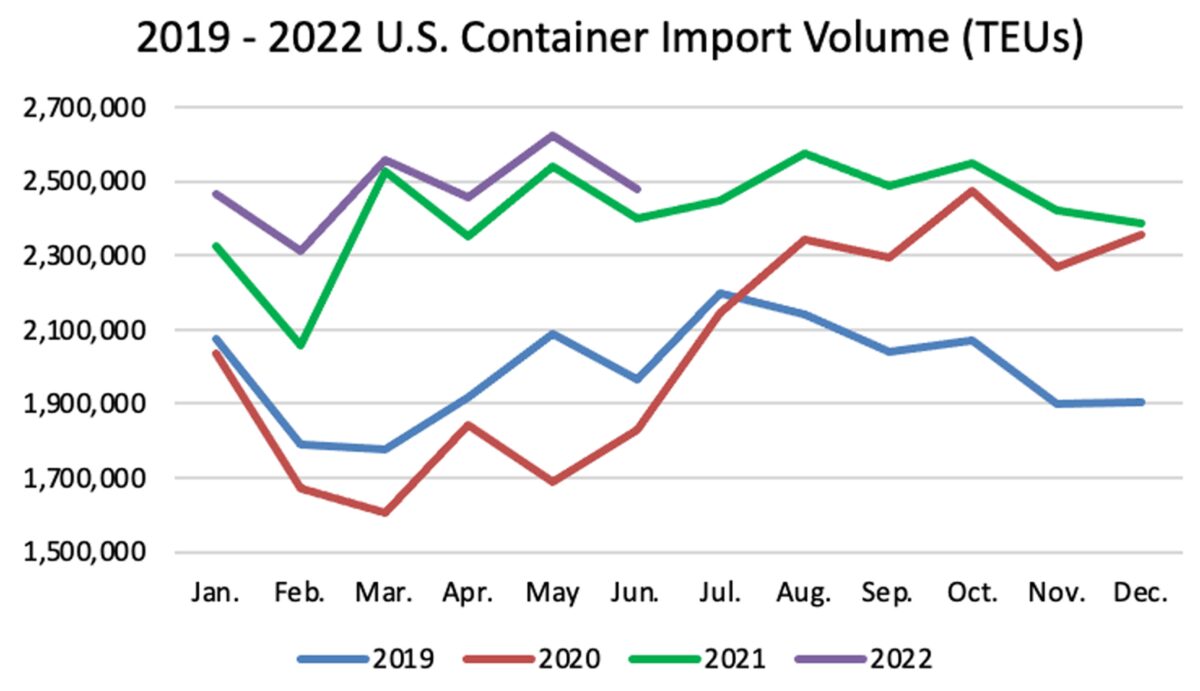

Recession fears abound, yet America’s ports keep racking up historically high numbers. Last month was the country’s best June ever for containerized imports. This month looks like it will be the best or second-best July.

According to The McCown Report, imports to the top 10 U.S. ports rose 5.9% year on year (y/y) to 2.16 million twenty-foot equivalent units in June, exceeding the 3% y/y gain in May and 5.1% gain in April.

Volumes continued to shift eastward. Imports to the top East/Gulf Coast ports rose 9.7% y/y in June, driven by double-digit surges in New York/New Jersey, Houston and Savannah, Georgia. Imports to West Coast ports rose 2.3%.

Compared to June 2019, pre-COVID, import volumes to the top 10 U.S. ports were up 26.9% last month, said McCown. East/Gulf Coast ports were up 40.3%, West Coast ports 15.8%.

According to Descartes, which just released its own report on U.S. containerized imports, “Every month in 2022 has been a record month when compared to the previous years.”

Descartes reported that there were 2.48 million TEUs imported to all American ports in June, up 3% y/y and up 26% from June 2019, pre-pandemic.

Offshore queues are still rising

More than halfway through July, there’s still no sign of a material dropoff in traffic at America’s import gateways.

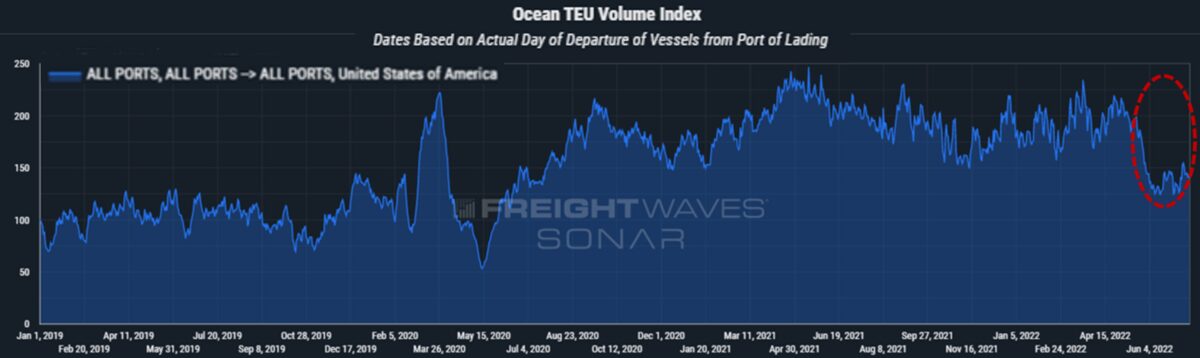

FreightWaves SONAR tracks U.S. Customs data on imports measured in TEUs (seven-day moving average). Import TEU data continues to align closely with 2021 numbers.

Meanwhile, the number of ships at anchor off U.S. container ports is still increasing. This is creating a growing “inventory” of import terminal demand.

As of Tuesday morning, there were 140 container vessels waiting offshore of North American ports, according to ship-position data from MarineTraffic and the latest queuing lists (in the case of Los Angeles/Long Beach and Oakland, California, where there are special queuing systems).

Of container ships offshore Tuesday morning, 37% were waiting off West Coast ports and 63% were off the East and Gulf Coast ports, with large queues off Savannah, New York/New Jersey and Houston.

The overall queue has now risen by 12% from 125 ships on July 8 and by 52% from 92 ships on June 10. Waiting ships hit a high of around 150 in January-February.

According to McCown, “The port congestion situation has morphed from primarily impacting the West Coast to … all coastal ranges. At ports with a backlog of container ships waiting for berths, there is no demand constraint affecting volumes and throughput will be driven by the ability to get containers out of the terminal.”

That ability is now being hindered on multiple fronts: by yard-utilization numbers in the high double digits at numerous terminals; by slowdowns in on-dock rail service out of Los Angeles/Long Beach, and most recently, by protests at the gates in Oakland by truckers opposed to California’s independent contractor law, AB5.

‘More moderate’ peak season ahead

The ongoing import barrage at U.S. ports coincides with mounting evidence of a slowdown in U.S. demand for exports out of Asia.

FreightWaves SONAR’s index of bookings bound for the U.S., based on the day of scheduled departure, fell sharply through May and stayed down through June and July. As of Tuesday, it was down 32% from May 1 and 33% y/y, albeit still up 30% from the same time in 2019, pre-COVID.

S&P Global Commodities reported Monday that there is “ample space” on ships departing Asia for North America. It was told by one carrier source that “everyone is predicting now that there will be a moderate peak [season].”

Flexport’s Ocean Timeliness Indicator — which gauges how long it takes for boxes to get from Asian factories to the gates at U.S. terminals — continues to ease. In particular, the time for the leg between Asian factories and departures of ships from Asia is falling sharply. The time for that leg is now down to its lowest level since June 2021.

Maritime Strategies International (MSI) said in its latest container sector outlook that “it continues to expect market balances to run out of steam through Q3 2022 with a sharp dropoff in Q4 2022.”

According to Stifel shipping analyst Ben Nolan, “Demand for container shipping remains well beyond the capacity of terminal infrastructure. The question is: As consumers move back to services from goods, can volumes remain elevated? We don’t think so.”

That said, given “so many bottlenecks throughout the supply chain,” Nolan expects “the correction [in rates] is likely to be gradual and [container shipping] companies should make grossly outsized returns along the way.”

Click for more articles by Greg Miller

Related articles:

- Container shipping spot rates still falling: What will be the new normal?

- Los Angeles port boss: Fix rail service or risk ‘nationwide logjam’

- Long Beach container backlog crosses red line as delays mount

- There’s still over $40B in cargo on container ships waiting offshore

- Asia-US container shipping rates are flashing two bearish signals

- Container shipping rates: Still sky high but falling back to Earth