The New Power division at Cummins Inc. probably won’t break even on earnings before interest, taxes, depreciation and amortization before 2027. But when it does, it may never look back. One reason is its investment in producing electrolyzers, a critical enabler to making hydrogen fuel for zero-emission long-haul trucking among myriad other uses.

IDTechEx forecasts the water electrolyzer market will grow over the next decade to $120 billion by 2033. By 2025, the firm estimates fivefold growth in electrolyzer manufacturing compared to 2022.

Cummins is far from alone in seeking to advance electrolyzers, devices or systems that use electricity to split water molecules into hydrogen and oxygen, producing hydrogen gas that can be stored as a compressed gas or liquefied.

Think of electrolyzers as the opposite of a fuel cell, which uses water and electricity to separate hydrogen and oxygen, creating water vapor as the only emission. In an electrolyzer, water is pushed through a stack with electricity. That pulls apart hydrogen and oxygen atoms.

Australia’s Fortescue recently entered a deal with fuel cell truck manufacturer Nikola. France’s Air Liquide and Germany’s Siemens formed a joint manufacturing venture in 2022. Norway’s Nel ASA has a U.S. presence. Smaller players Bloom Energy and Plug Power also participate, though Plug Power ended a venture with Fortescue in January. It said the math didn’t work.

Cummins is big and getting bigger in electrolyzers

Cummins, meanwhile, is big and getting bigger in electrolyzers. Much of the $100 million to $125 million of New Power capital expense in Q4 went to electrolyzers, Cummins CFO Mark Smith said on Monday’s analyst call.

“The electrolyzer business is really going to drive the majority of our progress towards breakeven in ’27 for New Power and the growth aspirations that we shared for 2030,” CEO Jennfer Rumsey said. “We expect to scale up the product, the supply chain and manufacturing and continue to see a growing backlog and conversion of orders into revenue.”

The 2030 goal could be $6 billion to $13 billion in revenue, Cummins told analysts last year. Near term, Cummins still projects $400 million in hydrogen revenue by 2025.

On a project basis, Smith said Cummins was gross margin positive on electrolyzers last year, “which is a good early indicator … that we’re on the right path for profitability as we move forward with more volume.”

Volume is coming from more than new facilities. Electrolyzer production will get 89,000 square feet of dedicated space at an existing Cummins facility in Fridley, Minnesota. Production will start at 500 megawatts of manufacturing capacity annually, which could grow to 1 gigawatt.

“We are tapping into that strength we have in our footprint and supply chain capability to help build out profitable product(s) as well as supply chain,” Rumsey said. “And that’s an advantage that I think Cummins has here.”

BorgWarner’s relentless electrification expansion

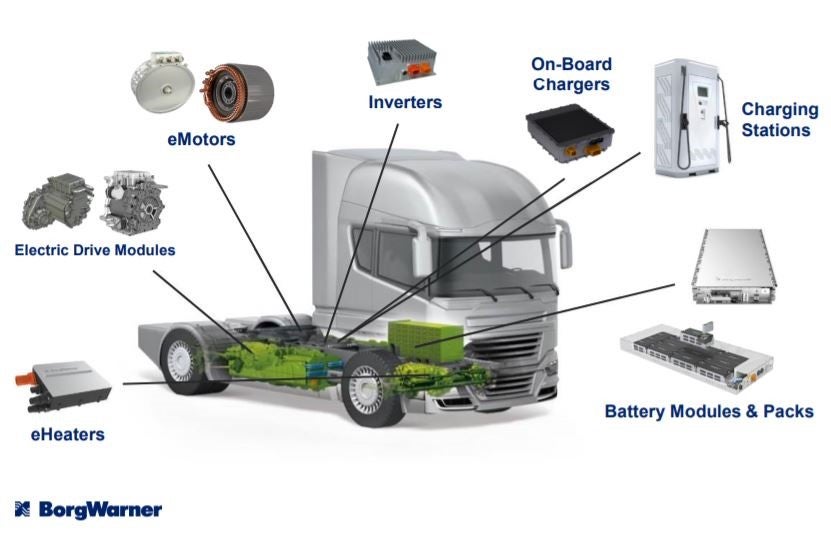

Old-line Tier 1 supplier BorgWarner Inc. continues its evolution into a major player in electrification. Cowen Inc. analyst Jeff Osborne listed these highlights from the company’s fourth-quarter analyst call:

- $3 billion in homegrown (organic) battery-electric vehicle sales for 2025, above its target of $2.5 billion.

- Recent acquisitions (AKASOL, Santroll, Rhombus, SSE and Drivetek) are expected to add $1.3 billion of EV-rated sales in 2025. AKASOL, which cost BWA $880 million in 2020, is expected to generate about $1 billion in revenue in 2025, up from about $300 million in 2022.

- BWA expects $4.3 billion of total EV sales in 2025 and is targeting $4.5 billion.

- The company is on the prowl for further mergers and acquisitions that could add an additional $700 million of incremental inorganic revenue.

BWA is spinning off the fuel systems and aftermarket parts of its business, some of which it acquired in a $3.3 billion acquisition of Delphi Technologies in October 2020.

Osborne’s take: Raise the target price for the stock to $60 from $52. BWA shares closed Thursday at $47.95.

A Borg Warner graphic from 2021 shows where it is putting its emphasis. (Source: Borg Warner)

Navistar invests $120M in Mexico expansion for cab painting

Navistar is spending $120 million over the next three years to expand the cab-painting area at its plant in Escobedo, Mexico. The Nuevo León facility is the Traton Group subsidiary’s largest factory and employs 6,200 people.

Much of Navistar’s manufacturing is located in a triangle of Escobedo (full-size truck assembly), Huntsville, Alabama (powertrains) and San Antonio (medium-duty truck assembly).

Since its opening in 1998, the Escobedo plant has produced more than 850,000 trucks. It currently is the home to the medium-duty International eMV electric truck, which is expected to move to San Antonio. Most of Escobedo’s production is exported to the U.S. and Canada. The investment is expected to reduce energy, water and gas use by as much as 10%.

Medium-duty market expansion shows Mack Trucks timed it right

Mack Trucks recently built the 10,000th medium-duty MD Series truck at its Roanoke Operations in Virginia. Mack returned to the medium-duty truck segment in 2020 after a two-decade absence.

It turned out to be a smart move as the segment expanded through the pandemic because of growing last-mile and regional delivery demand. Mack held a 5.3% share of the segment in 2022, according to parent Volvo Group’s most recent financials.

The fast-to-market MD Series came from discussions in 2018 and 2019, when Mack saw a steady state of 100,000 trucks a year. Some projections put the medium-duty segment for 2023 at 125,000 to 140,000.

Hydrogen hits

Honda Motor Co. will bring its latest fuel cell vehicle to market in 2024. But the Japanese company, which has partnered with General Motors on fuel cell development since 2013, would love to get into the fuel cell truck business. It just needs a partner.

Lashing together two or more of its jointly developed fuel cell stacks could power a heavy-duty truck, as rival Toyota showed in its pilot project with Kenworth. Toyota is moving to the next level, making truck-focused fuel cell stacks in Kentucky beginning this year. So Honda might already be behind the curve. You can read more about Honda’s plans here.

Meanwhile, Nikola got some good news this week from the California Air Resources Board. The Nikola Tre fuel cell electric Class 8 truck that goes into production later this year qualifies for CARB’s Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project (HVIP) program.

That means a serious spiff — a voucher starting at $240,000 and ranging up to $288,000 per truck. Customers also are eligible for a $40,000 clean commercial vehicle tax credit from the federal government due to the passage of the Inflation Reduction Act.

We’re still waiting for the first commercial hydrogen fuel cell trucks to hit the highway in the U.S. But the number of fuel cell passenger vehicles globally has surpassed 56,000, according to market research firm Information Trends. Most of those are in Korea, where hydrogen fueling availability is greatest.

Briefly noted …

As mentioned Wednesday in the headlines of Truck Tech on FreightWaves TV, Wabash secured a spot in Forbes’ list of America’s Best Small Companies 2023.

Geotab will integrate with Cummins to enable over-the-air connectivity for Cummins

engine control units through Geotab’s GO9 device.

Finally, this might be worth watching: According to Securities and Exchange Commission filings reported by management consulting company Fintel, two major investment funds were above the 5% threshold requiring they declare their holdings in Hyliion Holdings at the end of 2022.

Vanguard Group has about 11.8 million shares, or 6.6%, of the startup hybrid electric truck maker. BlackRock has 10.1 million shares, equal to a 5.6% stake. Both declare they are passive investors. Founder and CEO Thomas Healy is the largest shareholder with 18% of the stock.

That’s it for this week. Thanks for reading. Click here to get Truck Tech in your email on Fridays. And watch Truck Tech on FreightWaves TV on Wednesdays at 4 p.m. EST. Next week’s guest is Jose Samperio, executive director and general manager of Cummins’ North America On-Highway business.