Playing with Lego bricks to illustrate supply chain disruptions, how the passenger vehicle market mirrors the trucking industry, and Hyliion’s Hypertruck free rides — those and other musings from the ACT Research Seminar 67 this week in Columbus, Indiana.

Explain it to me like I’m a 4-year-old

When you see some of the full-size creations from Lego bricks, you know they are not just for children. Check the recommended ages on some of the boxes if you want evidence.

Those plastic bricks helped Paul Rosa, Penske Truck Leasing senior vice president of procurement and fleet planning, explain in layman terms the impact of supply chain disruptions.

Rosa displayed a slide with all of the parts, people and functions needed to flow goods and components needed for smooth production and distribution. Then he asked preselected audience members to open boxes of bricks and tell him what was missing.

By the time Rosa was done, the list of all the contributing factors to clogged supply chains was enormous:

- Massive quantities of offline parked units waiting for parts, also known as red-tagging.

- Managing thousands of units of offline units, with no preestablished system.

- Maintaining out-of-plant quality for thousands of offline parked units.

- Handling delivery of plant backlog of incomplete units when missing parts were finally received.

- Incredible material demand couples with limited availability, creating massive price increases.

- Auction materials — specifically semiconductors — to the highest bidders.

- Inability to ramp production when more parts become available.

- Replacement part shortages, including oils, lubricants and resins.

- Navigating all these issues daily and weekly for more than two years.

Now that is a brick house.

What does car market data tell us about trucks?

ACT Seminar 67 was a truck-focused event themed around autonomous and electric vehicles and their future impact on the industry.

So what was Patrick Manzi, chief economist of the National Automobile Dealers Association (NADA), doing on stage talking about the car business?

One interpretation: Providing some startlingly similar data to how the passenger vehicle and truck industries move in lockstep.

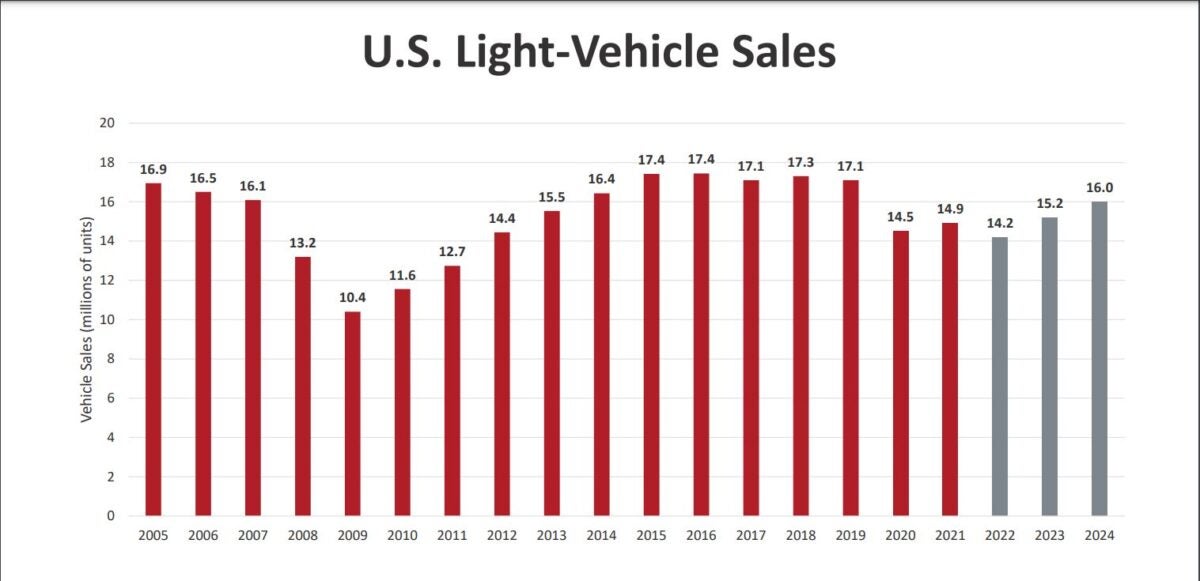

Consider that, like Class 8 trucks, production rates and sales are beginning to improve for cars and light trucks, reaching a seasonally adjusted 13.4 million in July. That was well off the industry trend of more than 16 million but a third consecutive month of improvement.

Electrification is coming a little more quickly to cars than trucks. Internal combustion engines still account for 87.8% of the market. But that is down from 91.4% a year earlier. Hybrids, battery-electric and plug-in hybrids all grew in share. Battery-electric vehicles account for 1.5 million or 0.5% share of all vehicles.

The relative scarcity of new cars because of supply disruptions (see item above) contributed to a record average transaction price for a new car of $45,646 in June. The average monthly loan payment was $704. Used car transaction price was $30,798 year to date through June. The monthly nut: $553.

Ticket to ride

Hyliion saved its big news for a day after founder and CEO Thomas Healy spoke. But its biggest win at the seminar was a piece of marketing brilliance. Hyliion offered rides in a development version of its Hypertruck ERX before and during dinner outside ACT Research’s headquarters.

Packing three riders in the sleeper cab for each short spin, Hyliion touched an audience it needs to reach if it’s going to sell enough of its natural gas-electric trucks to sustain itself. About 70 conference participants climbed on board Wednesday evening.

“It’s all about being green, but it’s not a good ROI for anybody at this stage,” said Steve Bassett, president of General Truck Sales, which operates three dealerships in Ohio and Indiana.

“It’s definitely quiet,” said Laura Perrotta, president of the American Truck Dealers, after her first exposure to an electric Class 8 truck. “It would have been cooler if they let me drive.”

Except for the expense of bringing the truck from Texas and the natural gas to power the generator, Hyliion paid nothing to ACT for providing the evening amusement.

“We still have a long way to go [until] the only vehicle being built is zero emissions to when the industry’s fleet turns over. It’s not about the technology of the EV or soon to be battery electric with hydrogen included. The technology is there with limitations, but … with the EV, it’s about the vehicle and the infrastructure. And you can’t have one without the other.”

Paul Rosa, senior vice president, procurement and fleet planning, Penske Truck Leasing

Turning off the LIGHTS

Volvo Trucks North America gathered the players from its unique Volvo LIGHTS electric truck demonstration program in Ontario, California, this week to officially close the curtain after a three-year run.

Volvo Trucks deployed the first of 30 Class 8 pilot Volvo VNR Electric trucks to fleet operators to collect real-world operating data and customer feedback. It is now selling a second generation of the VNR Electric, which can travel 275 miles on a single electric charge.

“The most valuable takeaway for our team was really experiencing the value of close cross-functional and cross-organizational collaboration as we continue to drive innovation and develop new solutions for sustainable transport,” VTNA President Peter Voorhoeve said in a news release.

VTNA and California’s South Coast Air Quality Management District led the project. Participants included NFI Industries, Dependable Highway Express, TEC Equipment, Shell Recharge Solutions (formerly Greenlots), the ports of Long Beach and Los Angeles, Southern California Edison, Calstart, the University of California, Riverside CE-CERT, Reach Out, Rio Hondo College, and San Bernardino Valley College.

Briefly noted

Navistar Inc. dealer West Michigan International opened the state’s first public electric commercial vehicle charging station at its Kalamazoo location. It is located directly off Interstate 94, one of the Midwest’s largest freight corridors.

Waymo Via is beginning testing of Freightliner Cascadia trucks in Texas that Waymo claims contain the first fully redundant autonomous Class 8 trucking platform. That means backups for steering, braking and other operations in case the autonomous truck encounters a problem.

The approximately 30 trucks used in testing and human-supervised freight hauling for J.B. Hunt Transport are upfitted by Waymo in Detroit near the Daimler Truck Detroit technology unit.

Canada’s Pride Group is ordering 200 Freightliner eCascadias and 50 eM2 medium-duty trucks. It is the second significant order for the Freightliner products following the 800 units ordered by Sysco Corp. in May.

Mack Defense has received an order from the U.S. Army for an additional 144 specially built M917A3 Heavy Dump Trucks dump trucks, tested under machine gun fire and other ordnance to assure occupants are protected.

That’s it for this week. Thanks for reading. Click here to get Truck Tech via email on Fridays.

Alan