DUBLIN, Va. — Like a parent walking a young child across the street, Volvo Trucks North America is holding its customers’ hands when it comes to Class 8 electric trucks — whether they like it or not.

VTNA is the early leader among OEMs selling electric trucks in the U.S. It holds more than 60% of the nascent market compared to about an 11% total American market share.

Over time, Volvo’s dominance likely will shrink. Especially when U.S. market leader Daimler Truck North America begins regular production of the Class 8 Freightliner eCascadia. Paccar brands Kenworth and Peterbilt are also in the game along with Volvo sibling Mack Trucks.

Maybe it won’t, though. Volvo has a circular strategy. Instead of just selling a battery-powered truck, it presents itself as the solution to customer anxiety about going electric by removing the biggest challenges.

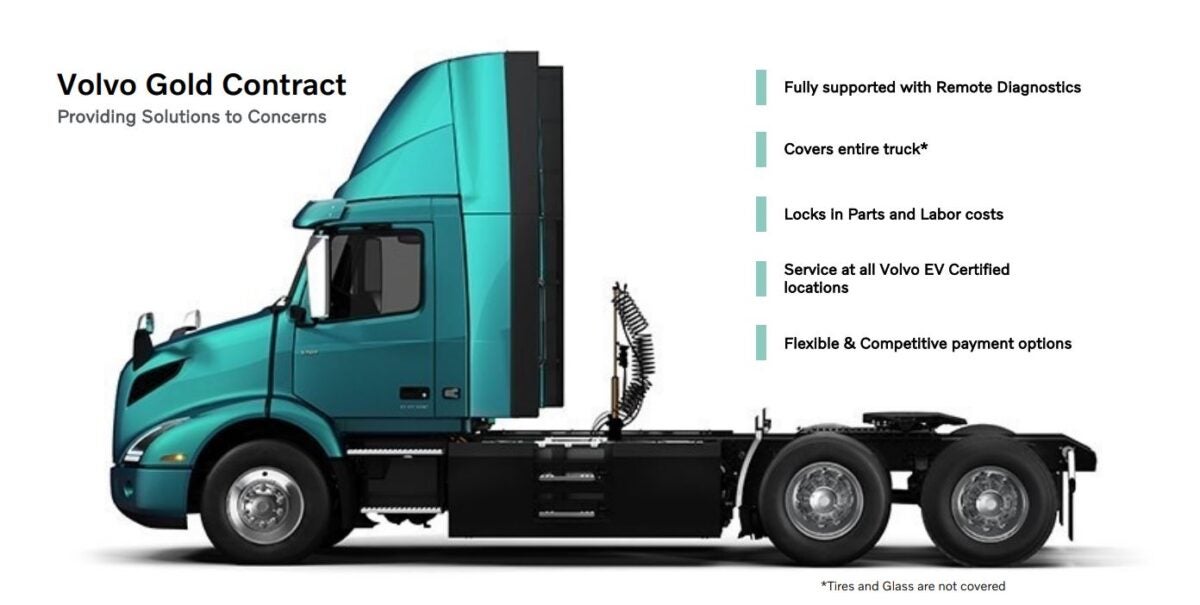

The security comes in the form of the Gold Contract, required for any customer of a VNR Electric daycab.

“We just want to cover all bases and make sure everything is provided to the customer,” said Sam Ellis, VTNA product manager, services and solutions.

‘Soup-to-nuts agreement’ for electric trucks

The Gold Contract is a soup-to-nuts agreement that covers the first six years of basic and preventive maintenance with genuine Volvo parts and charging infrastructure at certified dealerships. So far, Volvo has certified 18 dealers to handle electric trucks. Another 55 are in process at a cost of $150,000 to $300,000 a dealership.

VTNA’s first certified dealership, TEC Equipment in Fontana, California, helped the Maersk-owned Performance Team put into service 30 of 126 Volvo VNR Electric trucks it ordered in March.

TEC identified which of five VNR Electric configurations best suited its daily freight routes. It used Volvo Trucks’ Electric Performance Generator tool to simulate real-world routes best-suited to electric trucks based on speed, payload, terrain and ambient temperature. The EPG also checks to see whether public charging is available for a top-off charge.

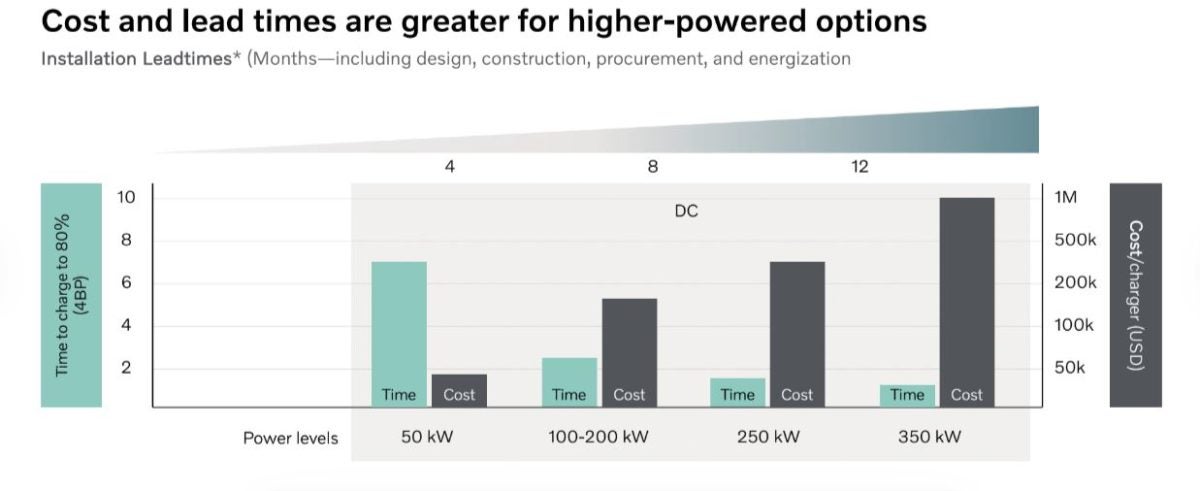

Volvo sells and leases charging stations. Partnering with third parties on hardware and software helps determine the site work needed to accommodate chargers from 50 kilowatts to 250 kW. Bigger chargers can bring a truck to 80% state of charge in two to seven hours.

Like other OEMs, VTNA helps find and apply for grants to pay for the electric trucks that can cost three times as much as a diesel-powered model.

It helped secure $3.9 million in grants for California customer QCD to offset the cost of 14 VNR Electric trucks, eight 80 kW direct current chargers and two portable chargers. Counting the incentives, the lease financing ended up on par with diesel trucks.

‘New technology is always a challenge’

“Adapting to new technology is always a challenge,” Ellis said. “We’re trying to make it as easy as possible with peace of mind. A lot of fleets know what it costs to operate a truck per mile. This is new. They don’t know what components are going to wear out faster and things of that nature. So there’s a fear there.”

In late September, Volvo took dealers, customers and media through its approach at the New River Valley manufacturing complex nestled between the Blue Ridge and Shenandoah mountains.

“We are here to educate. We are here to help,” VTNA President Peter Voorhoeve said in opening remarks at the daylong event.

A few customers signed up for the Class 8 Volvo Electric VNR and the Gold Package when the presentation concluded and they drove the truck on a couple of loops around a closed course.

Mangus Koeck, VTNA vice president of strategy, marketing and brand identity, declined to give a number of deals signed, “but we were very pleased.”

The heat is on for transitioning to electric trucks

Fleets face pressure from tighter state and federal regulations on greenhouse gas emissions and customers demanding zero-emission transport to meet their own sustainability goals. Diesel is still decades from being obsolete, but it faces increasing threats to its future. Fleet owners listen, even if they bristle at being told what to do.

“The customer decision may not be totally driven by ROI [return on investment],” said Jared Ruiz, VTNA acting lead of electromobility. “If I can’t satisfy the [sustainability] goals of my customer, then I’ve got a bigger issue.”

Signing on to purchase or lease a truck that covers maintenance, repairs, towing battery state of health and remote diagnostics could make sense. Going electric is much more than replacing a diesel-powered truck with a battery-powered one.

“They have to change the people involved,” Ruiz said. “Now we have this electrification project. It affects our site, affects our dispatch, affects our operations. There’s a lot more departments involved with the customer and externally.”

For its part, Volvo aims to cut its carbon dioxide emissions 50% by 2030 and 100% by 2040. Sweden-based parent Volvo Group has a more aggressive goal of 35% CO2 reduction by 2030.

Integration: Helpful or disrespectful of customers?

Volvo isn’t alone in putting a bow on managing electric fleets. The as-a-service approach — whether it’s called mobility, vehicle, charging or truck — integrates the OEM or startup deeply into a fleet’s business.

When it begins making hydrogen-powered fuel cell trucks in 2023, electric truck and hydrogen fuel developer Nikola plans to offer a single contract covering the cost of the truck, maintenance and fuel on a seven-year, 1 million-mile contract. Startup Watt EV wants to sell the truck and infrastructure access.

Daimler Truck offers consultative services, Detroit-made chargers and help securing grants that reduce up-front costs of electric truck purchases. But CEO Martin Daum wants nothing to do with ordering its customers to buy the services.

“Trucking as a service for me [is] one of those blah, blah words,” Daum said. “That is disrespect to the business of our customer. I have far too much respect [to think] that just because I build a truck, I can run a trucking company.”

Alexis Clemons, VTNA electromobility sales manager for national accounts, said customers are more accepting of the Gold Contract than she anticipated.

“The questions I get are, ‘Do you see a day when it might be possible that we could take that on and do some of the activities that we are traditionally doing?’”

Clemons responded with a definite maybe.

“I absolutely see that as long as safety is the No. 1 consideration,” she said.

Related articles:

Maersk orders 110 electric Class 8 trucks from Volvo

Startup WattEV reviving the Pony Express with electric trucks

Electric trucks: Sysco signs for record 800 Freightliner eCascadias