep flowing in as carriers reinvest their profits in modern fuel-efficient tonnage,” Alphaliner shipping analyst Stefan Verberckmoes told American Shipper. “The size of the orderbook is obviously a reason for concern.”

Nolan said of the coming newbuild wave: “It’s like watching an episode of ‘The Office’ for the 20th time and still cringing as Michael Scott makes some embarrassing and ridiculous comment. You know it’s coming, but you can’t look away.”

According to Alan Murphy, CEO of Sea-Intelligence, “The fact that it takes two or more likely three years to build supply is something that’s always been a problem in this industry. [As a result] we’ve always had booms and busts. It’s not uncommon for carriers to overshoot the market. That’s part of the model. You overshoot a bit and it balances out over time. And it does feel like we’ve overshot.”

Murphy told American Shipper: “I have continually said that with the pandemic upswing in freight rates and all the money pouring in that the carriers would have certainly learned their lesson [on overordering]. I’ve said that a lot.

“I think at some point it’s conceivable I might have to eat my words.”

World’s largest ocean carrier is ordering the most ships

Critics of ocean carriers claim the freight market is no longer competitive enough. But in the newbuild market, carriers are aggressively competing with each other for newer, larger, more efficient fleets.

MSC and Maersk cooperate on service capacity via the 2M Alliance. MSC unseated Maersk as the world’s largest ocean carrier in January. As a result of its newbuild orderbook — which continues to grow — MSC is now running away with the crown.

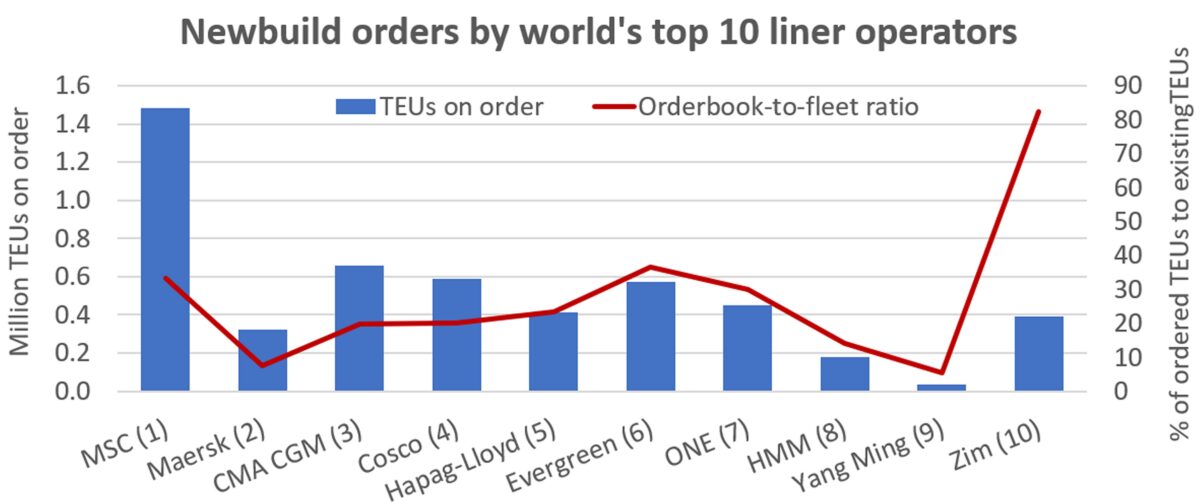

It has by far the largest orderbook, at 1,482,178 TEUs, according to Alphaliner (including chartered ships ordered by intermediaries). MSC’s orderbook capacity is now 33.4% of its on-the-water fleet. Evergreen has an orderbook-to-fleet ratio of 36.7%, with ONE at 30% and Zim (NYSE: ZIM) at 82.3%.

“The orderbook has grown bigger than the combined capacity of the existing fleets of the world’s fourth, fifth and sixth largest carriers: Cosco Shipping, Hapag-Lloyd and Evergreen,” said Verberckmoes.

New container ships by size category

The popularity of different size categories has changed since container shipping’s latest building spree began in Q4 2020. “The order boom was initially focused on the two extremes of the vessel market: 24,000-TEU ‘Megamax’ ships for Far East-Europe trading and small regional vessels [mostly deployed in intra-Asia trades],” explained Verberckmoes.

“Two other ship types have become increasingly popular since: the 13,000-TEU to 15,000-TEU ‘Neopanamaxes’ that can be deployed on all major trades, and compact 7,000-TEU-plus ships that are expected to become the successors of a generation of older classic ‘Panamax’ ships.”

These mid-sized 7,000- to 15,000-TEU newbuilds are the type of vessel that carriers deploy in the Asia-U.S. trades. Such orders could offer relief for U.S. importers and exporters.

As for when potential relief could come, Murphy believes it would be more toward the end of next year than the beginning. “Most of the new vessels don’t come onstream until the second half of 2023. That’s when we would start to see a material impact on the supply-demand balance.”

In search of ‘golden solution’ on capacity

One theory on why there have been so many container-vessel newbuild contracts: Shipping habitually overorders. This time is no different. There may be fewer competitors due to consolidation, but liners are now historically flush with cash, they’ll individually spend too much of their windfalls on new ships, and collectively make the same mistake.

“One of the head-scratchers behind the continued ordering of container ships is the fact that prices are high and continue to move higher,” said Nolan. “Current newbuild prices are 18% higher than normal levels and up 5% since the first of the year. Not only do companies continue to order vessels into what is likely to be a period of persistent oversupply, but they are taking increased residual [resale] value risk in doing so.”

A different take on the high orderbook is that carriers have a greater ability to offset supply pressures. “There are reasons to believe it won’t be as dire as it looks,” said Murphy.

Carrier alliances proved in Q2 2020, during the height of pandemic lockdowns, that they could successfully “blank” (cancel) enough sailings to match vessel supply with demand and prevent freight rates from collapsing. They could do so again in 2023-25 to offset newbuild deliveries.

“There has been a fundamental shift in decision-making within the shipping lines,” explained Murphy. “There is now the ability to cut capacity with very short notice [through blank sailings]. What used to take two to three months can be done in a week.”

The ideal scenario, he believes, is for carriers to have excess capacity available for market spikes yet be able to throttle down capacity during market lows, with profits from spikes justifying the costs of excess capacity.

“If a shipping line had excess capacity in 2021, imagine how much more money it could have made,” said Murphy. “The golden solution is to have sufficient slack capacity to be able to reap the benefits of the market [highs]. We’re not saying there’s going to be another pandemic, but there could be something like that, plus there’s the fundamental problem of seasonality. [If you had excess capacity] rates would be lower but overall profits would be higher simply because you’d move more boxes [during market highs].

“So, do you tailor the capacity to meet the peak or the bottom of the trough? Neither is optimal. But the carriers need to thread the needle. They need to have capacity that’s perfect for the peak but can be justifiably removed in the trough.”

Charter expirations, scrapping, slow steaming

Beyond blank sailings, carriers can reduce fallout from the coming newbuild wave by letting charters expire and increasing the share of their fleets that they own versus lease. “There’s clearly an increased focus on owning [assets] right now,” said Murphy.

In the case of ships on order that will be owned by the liners themselves, future owned tonnage can supplant currently chartered tonnage.

In the case of ships on order that will be owned by intermediaries and leased to liners, new and more fuel-efficient chartered tonnage can replace older chartered tonnage. “There have been a lot of technical improvements,” noted Murphy. “The newer vessels are much more efficient to run.”

Newbuilds (whether owned or chartered) also allow carriers to replace older tonnage with assets that can use new fuels to comply with future environmental regulations. According to Nolan, “One of the culprits is undoubtedly people ordering to have more efficient ships that operate on LNG or methanol or whatever is the latest flavor of the month with respect to fuel types.”

Shipping lines can also offset future newbuild fallout by scrapping older tonnage. “That’s certainly one of the ways carriers are intending to balance this inflow of supply,” said Murphy.

Yet another possible counterbalance to newbuilds: Environmental rules could effectively require ships to “slow steam” (sail slower) to reduce emissions. The slower the ship speed, the more ships needed to provide the same service.

“It is believed [by carriers] that within the next 10 years, some politician — and maybe it’s not the IMO [International Maritime Organization], it could be the EU — will enforce a mandatory speed limit,” said Murphy.

Click for more articles by Greg Miller

Related articles:

- Biden to ocean carriers: ‘The rip-off is over’

- Asia-US container shipping rates are flashing two bearish signals

- Retail slump? E-commerce sales still ‘stunning,’ clothing ‘crazy hot’

- Los Angeles port: Peak season coming soon, strong imports ahead

- Boom times not over yet: US container ports still near highs

- Container shipping jackpot continues: CMA CGM profits soar