Two transportation and logistics analysts placed lukewarm equity opinions on the broader transportation complex on Monday with one favoring ownership of asset-based carriers while the other voiced a neutral stance.

Morgan Stanley sees signs of ‘bottoming,’ raises outlook to ‘in-line’

Morgan Stanley (NYSE: MS) analyst Ravi Shanker has turned more constructive on the transportation and logistics companies he follows, raising his industry outlook to “in-line” from “cautious” in a Monday note to clients.

Shanker said some key leading indicators, including an internal truckload freight index and a spot rate data set, have stopped falling.

“A sea of red flag data points are starting to show the first signs of orange and yellow (potentially on the way to turning green in one-two quarters), Shanker said. “This drives our view that the freight transportation downcycle may be bottoming and could inflect to an upcycle in the coming months.”

He noted that a deceleration in these same data points in December 2021 prompted a decision to downgrade the space to cautious.

The firm’s forecasting tool now shows truckload spot rates moving 15% higher over the next 12 months.

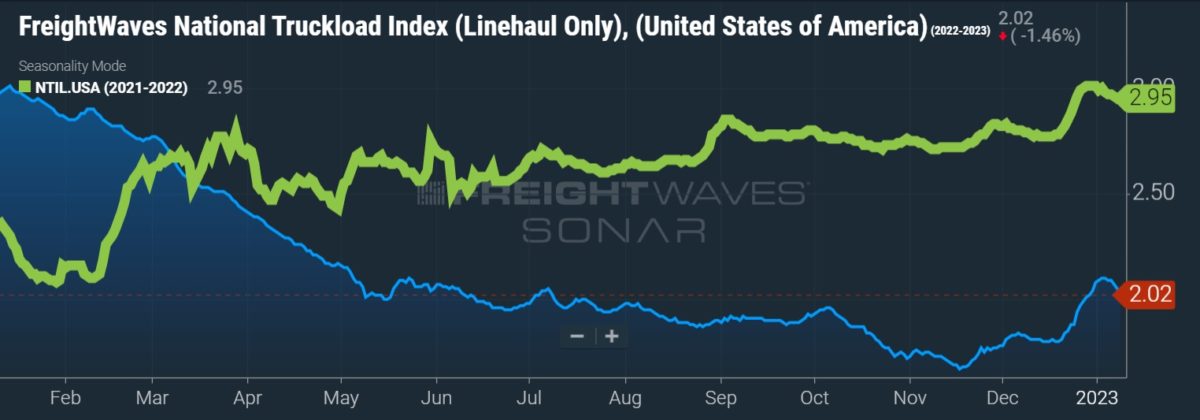

After a 10-month decline, FreightWaves National Truckload Index (linehaul only excluding fuel) shows spot rates have increased 20% from a mid-November low. However, spot rates are still 33% off all-time highs established a year ago as the industry embarks on contractual bid season.

Shanker said expectations are “starting to normalize” as share prices on the names in his coverage universe have fallen 25% on average from all-time highs and forward earnings-per-share estimates are 10% off the peak. He noted in the later part of downcycles valuation multiples increase as EPS estimates move lower.

“While there is clearly more risk to [EPS] numbers, early cycle transport stocks tend to start going up (as the multiple expands) with the last one-two EPS cuts (which likely happens in early 2023).”

He favors early cycle TL and less-than-truckload stocks, noting that their earnings held up “much better than expected” in the beginning of the downturn and that “trough EPS is nowhere near as low as the market has priced into the stocks, which will result in a much larger multiple reset than EPS will decline.”

Shanker was also encouraged by responses from his quarterly shipper survey.

Shippers’ outlook on the overall economy improved slightly for the first time since the second quarter of 2021, up to 4.6 from a third-quarter reading of 4.4. However, the 20-year-old data set remained below the long-term average of 5.9. He said the survey also showed net inventories moved slightly lower in the fourth quarter, which was “the first time that has occurred in an overstocked condition since mid-2018.”

Fifty-three percent of those surveyed expect merchandise levels to normalize by the middle of 2023, likely early in the second half as majority sentiment now indicates normalization in the second half versus the third-quarter update that still showed the first half.

The responses were more bifurcated this quarter as both categories denoting change — those needing to grow inventories (31%) and those needing to lower levels (42%) saw 800 basis points of growth.

“Given the off-the-charts pace of net ordering declines (i.e. continued destocking), it appears unlikely that the inventory problem will get worse (and is far more likely to get better) from here,” Shanker added.

The data set first showed a potential oversupply condition in the 2021 third quarter, which was roughly two quarters before retailers noted it as a concern.

“We see signs that the 2022 freight downcycle may be bottoming, and a midyear normalization of inventory levels could potentially flip to an upcycle in 2H23 and 2024,” Shanker continued. “The magnitude of the upcycle will depend on broad macro conditions (mild if the U.S. consumer and global Industrial economy are still under pressure, or significant, if macro improves) potentially exacerbated by supply-side tightening catalysts (which drove the last two upcycles in 2018 and 2021 to new record highs) like AB5.”

His take on the railroads and parcel stocks, which tend to fare better later in the economic cycle, was less constructive as he believes “risk to numbers and valuations remain highest” as “investors may still be hiding out to ride out the downcycle.”

“The main risk to our call is that we are too early in calling for a bottom if consumer spending/macro risk driven by rates and inflation is ahead of us. Similarly, even if we are right about inventory bottoming, the upcycle may be farther out if macro remains weak.”

He noted that consumer spending has held up well as inflation has likely peaked and interest rates could be peaking soon.

Susquehanna moves to the sidelines

Citing a “risk-reward downshift” in the first half of 2023, Susquehanna Financial Group analyst Bascome Majors cut his sector view to “neutral” from “positive” on Monday.

Last spring, he upgraded several of the trucking-related stocks he follows to a positive rating. In the period since, most of those calls have panned out, outperforming the broader S&P 500. However, Majors has made the decision to move to the sidelines given what he believes will be “a hard-to-stomach 1H23 fundamental cocktail of a lingering volume ‘air pocket,’ a rollover in contract pricing, and incremental [year-over-year] pressure from equipment gains.”

He’s concerned a lack of inbound ocean container freight means retailers won’t be restocking “before at least 2Q.”

Majors’ ratings for the asset-based TL carriers he covers — Knight-Swift (NYSE: KNX), Werner (NASDAQ: WERN) and Schneider (NYSE: SNDR) — were lowered to neutral. He said the spring upgrades of those stocks were tied to share prices getting washed out over freight recession concerns at the time, which presented “trough-on-trough valuation opportunities [lower multiples on lower forward EPS estimates].” His call at the time was that a freight recession was already priced in.

However, with the recovery in share prices since, EPS estimates have continued to step lower, which Majors believes has created a far more balanced risk-reward setup.

“Looking forward, we do believe there will be an early cycle multiple expansion that drives shares higher,” he said. “But late-cycle share performance has already far exceeded previous extended trucking rate downturns, and we just don’t believe we’re deep enough into late cycle for that to drive incremental outperformance in 1H23.”

He cut his 2023 estimates by 6% for Knight-Swift and by 3% for Schneider. Werner was left unchanged.

He doesn’t see spot rates improving year over year until the back half of 2023 with contract rates rolling over early in the year. He noted contract rates remained positive in November for a 27th straight month but have been down sequentially in four of the last five months.

Majors also downgraded J.B. Hunt (NASDAQ: JBHT) to neutral, cutting his 2023 EPS estimate by 16%. He said weakness in container imports and pricing pressure as TL bid season occurs amid general weakness in the spot market are detractors. He also believes accessorial charges for excess container detention, a constant throughout the pandemic, will diminish “as retail supply chains normalize without enough freight demand to immediately capitalize on the loosened container supply.”

He still favors Hub Group (NASDAQ: HUBG), which trades at a lower valuation.

Majors downgraded LTL carrier Saia (NASDAQ: SAIA) and LTL and trucking conglomerate TFI International (NYSE: TFII) to neutral. Earnings expectations for both companies were cut by 7%. He lowered his number on Old Dominion (NASDAQ: ODFL) by 5%, where he already held a neutral opinion.

“But there is an eventual light at the end of the tunnel, as we model double-digit EPS gains for all our trucking and logistics names in our initial 2024 estimates,” Majors said.

Shanker maintained “overweight” ratings on TLs Knight-Swift (“top pick”), Schneider and Werner, with equal-weight ratings on Heartland Express (NASDAQ: HTLD) and U.S. Xpress (NYSE: USX). He also kept overweight ratings for LTLs TFI International, ArcBest (NASDAQ: ARCB) and XPO (NYSE: XPO). He upgraded Saia to equal weight. He maintained his equal-weight opinion on Old Dominion.

More FreightWaves articles by Todd Maiden

- How changes in supply chain finance disclosure could impact shippers

- Private equity adds another piece at Port of Charleston

- Forward Air to buy expedited LTL provider Land Air Express