Container shipping stocks are down double digits since March, yet ocean carriers are still posting record or near-record results. Several Asian liner companies have just released preliminary revenues and profits for Q2 2022 as well as monthly operating data through June.

Despite pessimistic sentiment on stocks, the numbers are still huge.

Cosco

China’s Cosco, the world’s fourth-largest liner group, said Wednesday that it expects net profit for the first half of 2022 of 64.7 billion yuan ($9.7 billion), up 74% year on year (y/y).

Second-quarter profits totaled 37.1 billion yuan, making it the most profitable quarter in the company’s history. Cosco’s second-highest quarterly profit was 30.5 billion yuan in Q3 2021. It earned as much in the latest quarter as it did in the entire first half of last year.

OOCL

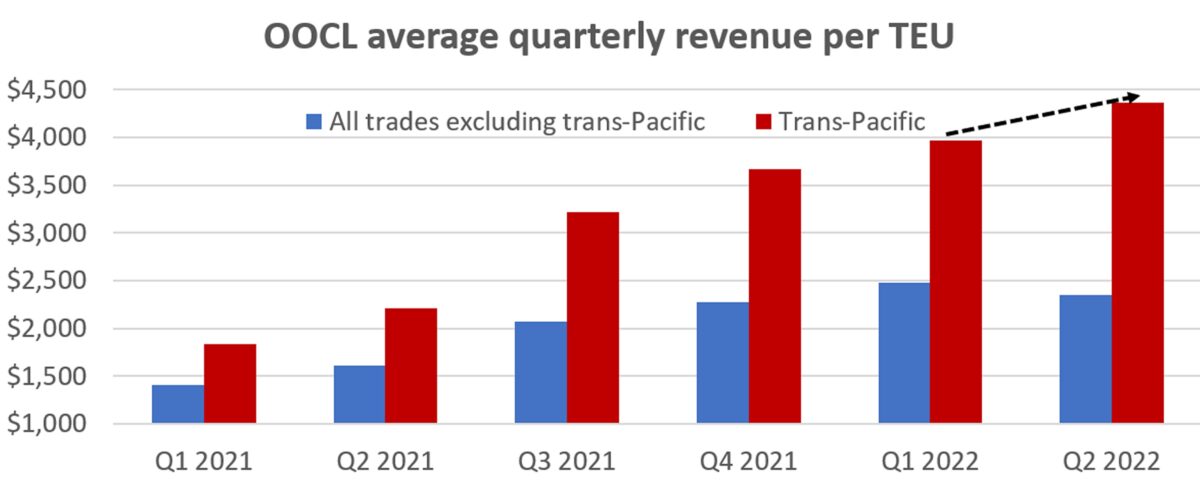

Cosco subsidiary OOCL posted preliminary operating results on Wednesday. OOCL’s disclosures provided more insight on how carrier revenues have kept climbing despite falling spot rates and lower volumes due to both congestion and, more recently, weaker import demand.

Revenues continued to rise over the past year because the average revenue per twenty-foot equivalent unit increased even as TEU volumes faltered. In recent months, higher average revenue per TEU has been driven by higher contract rates, particularly for U.S. importers, with those contract rates more than offsetting lower spot rates.

Hong Kong-headquartered OOCL reported total revenues of $5.3 billion for Q2 2022, up 52% y/y despite a 5.6% drop in throughput that OOCL attributed to “severe congestion.” The latest quarter’s revenues represent a new all-time high.

OOCL’s average worldwide revenue per TEU jumped 61.5% y/y to $2,874 in Q2 2022. The trans-Pacific market was by far the biggest driver. Revenue per TEU in the trans-Pacific spiked 97.6% y/y to $4,365. OOCL’s cargo in other trades (Asia-Europe, trans-Atlantic, intra-Asia) averaged only $2,355 in revenue per TEU, 46% below the trans-Pacific average.

Highlighting the diverging trends in trans-Pacific spot rates and contract rates, OOCL’s average revenue per TEU in the trans-Pacific (including both spot and contract business) increased 10% in the second quarter versus the first quarter of this year, despite indexes showing a clear decline in spot rates on this lane in April-June versus January-March.

Evergreen, Yang Ming

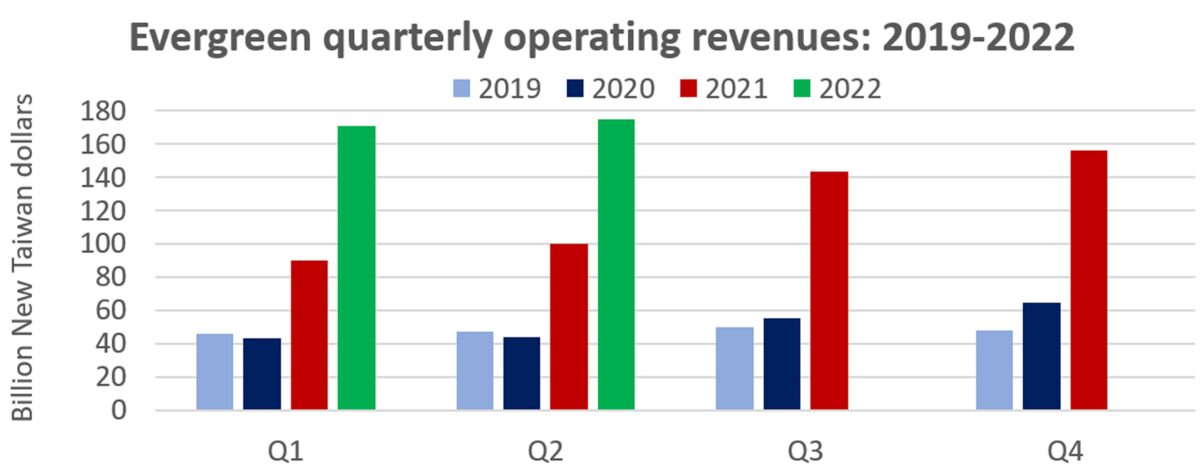

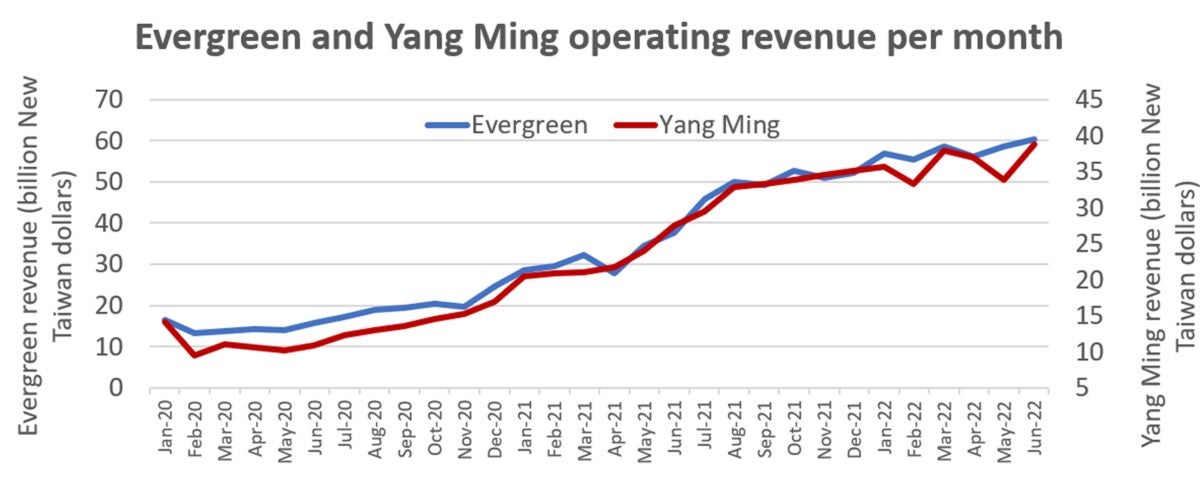

The same pattern — higher revenues despite lower spot rates — shows through in monthly operating data from Taiwan’s Evergreen and Yang Ming.

Yang Ming, the world’s ninth-largest ocean carrier, posted its June revenues on Friday.

For Q2 2022 overall, revenues hit a new high of 109 billion New Taiwan dollars ($3.7 billion). Inflows accelerated through the period, with June boasting the company’s highest monthly revenues ever: 38.7 billion New Taiwan dollars ($1.3 billion).

Evergreen, the world’s sixth largest carrier, also just posted its June operating revenues; Q2 2022 came in at a new all-time high of 175 billion New Taiwan dollars ($5.9 billion).

As with Yang Ming, the pace accelerated through the quarter. June saw the highest monthly revenue in Evergreen’s history: $60.2 New Taiwan dollars ($2 billion).

Maersk, Hapag-Lloyd

European carriers will report Q2 2022 results in early August. Deutsche Bank analyst Andy Chu expects fresh records when Maersk (the world’s second-largest liner operator) and Hapag-Lloyd (No. 5) report.

The analyst forecasts that Maersk’s earnings before interest, taxes, depreciation and amortization will come in at $10.4 billion in Q2 2022, surpassing the previous record of $9.1 billion in the first quarter. Chu forecasts Hapag-Lloyd’s Q2 2022 EBITDA at $4.9 billion, just above first-quarter levels.

“We expect a strong Q2 reporting season. In most cases … we think FY 2022 will be a record year,” said Chu. The caveat for container-shipping stocks: “We think company outlooks for 2022 are largely irrelevant, as share prices are being driven by the macroeconomic outlook — interest rates and energy prices — and not the stock specifics.”

Click for more articles by Greg Miller

Related articles:

- California ports piling up again: Too many containers sitting too long

- Asia-US container shipping rates are flashing two bearish signals

- Retail slump? E-commerce sales still ‘stunning,’ clothing ‘crazy hot’

- Los Angeles port: Peak season coming soon, strong imports ahead

- Boom times not over yet: US container ports still near highs