The highlights from Tuesday’s SONAR reports are below. For more information on SONAR — the fastest freight-forecasting platform in the industry — or to request a demo, click here. Also, be sure to check out the latest SONAR update, TRAC — the freshest spot rate data in the industry.

Market Watch for Oct. 25:

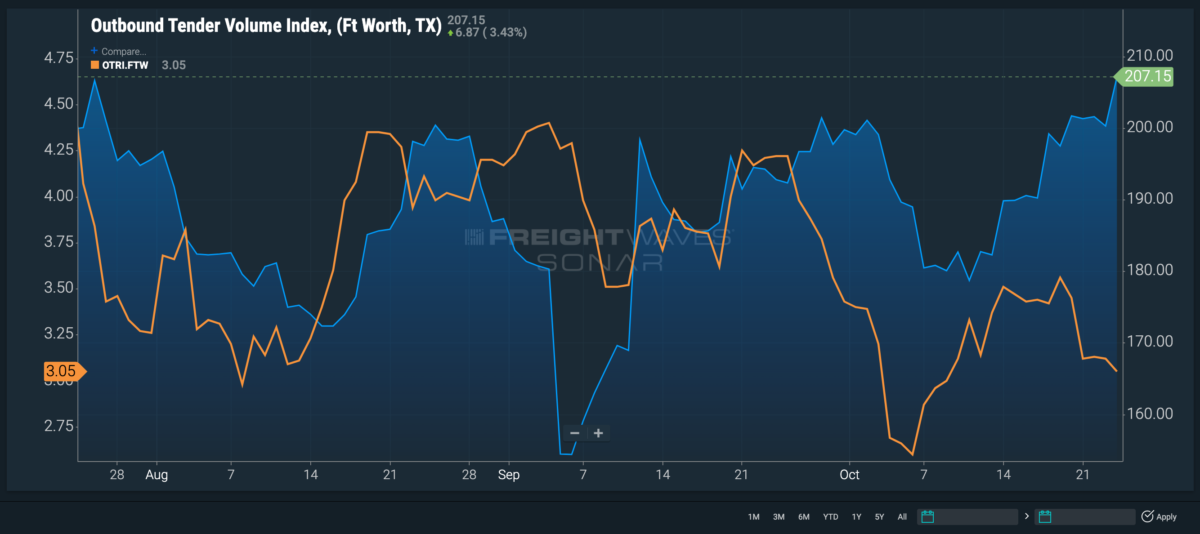

Fort Worth, Texas

Outbound demand from Fort Worth is trending up for the second week in a row.

Volumes leaving the Fort Worth market were down 11% in the first half of October, but starting on Oct. 11, the Outbound Tender Volume Index is up 28.5 points, or 16%, to a six-month high of 207.1.

Inbound freight levels, on the other hand, are trending down this month. The Inbound Tender Volume Index is down 39 points, or 15.8%, placing the disparity between inbound and outbound volumes at less than 1%. The slim variance between the two volume levels moved the Headhaul Index for Fort Worth up more than 48 points to -.81 — one of its highest values on record since 2018.

Neighboring market Dallas saw a slight uptick in outbound volumes Monday after more than two weeks of decline. The Outbound Tender Volume Index in Dallas edged up 1.5 points Monday after hitting its lowest level since February 2021. Rejection rates remain at some of their lowest levels in Dallas at 4.4%.

Rejection rates in Fort Worth are trending down in the past week. The Outbound Tender Reject Index is down 51 basis points to 3%. Even with a decline in inbound capacity, enough carriers are entering the market to handle the increase in outbound demand.

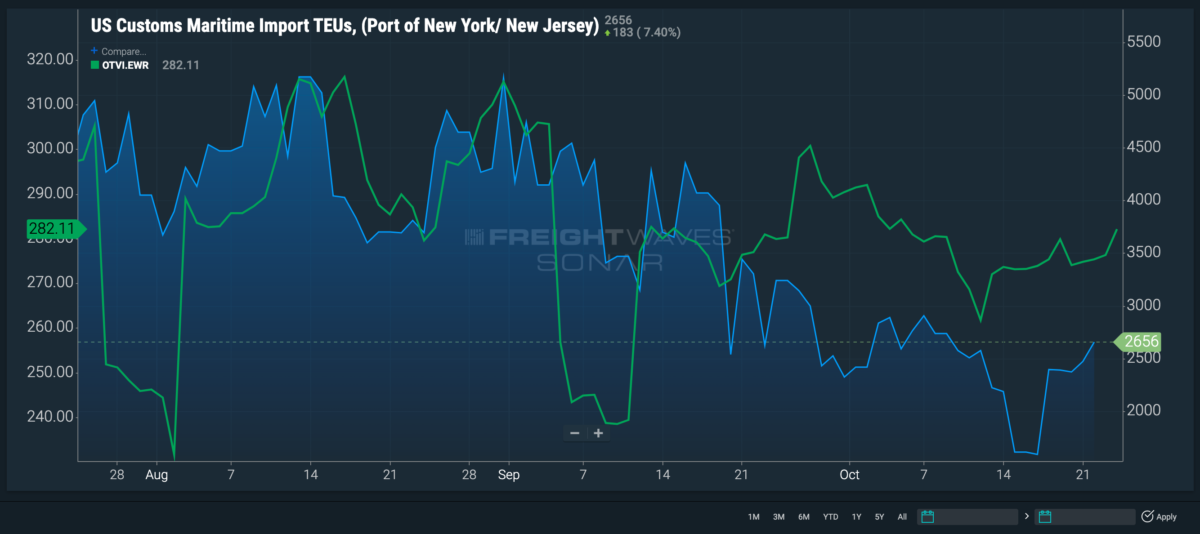

Elizabeth, New Jersey

Truckload volumes leaving Elizabeth, New Jersey, are swinging up as imports to the Port of New York and New Jersey are rising this week.

The Outbound Tender Volume Index for Elizabeth is up more than 8 points, or 3%, since last Thursday to 282.1. Rejection rates are trending up as well. The Outbound Tender Reject Index is up 113 bps since Oct. 13 to 5.5%.

Rising volumes and rejection rates coincide with an increase in imports to the Port of New York and New Jersey. The seven-day moving average of imported container volumes cleared through customs in New York and New Jersey is up 11% since Oct. 18 and still on an upward trajectory.

NTI as a point of reference

The National Truckload Index is a daily look at how spot rates in specific lanes hold up in comparison to the national average, giving carriers and brokers an idea of which lanes to gravitate toward or avoid.

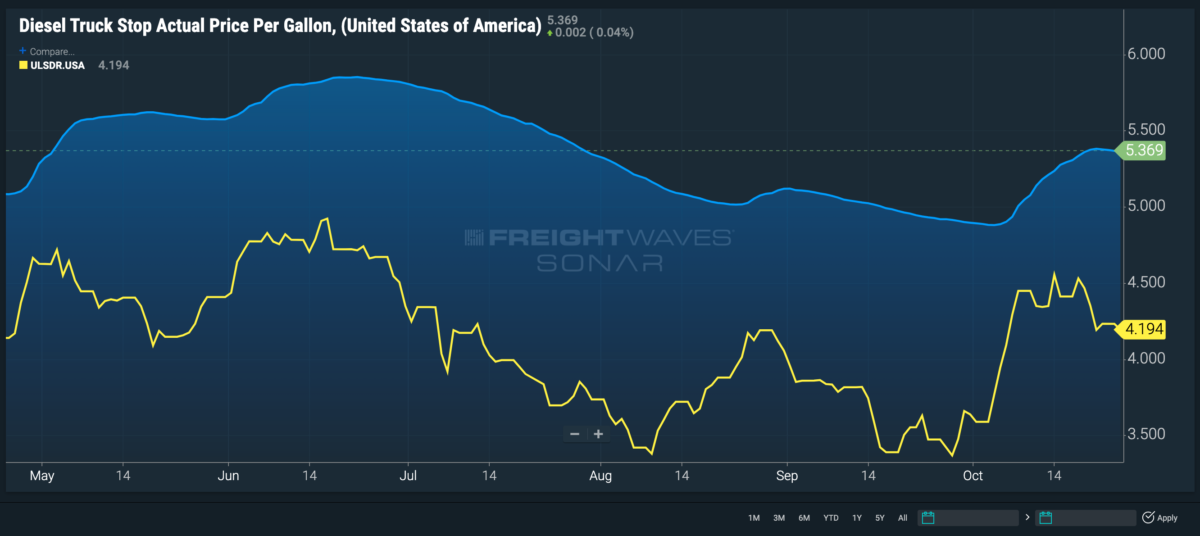

Diesel fuel prices

Retail diesel fuel prices have been rising consistently for the past three weeks but are finally starting to level out.

Diesel is nearly 40 cents higher now than it was on Oct. 5, but prices started to plateau around $5.38 a gallon last Thursday and were slightly lower Tuesday at $5.36.

Meanwhile, the rack price of fuel is down to $4.19. The spread between the two reached $1.03 last Thursday and has since climbed to $1.17 as station owners are comfortable enough not to continue to raise their prices.

Lane to watch: Houston to Fort Worth

Spot market rates from Houston to Fort Worth have been trending down for the past two weeks as rejection rates out of Houston were falling to their lowest levels since 2020, but spot rates remain 15 cents above the national average at $2.75 a mile.

Rejection rates are now trending up in Houston, which will begin to put upward pressure on these spot rates, and Fort Worth is seeing a surge in outbound volume, indicating that booking a load coming out should be rather easy.