Editor’s Note: This story has been updated to include supply chain impacts from Hurricane Harvey

The National Hurricane Center has seen rapid intensification of Hurricane Harvey today and is now expecting the storm to gather strength before it makes landfall in Texas late Friday/early Saturday morning. The trucking and shipping industries are now watching the storm closely as its final path and impacts will influence area spot rates, capacity, and fuel costs.

“Water vapor images indicate that the cyclone’s outflow is expanding – indicative of low shear- and Harvey will be moving over a warm eddy of high oceanic heat content in the western Gulf of Mexico in about 24 hours,” NHC said. “As a result of these conditions, several intensity models, including the ICON intensity consensus, are now explicit showing Harvey reaching major hurricane intensity (Category 3).”

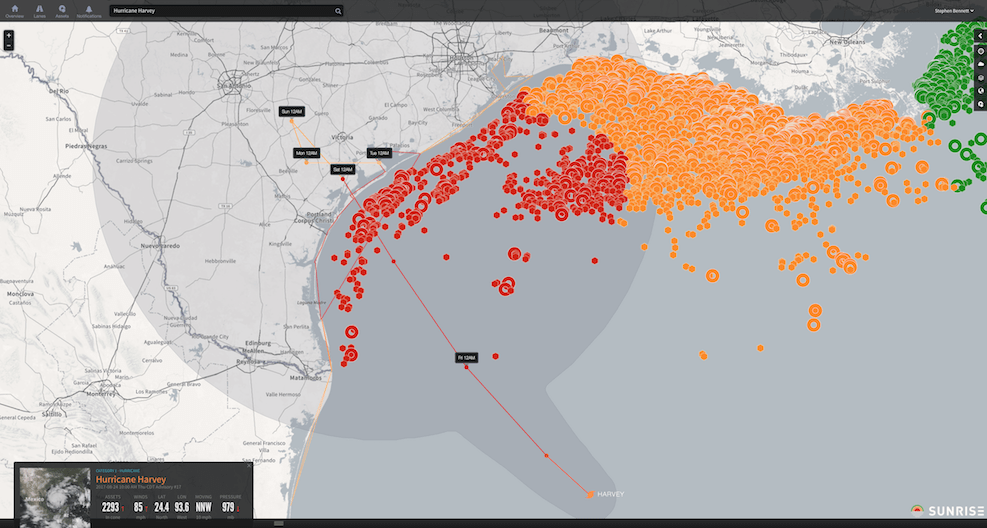

Harvey is expected to come ashore near Corpus Christi, TX, and impact the Houston metro areas and then stall over land. In its latest update to the transportation and shipping industries, supply chain risk analytics firm Riskpulse, says that while the storm prediction has changed in terms of intensity, its predicted effects have not.

“The greatest risk, by far, is significant flooding after landfall,” the firm said in its Riskpulse Real Time Analysis Feed for Harvey. “Stronger winds will be experienced by a small portion of the coast north of Corpus Christi, where Harvey’s core makes landfall. Elsewhere, the persistent rain will pose the greatest threat, creating widespread flooding risks through at least the first half of next week.”

With the storm gaining strength and expected to cause widespread flooding – perhaps up to 20 inches of rain will fall in some areas, Riskpulse said – the impact on trucking operations is expected to be great.

Mark Montague, of DAT, says that the top shipping lanes from Houston are to Dallas, Laredo, San Antonio, Denver and Chicago, all of which could see disruptions are freight movement is slowed. Some shippers are also rushing to get product out of the Houston area ahead of the storm, and that is something that could drive up rates in the area. The timing is also troublesome from a rate perspective, coming the week right before Labor Day, which generally sees higher rates as shippers move product before the long weekend.

Beyond the rate impact, delayed and cancelled shipments could cause capacity issues next week.

Riskpulse’s Real Time Analysis Feed for Harvey has been updated this evening with more specific supply chain impacts and it includes data on potential impacts to stores. The company has issued a “Condition Red” for shipping lanes shipping lanes, pick-up and drop-off locations, and customer shipments traversing southern Texas beginning tomorrow and persisting through early next week.

“We are advising our customers to adjust their operations to account for storm impacts,” the update says. “We expect destructive hurricane-force winds in some locations and a prolonged period of heavy rainfall that will likely lead to catastrophic flooding in other areas. Damaging hurricane winds will be limited to a small geography near Corpus Christi, TX, while flooding rainfall will impact a far larger region across Southeast Texas including the Houston metro area.”

Riskpulse says that over 800 convenience stores in Texas are at “high risk” and stores in the Rockport, TX, area are at particular risk for damage, which could prolong closures. Other retailers are also going to be affected, with Riskpulse noting that inbound deliveries to 168 store locations between San Antonio and Houston could be difficult if not impossible.

The flooding likelihood, especially along I-10 and I-35 where some locations may be impassable, could affect up to 9,000 total shipments scheduled for Friday through early next week, although the firm noted that 732 shipments between Saturday and Monday are at high risk of being disrupted mostly due to flood conditions.

Fuel prices both in the southeast and around the country could also be impacted. According to USA Today, Royal Dutch Shell, Anadarko Petroleum and Exxon Mobil had already started evacuating workers from rigs and reducing production of oil and gas in the region. The Gulf provides more than 45% of the nation’s oil refining capacity, the paper said, and generates 17% of American crude oil output and 5% of dry natural gas output.

Long-term disruptions could drive fuel prices higher in the weeks ahead. Even before the storm hit, gas prices have started moving upward, say the experts at Breakthrough Fuel, which provides fuel management solutions to transportation companies. Diesel prices, though, have not seen a spike ahead of the storm.

“We have already seen some premium [this year] on gas prices, but we haven’t seen that on the diesel side,” Brett Wetzel, senior manager-applied knowledge, at Breakthrough told FreightWaves. He added that sudden spikes fuel prices are more likely on the gas side than diesel since commercial trucking provides a more common pattern of fuel usage. Consumers, he says, will tend to rush to fill their cars before a big storm. “It will be much harder felt on the gasoline side than the diesel side.”

Diesel prices in the Texas and Gulf Coast region have risen about 1 to 1 ½ cents today, Wetzel says, which “is well within normal ranges.”

The Gulf Coast region, stretching from Corpus Christi, Texas, to Lake Charles, LA, is home to about 30 refineries, the American Journal of Transportation reports, with the potential to product 7 million barrels a day of refining capacity. With the storm expected to make landfall near Corpus Christi, significant disruptions are likely.

Texas has not had a hurricane landfall since 2008 when Ike came ashore as a Category 2 storm.

The American Journal of Transportation also noted that Phillips 66 shut down its Lake Charles plant late Tuesday after one of its power suppliers said there was a high potential for an electrical failure.

“[The] biggest impact of this storm will be a significant reduction of crude oil imports into the Texas Gulf Coast, resulting in refineries cutting crude rates,” Andy Lipow, president of Lipow Oil Associates in Houston, told the American Journal. “There will also be a significant impact on petroleum product exports impacting supplies into Mexico.”

Any longer-term rise in diesel prices will likely be a result of significant damage to drilling platforms or refineries, Wetzel noted. Without knowing the resulting impacts of the storm, it’s difficult to predict the fuel price impact. However, Wetzel notes that the Gulf region also brings in a lot of oil imports, and last year Hurricane Hermine caused a one-week shutdown of ports in the area, stopping the flow of imported oil.

Wetzel thinks any fuel price impact will be limited due to increased U.S. production in the last two to three years, creating increased inventory levels. “That will lead to a little insulation,” he says.

Wetzel and Daniel Cullen, vice president-advisory services for Breakthrough Fuel, mentioned that the timing of the storm could create an interesting choice for refinery owners. October is often a time when refineries shut down for maintenance, and Cullen notes that taking refineries online and offline are among the most dangerous times for damage to them.

“What some are talking about is that they may shut down the refineries and then leave them shut down a few more days or week so they don’t have to start it up in August, shut down and then start again in October,” Cullen says.

As the region expects widespread damage from flooding, there is concern that some refineries may suffer damage and remain offline for a while. While that is possible, Cullen says that following Hurricane Rita in 2005, refineries “really bolstered themselves…and while they may shut down for the storm, they are much better prepared to weather the storm.”

One other note from Wetzel is that with the Corpus Christi area expected to suffer the brunt of the storm now, refineries there and in San Antonio may facing the highest risk of damage. However, most of those refineries are producing export oil, he says, so there may not be much impact on domestic supplies. Damage to refineries in Houston, though, would be a different story.