The EU ban on Russian seaborne crude imports went into effect a month ago. This market-altering event was supposed to hike crude tanker rates by forcing cargoes to travel longer distances.

It hasn’t happened yet. Not only has there been no rate spike, but crude tanker spot rates — while still highly profitable — are down double digits since Russian restrictions went into force.

Clarksons Securities reported Tuesday that spot rates for eco-design very large crude carriers (VLCCs; tankers that carry 2 million barrels) were $45,600 per day, down 28% month on month. Spot rates for Suezmaxes (1 million barrels) were $57,800 per day, down 26% month on month. And spot rates for Aframaxes (750,000 barrels) were $75,300 per day, down 23% month on month.

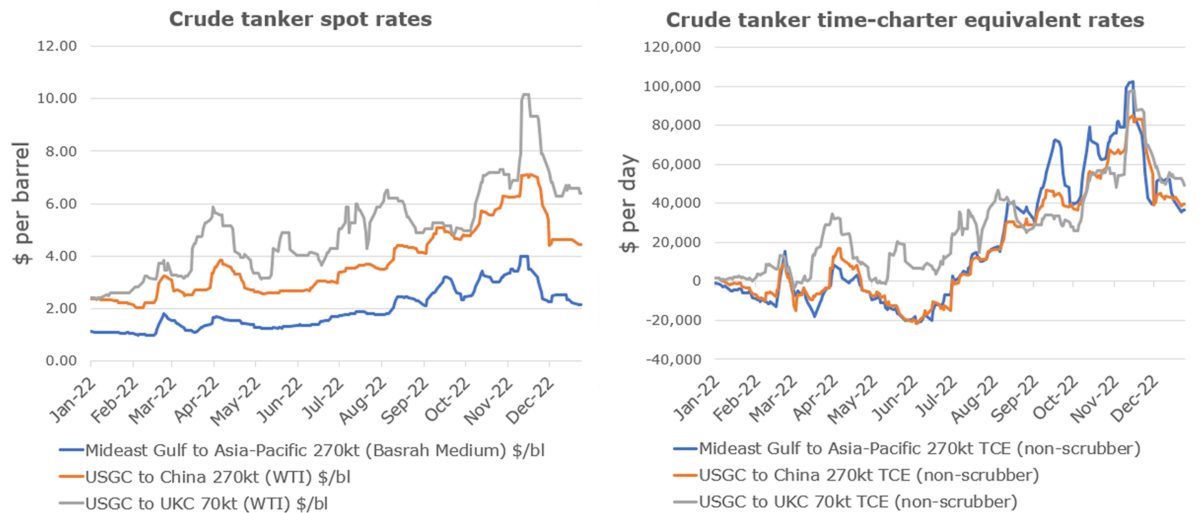

Data from price-reporting agency Argus Media shows the same pattern of decline. Argus’ assessments for the Mideast-to-Asia Pacific and U.S. Gulf-to-China VLCC routes, as well as the U.S. Gulf-to-Europe Aframax route, peaked in late November and have since fallen back to September-October levels.

More tankers entering non-Russia trades

The EU ban on seaborne imports of Russian crude went into effect Dec. 5. The restrictions also included EU and G-7 sanctions forbidding EU and G-7 insurance and shipping services for tankers carrying Russian crude to non-EU buyers if the crude was priced over $60 per barrel.

This pushed tankers that had been carrying Russian crude pre-Dec. 5 into non-Russian trades and shifted more Russian cargoes to ships using non-Western insurance.

“The spike in rates post-Dec. 5 hasn’t materialized yet,” Nick Watt, Argus Media’s editorial manager for freight, told FreightWaves.

“In fact, crude tanker rates continued to fall from their November peaks as the rush among European refiners to secure crude pre-ban subsided and tonnage availability expanded. Tankers that had been hauling Russian crude before the ban joined the mainstream fleet, adding to the downward pressure,” said Watt.

Reduction in Russian export volumes

Sanctions could also be having a negative effect on tanker demand by reducing available cargoes out of Russia.

Reid I’Anson, senior commodity analyst at Kpler, told FreightWaves, “Russian seaborne oil exports weakened considerably in December, finishing the month at 2.7 million barrels per day [b/d].” That’s down 13% from November and 14% year on year, to the lowest level since December 2020.

“This was likely due to several factors,” explained I’Anson. “Domestic production declined significantly, finishing at 10.3 million b/d, down from 10.86 million b/d in November.

“Refinery runs also remained elevated, holding at 5.67 million b/d, off only slightly against month-earlier levels and toward the upper end of the post-invasion range. This is also reflected in strong Russian seaborne clean product export figures for the month of December.”

The EU ban on imports of Russian products such as diesel goes into effect Feb. 5. Before then, EU countries are scrambling to import as much as possible. According to Kpler data, the EU imported 1.04 million b/d of Russian clean products in December, up 6% from November and 22% year on year.

Russia’s focus could shift back to exporting more crude, as opposed to refining more products, when the EU stops buying Russia’s products.

I’Anson noted that Russia’s energy minister “indicated that the EU’s ban on clean products could push Russia to export more oil. Hence, we need to be careful in assessing whether December is a good indicator of things to come on the oil side.”

Yet another factor that could prove transitory involves crude from Russia’s ESPO pipeline, which loads in the Pacific. “Seaborne ESPO loadings in December finished at 719,000 b/d, down from 823,000 b/d in November, due in part to inclement weather,” noted I’Anson.

Seasonal and sentiment issues

Several analysts pointed to seasonal factors for the recent pullback in tanker rates. Jefferies analyst Omar Nokta said rates softened “during the traditionally quiet final week of the year.”

Clarksons Securities analyst Frode Mørkedal said “the crude tanker market appeared to have taken a holiday hiatus, since the activity was minimal and lackluster.”

Weak sentiment in light of surging COVID cases in China may also be playing a role.

Brokerage Fearnleys said that there was “a lot of bearish talk” in the VLCC market in the last week of 2022 and “the lists remain lengthy [referring to position lists of tankers waiting for cargoes].”

Crude tanker stocks also down double digits

Crude tanker stocks remain the second-best-performing segment of shipping equities after product tanker stocks. However, crude tanker stocks have fallen double digits since the Dec. 5 deadline, despite commentary that changes in the Russian crude market will buoy spot rates and be a positive catalyst for shares.

Tanker stocks continued to pull back on Tuesday. Since the Russian restrictions were put in place, the stock price of DHT (NYSE: DHT), which owns VLCCs, has declined 17%. Frontline (NYSE: FRO) — which owns VLCC, Suezmaxes, Aframaxes and product tankers — is down 20%.

Shares of VLCC and Suezmax owner Euronav (NYSE: EURN) and Suezmax owner Nordic American Tankers (NYSE: NAT) have declined 21%.

Click for more articles by Greg Miller

Related articles:

- 2022’s top shipping stories: Container boom ends, war fuels tankers

- Could Russia sanctions work in practice even if they fail on paper?

- Chaos theory: How tankers thrive amid energy crisis and war

- Crude tanker owners see dollar signs as Russia ban draws near

- Sanctions are about to slam Russia’s still-booming oil export trade

- Russia oil sanctions: How conflict with EU rules threatens G-7 price cap

- G7’s grand plan to squeeze Russia oil windfall hinges on tanker shipping