Both freight shipments and costs stepped higher year over year (y/y) in September, according to Cass Information Systems. However, the comps become more formidable moving forward as the freight economy distances from record levels.

Shipments increased 4.8% y/y in September but were 2.9% lower than August levels. The shipments component of the Cass Freight Index reached a more than four-year high in August.

“U.S. freight volumes continued to exceed low expectations in September with more buoyant demand than feared in the start of peak shipping season,” ACT Research’s Tim Denoyer commented in the report.

| September 2022 | y/y | 2-year | m/m | m/m (SA) |

| Shipments | 4.8% | 5.4% | -2.9% | -2.9% |

| Expenditures | 21.2% | 60.2% | 0.3% | -1.9% |

| TL Linehaul Index | 3.9% | 17.1% | -2.2% | NM |

However, Denoyer cautioned against the likelihood of continuation in the trend — up y/y in the last three months — pointing to an easy prior-year comp during the month. He also believes retailers discounting excess inventories, preholiday inventory build and improved fluidity in the automotive supply chain were supportive of volumes.

If normal seasonal trends hold for the rest of the year, the report said shipments will be up y/y between 2% and 3% in October and down slightly for the fourth quarter. “Tougher comps in November and December also suggest the recent increases are temporary.”

Denoyer continued, “It sure doesn’t feel like freight volumes were up nearly 5% y/y in September, does it? Our analysis suggests this will not repeat for quite some time, and it took the right combination of easy comps and temporary factors to make happen.”

Supply chain data provided earlier this month showed a notable slowdown in the back half of September compared to the first 15 days of the month. Sentiment around transportation capacity indicated incremental loosening with a material step down in pricing. Weakening freight fundamentals and growing concerns of a muted peak shipping season had analysts reeling in earnings estimates ahead of third-quarter reports.

The expenditures subindex was 21.2% higher y/y during September, which was a slight acceleration from August’s y/y growth rate (up 20.4%). On a sequential comparison the index was 0.3% higher in the month.

The expenditures data set looks at the total amount of money spent moving freight, including fuel expense. Average weekly retail diesel fuel prices were more than 45% higher y/y in September but close to flat when compared to August. When backing out the decline in shipments, rates were 3.3% higher sequentially. Seasonality and a mix shift toward higher-cost modes were cited as reasons for the increase.

The cost index is expected to log a full-year increase of 23% y/y, turning negative in February.

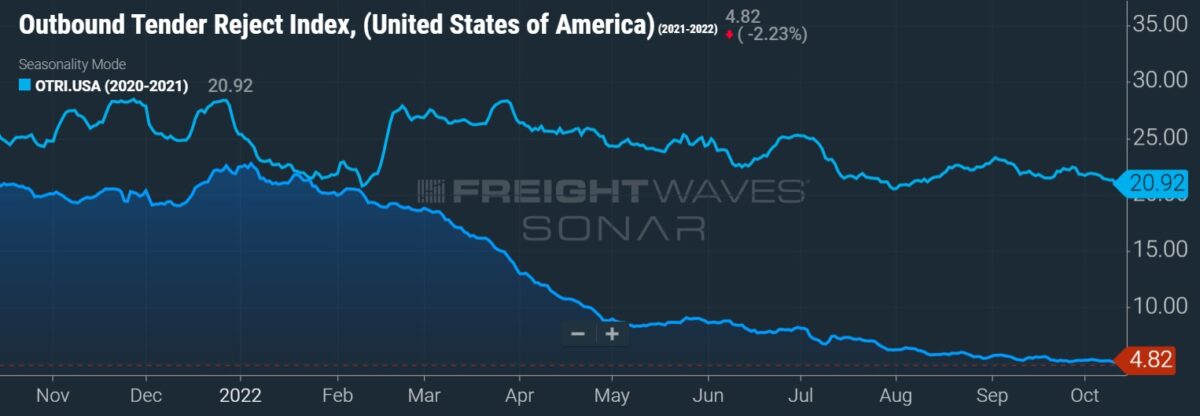

“The supply/demand balance in U.S. trucking markets has loosened significantly this year, and as a result freight rates are leveling off and set to slow sharply in the months to come,” Denoyer said. “While shippers aren’t seeing any real savings yet, considerable cost relief is now highly probable for 2023, which we think will be welcome news for the broader inflation picture.”

The Cass Truckload Linehaul index, which excludes fuel and accessorials, increased 3.9% y/y but was 2.2% lower than in August. The index value was the lowest of the year, with September marking the fourth sequential decline. The data includes both spot and contracted freight and is forecast to turn negative y/y in January.

“There is little real questioning of the consensus that the freight economy is in a soft patch that could be with us for a while,” Denoyer said. “While demand is still looking about flat this year, the supply side recovery has turned the market from tight to loose. Thus, the reason market dynamics are much different this year — it is not that there is less freight. It’s more capacity.”

More FreightWaves articles by Todd Maiden

- Transfix pulls IPO, new private funding round planned

- September weakness pushes analysts to lower estimates ahead of Q3 reports

- KAG Logistics expands 3PL platform through Connectrans deal